[ad_1]

“CEOs of the big banks reading this list are probably somewhat worried,” said Isaac Boltansky, director of policy research at Compass Point Research & Trading. “The progressives have absolutely won the day on this point.”

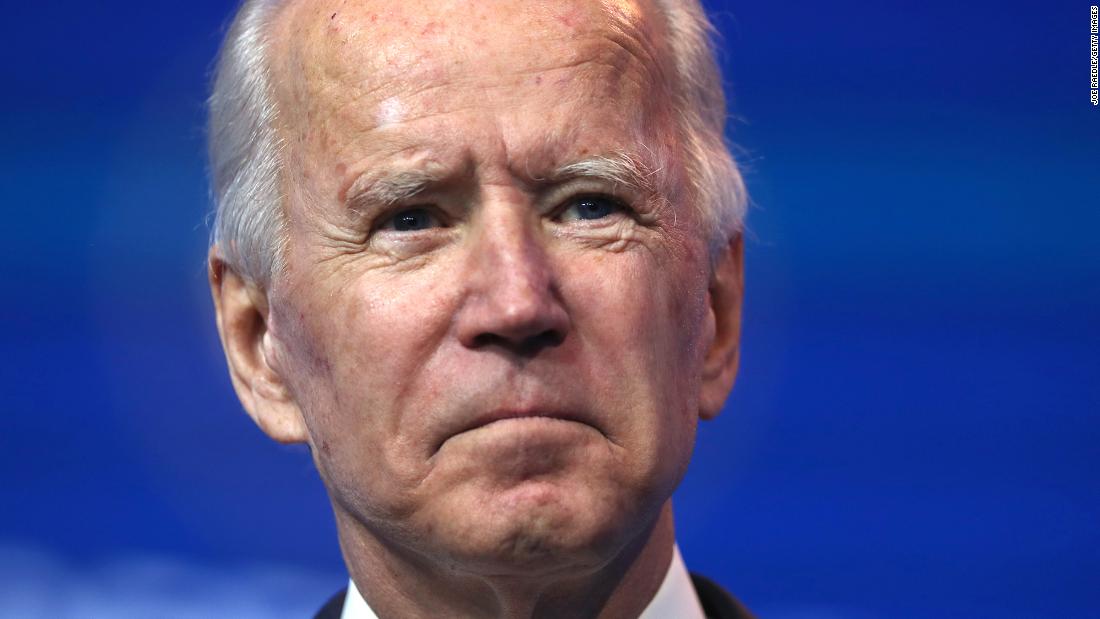

Biden brought in around 500 people to work with government agencies, from the CIA to the United States Postal Service, and help shape the future of government policy and appointments.

‘He made a lot of enemies’

Gary Gensler, who will lead the team working with financial regulatory agencies including the Federal Reserve, SEC and FDIC, may be at the top of Wall Street’s list of concerns. Gensler headed the Commodity Futures Trading Commission from May 2009 to January 2014.

“Gary Gensler definitely brings back bad memories,” Boltansky said.

Although Gensler is a former Goldman Sachs banker, he is now seen as a staunch ally of Warren on Wall Street.

“He’s made a lot of enemies in Washington and in industry,” said Ed Mills, Washington policy analyst at Raymond James. “The fact that he is leading this is a signal to the Elizabeth Warren wing of the Democratic Party that she has a voice over financial regulatory choices.”

Biden appeals to fierce criticism of big banks, private equity firms

Kelleher, who declined to comment, is not exactly from the Robert Rubin wing of the Democratic Party. (Rubin, former Chairman of Goldman Sachs, served as Secretary of the Treasury under President Bill Clinton.)

“Once a private equity firm extracts the maximum amount of value, they then try to return it to the public market so that they can cash in on the quasi-carcass of a company,” Kelleher said.

Meanwhile, Biden has a separate team overseeing the transition from the Consumer Financial Protection Bureau, the agency that is Warren’s brainchild.

“Leandra English has extensive experience not only with the problems but also with how the mechanics of the CFPB work,” said Boltansky of Compass Point.

He noted that Trump’s transition had encountered “obstacles in the road” because the president had patted some people who did not have much experience in government.

No major revisions are coming

Of course, it’s important to note that Biden only appointed a transition team, not a full Cabinet. There is no guarantee that his choices to run large agencies will ultimately please Warren and the progressive wing of the party.

And even if Biden wanted to pick regulators who would be very tough on Wall Street, Republicans in the US Senate might have the votes to block those appointments. (Unless Democrats sweep away second-round races in Georgia, Republicans will retain control of the Senate.)

“Progressives are absolutely the first on this invisible dashboard between progressives and centrists,” Boltansky said.

But Boltansky noted that “we are at a very different stage in the evolution of financial regulation” than in 2009, when the Obama administration took over. At the time, during the Great Recession, it was clear that a major overhaul of Wall Street was not only inevitable, but necessary. And it took years to implement the Dodd-Frank Act of 2010.

Today, Wall Street is not seen as the top priority, with the Biden administration likely to focus instead on the pandemic, inequality and the climate crisis. And the fact that banks have weathered the health care crisis (at least so far) suggests that Dodd-Frank has worked to strengthen the system.

Is the prison too big?

“If you are a bank that has a scandal then you must be worried,” said Mills, Raymond James analyst.

Yet like other Democrats, Biden will need to balance this urge to root out the wrongdoing of Wall Street with the need to keep capital flowing.

“They need the economy to work to be reelected,” Mills said. “And you can’t make the economy work if the banking industry isn’t.”

[ad_2]

Source link