[ad_1]

For those still licking the wounds of a sale that even your teenager probably saw coming (via TikTok), here’s a heartwarming chart from Goldman Sachs.

This shows us that the S&P 500 SPX,

5,000 are out there, provided COVID doesn’t throw more nasty variants at us, China’s vast economic engine doesn’t stop, and central banks don’t brake too soon. And other reasons.

And the believers are out there, with stock futures rebounding, surprise, surprise, after the worst session for the S&P since May as “buy down” calls come in.

In the foreground is JPMorgan’s chief global strategist Marko Kolanovic, who is not about to back down after raising his S&P 500 outlook just a week ago – he sees 4,700 by now. end of the year and more than 5,000 for 2022.

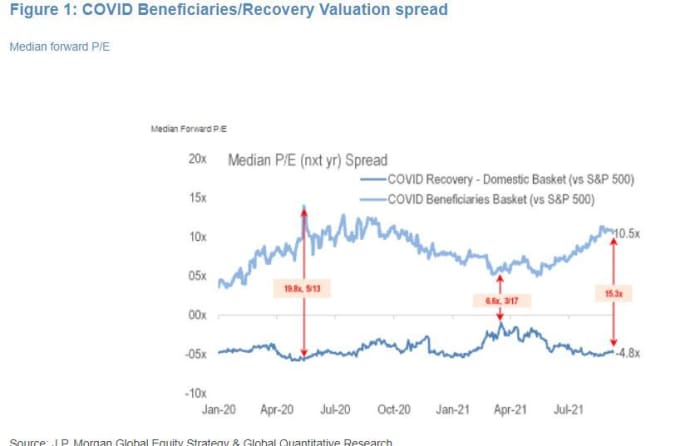

He and his team blame technical selling, bad liquidity and the “overreaction of discretionary traders to perceived risks” for Monday’s pop. “However, our fundamental thesis remains unchanged and we see the sell-off as an opportunity to buy the downside,” adds Kolanovic. “Risks are well signaled and assessed, with multiples of actions returning to post-pandemic lows for many reopen / recovery exposures; we are looking for cyclical stocks to regain leadership as the delta weakens. “

Strategists refer to this chart of the JPM COVID recovery basket, which has “reversed its outperformance since the start of the year with multiples returning to post-pandemic lows.”

“As long as COVID continues to subside, the strong momentum is expected to continue into 2022 as companies begin to replenish depleted inventories and increase investment. Central bank policies should remain growth-oriented, and even China’s slowdown will likely soon be countered by a political pivot, ”Kolanovic said.

Read also : Investors are in a historically bad mood. Their three biggest fears are exaggerated, says the strategist.

Another line of support for stocks comes from the Russell 2000 Small Cap Index, according to this tweet (h / t Daily Chart report). The index fell 4% on Monday, but still hasn’t fallen from its average price over the past 200 days, meaning it’s still in a long-term uptrend. Small caps have in the past led larger indices in both directions.

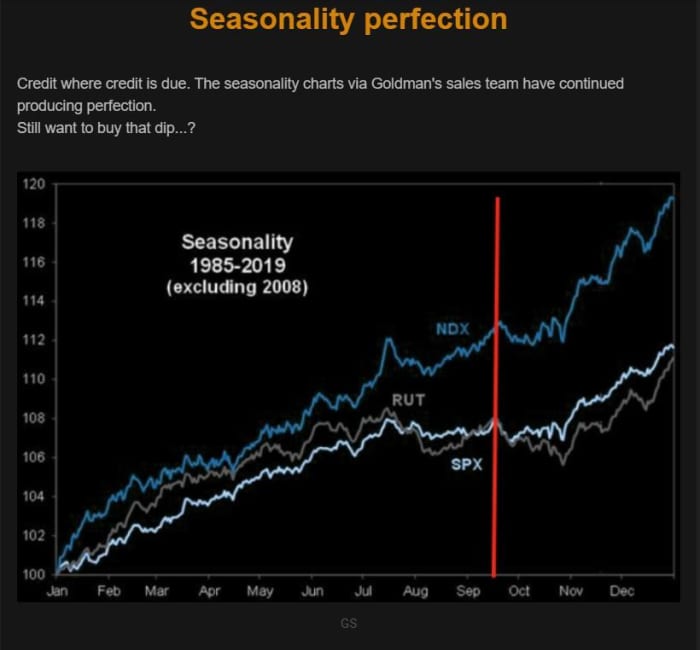

But the last word goes to The Market Ear blog, which highlights a Goldman chart that appears to show there may be an even better downside to buy in the near future. After all, we are only halfway through a traditionally tough seasonal period for inventory.

If more losses are to come, we may be on schedule.

Fed meeting kicks off

The two-day Federal Open Market Committee meeting begins Tuesday, with attention focused on perhaps more hawkish forecasts for interest rates. It was then that the Organization for Economic Co-operation and Development cut its growth forecasts in the United States and around the world due to the delta variant of the coronavirus, but lifted them for 2022.

Johnson & Johnson JNJ,

says its COVID-19 vaccine booster increases antibodies.

Shares of struggling real estate giant China Evergrande 3333,

blamed for the collapse at the start of the week, fell another 0.4% on Tuesday ahead of looming debt payments. Yet neither Wall Street nor a guy who should know sees a China-inspired Lehman moment.

About UBER,

stocks are climbing after the ridesharing group revised up its outlook for the third quarter.

US Bancorp USB,

signed an $ 8 billion deal for the MUFG of Mitsubishi UFJ Financial Group,

MUFG Union Bank, the latest in a wave of regional bank mergers that analysts say is far from over.

Activision Blizzard ATVI,

Confirmed information that the Securities and Exchange Commission is investigating the video game publisher’s handling of workplace issues, such as discrimination and harassment.

Shares of Universal Music Group UMGP,

a spin-off from the music label Vivendi VIV,

jumped 37% on its Amsterdam business debut. JPMorgan calls this a “must own stock”.

Read: The IPO market braces for 14 deals this week

The steps

ES00 futures contracts,

YM00,

NQ00,

indicate that this market is poised for a strong comeback, with European equities also higher and even Hong Kong’s Hang Seng HSI,

closed up 0.5%, although the Nikkei NIK,

fell 2.1%. The CL00 energy also bounces back,

NGV21,

and the prices of PAZ21 metals,

SIZ21,

BTCUSD bitcoin always hurts,

Ethereum ETHUSD,

and other crypto prices.

Random readings

Dinosaurs had feathers, because China says so.

A wrong turn costs the winner of the half marathon their medal.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link