[ad_1]

I'm sure you've all been forewarned, investing in small-cap stocks that seem like gambling. Sometimes you come to the top, while sometimes you can lose a significant portion of the investment . Do not get me wrong, there are many small caps that offer great potential. However, there are significant risks involved.

I find that this is especially true with momentum stocks. Those who have had significant returns over a short period of time. If you invest in a stock only because it's had an escape performance, you're probably already late to the party. This is particularly true for small caps

Before going any further, it is important to note that this article includes stocks traded on the TSX Venture Exchange (TSXV). Although available, it is not recommended that US investors buy shares of the TSXV in the over-the-counter market. Why? They have little or no liquidity. They should be purchased directly from the Canadian Stock Exchange

I was inspired to write this article as a result of a recent conversation I had with one of my co – workers. Sometimes he comes to see me with his recent stock picks. I guess he's looking for a validation that he's made a good choice.

What stock was this this time? Garibaldi Resources Corp. (OTC: GGIFF) [TSXV:GGI]. Certainly, I had not heard of the company. He could not tell me anything other than the fact that it was the Top Pick of the TSX Venture Exchange 508 of 2018. For those unfamiliar, the TSX Venture Exchange is a public market Venture Capital for Emerging Companies. Essentially, it is the agricultural team of the Toronto Stock Exchange and, as it grows, it can eventually become the TSX 's primary index.

The TSX Venture 50 lists 10 companies in five industries: clean technology, diversified industries, mining, and oil and gas. , and technology and life sciences. There is an additional methodology behind the list, but basically, it is a list of the best performing stocks of the previous year.

When asked about the performance of the TSX Venture Exchange 50, my colleague is also empty. It is clearly an investment focused on momentum.

I took the initiative to look at the best choices of the last five years to see how these dynamism titles behaved. The results speak for themselves and there is an important lesson to learn

2017 TOPX

DynaCERT Inc. (OTCQB: DYFSF) [TSXV: DYA]

Top of the list in 2017 was DynaCERT Inc., an energy company specializing in the supply of carbon abatement technologies. The Company is engaged in the development of hydrogen generating systems designed for commercial use. It has a current market capitalization of 66 million Canadian dollars.

In 2016, DynaCERT posted an impressive 507% return. After peaking in early 2017, the company has been trending downward. During the year that followed, he was named "Top Choice" of Venture Exchange and lost 42% of its value. To date, the company has lost 66% since it's got that status.

2016 TOPX TOP VICE 2016

VANC Pharmaceuticals Inc. (OTCQB: NUVPF) (OTCQB: NUVPD) [TSXV: VANC]

Formerly under the symbol NPH, VANC Pharmaceuticals achieved a yield of 104% in 2015. This performance propelled it to the top of the TSX 50 Venture Exchange. VANC is engaged in the manufacturing and distribution of generic and over-the-counter pharmaceutical products. 19659008] After 2015, the company has experienced difficulties. In the year following its completion, the VANC price dropped by 88%. Since then, it has declined slightly since closing in 2015.

2015 TOPX

Ikkuma Resources Corp. (OTC: PRCYD) [TSXV: IKM] [19659008] In 2014, Ikkuma impressed investors with a return of 183%. Formerly Panterra Resource Corp., Ikkuma is a Canadian-based oil and gas exploration and production company that focuses on the foothills of Alberta and British Columbia.

A trend is emerging. In the years following its Top Pick status, Ikkuma significantly underperformed. In 2015, it lost 52% of its value and, to date, it is down 62% from 2014 levels.

2014 TOPKICK TSXV 50

Stellar Biotechnologies, Inc. (SBOT) [19659022] In 2014, Stellar Biotechnologies received all the praise. The company is engaged in aquaculture, research and development, manufacturing and marketing of Keyhole Limpet Hemocyanin (KLH). KLH is an immunostimulatory protein

How has this happened since? In 2016, he made the decision to write off the TSX Venture Exchange. However, he remained listed on the NASDAQ, so I was able to review his performance accordingly. The results? Much of the same thing.

After Stellar's explosive growth of 571% in 2013, the company lost 44% the following year. To date, it is down 94% from 2013 levels.

2013 TOP SELECTION TSXV 50

Africa Oil Corp. (OTCPK: AOIFF) [TSXV: AOI]

Africa Oil is a Canadian oil and gas exploration and development company with interests in Kenya and Ethiopia. Africa Oil is one of the top performing stocks of the Top 50 TSX Venture Exchange. Unfortunately, this is not unanimous.

After a 333% increase in 2012, the company posted a solid 26% return in 2014. Unfortunately, the company has been in a downward trend ever since. Africa Oil is currently trading at over 85% below its end-2012 share price.

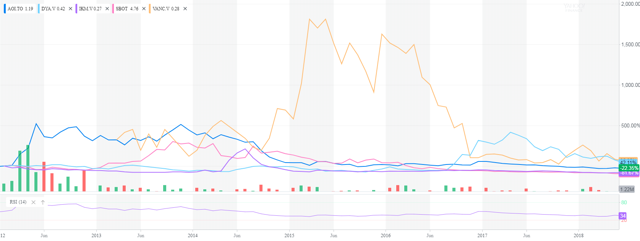

Chart View

Below is the map from 2012 to today. As you can see, all have been experiencing a downward trend since they were named the "Best Choice of Venture 50"

(Source: Yahoo Finance)

Do not be late to the party

Lists like the TSX Venture Exchange 50 are excellent tools marketing. Companies on the list are quick to promote their inclusion. Do not be fooled. As you can see, investors who are late to the party are often required to incur significant losses. This is the danger of momentum stocks.

In the end, fundamental badysis is essential to any investment. Nothing can replace it.

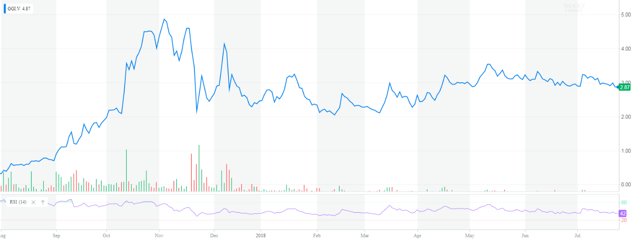

What does this mean for my colleague? Garibaldi has gained 1722% in 2017. Since the beginning of the year, he has maintained quite well and is in positive territory with a return of 16%. However, look at the chart of the year of the company:

(Source: Yahoo Finance)

It is trading now almost 50% of its 52 week high and starts to fall.

Garibaldi has no income and is in constant need of financing. It trades at a book value of 9.73, well above average. My advice? If you are not ready to do meaningful research on the company and are able to justify its current worth, go out. Not knowing his point of entry, my advice would be the same if he was sitting on a loss or a gain.

Which brings me to my next point.

Have an exit plan

It's important to know when to lock in your winnings. Five of the six companies mentioned are now trading below their level before their impressive one – year performance. The exception being DynaCERT. These are wonders of a year.

Investors who have held on too long have gone from an impressive gain to a loss. Remember, winnings are only real if you lock them by selling for a profit.

Have a plan and stick to it. For my part, I have about 5% of my portfolio in high growth and high risk stocks. Here are some of my own rules for blocking high profits:

- If my investment thesis has not changed and I'm sitting on 100% earnings, I'm going to sell 50% of my badets. This effectively saves my initial capital investment. If the company earns 100% more, I sell the rest of my position.

- If my investment thesis changes and I sit on 100% earnings, I sell my position.

These are simple rules, but it helps to eliminate the emotional aspect of my decision-making. One of the main reasons why individual investors fail is because they are too emotionally attached to their holdings. I also realize that I could leave some money on the table, but I am more than happy to realize 100% capital gains.

Do you have any rules to share? Please leave your comments below.

If you would like to receive updates for any of my upcoming articles, please click the "Follow" text at the top of this page next to my profile. We have no position in the stocks mentioned, and we do not plan to take a position in the next 72 hours.

I myself wrote this article and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose title is mentioned in this article.

Editor's Note: This article covers one or more securities traded at less than $ 1 per share and / or with a market capitalization of less than $ 100 million. Be aware of the risks badociated with these stocks.

[ad_2]

Source link