[ad_1]

By Mikey Campbell

Wednesday, August 21, 2019, at 15:59 Pacific Time (6:59 pm ET)

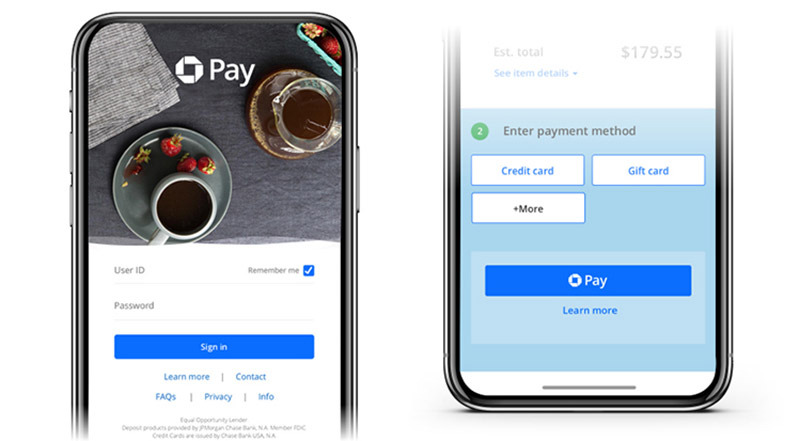

JPMorgan Chase on Wednesday told customers of its mobile payment solution Chase Pay that the service would soon be available for in-store use, leaving a previously touted payment platform on a road already cluttered with failed products.

According to an announcement posted on the platform's dedicated website, Chase Pay customers will no longer be able to use the smartphone app from physical POS terminals as early as 2020. Chase plans to continue processing purchases made online and through supported applications.

JPMorgan has begun to inform existing customers of the change by email, reports Bloomberg.

The disappearance of Chase Pay, at least in stores, ends a four-year experience in mobile payments that began in 2015 through a partnership with Merchant Customer Exchange. At the time, Chase chose to integrate MCX's currentC platform, now missing, to create a smartphone app that replaces credit cards with scannable barcodes.

CurrentC failed to gain ground and was finally killed after a brief beta period in June 2016. Nine months later, JPMorgan took over the platform and other FinTech assets from MCX .

"When we first started four years ago, the payment space has changed a lot with time and customer behavior has changed," said Eric Connolly, head of Chase Pay. "Many merchants have turned to online shopping, in-store purchases and invested in their online presence and applications."

Chase Pay continues its efforts by refocusing its efforts on web-based payments and applications. As noted by BloombergHowever, according to a study conducted by the PYMNTS.com website, the JPMorgan solution was accepted by less than 1% of online merchants at the end of the quarter. The bank believes that Chase Pay will increase its market share and announced Wednesday the forthcoming support of GrubHub and its LevelUp holding company, the Chase Center app and more than 60,000 merchants from the Big Commerce network.

"We continue to focus on our customers and they use the Chase Pay button on merchant websites and their apps, and now use more than ever their Chase cards to pay," Connolly said in a statement. "We are therefore focusing more and more on expanding the presence of Chase Pay in more applications and websites for merchants."

While competing payment platforms are struggling to impose, Apple Pay continues to increase its market share. Analysts at Morgan Stanley in July described Apple's solution as "the undisputed leader in application / phone-based digital wallets," pointing to strong growth in online usage year-on-year. While PayPal remains the king of transactions in number and volume, Apple Pay is slowly catching up.

Apple's payment strategy should get a boost with the recent launch of Apple Card, a first digital credit card and NFC offering extensive integration with Apple Pay.

[ad_2]

Source link