[ad_1]

On Thursday, May 16, 2019, Kinder Morgan, Inc. (KMI), a giant of energy in pipelines and the midstream, made a presentation at the Barclays America Select franchise conference. As usual for presentations of this type, Kinder Morgan exposed its position in its sector and presented an investment thesis to potential investors. The company has also put a lot of effort into discussing trends in the energy sector in North America. Currently, some trends are generally strong in the energy sector and Kinder Morgan is well positioned to capitalize on them and, in doing so, create the kind of growth that has made the company a favorite of dividend investors for years. .

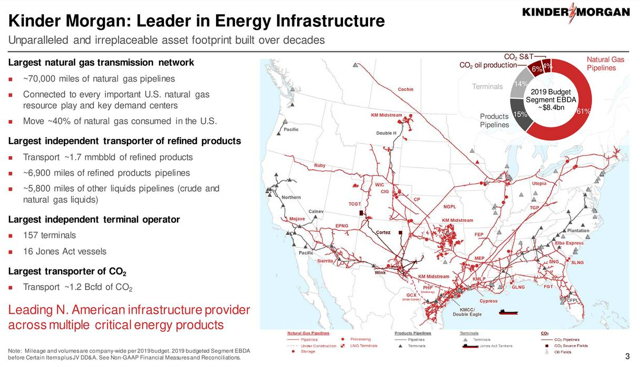

Kinder Morgan is the largest pipeline company in North America. The Company has approximately 70,000 miles of pipelines, 6,900 miles of refined products, 5,800 miles of pipelines and natural gas liquids, and 157 terminals.

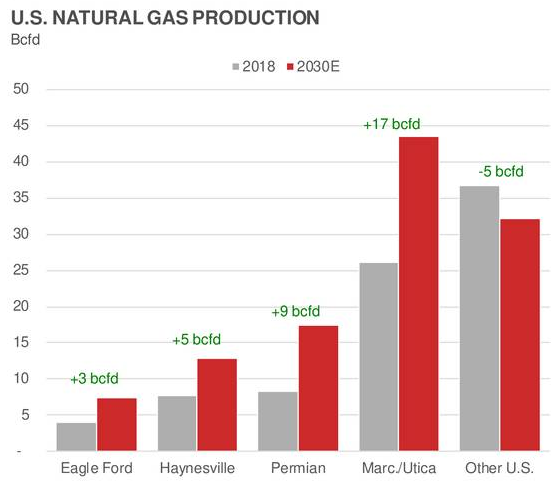

This gives the company a presence in all the major basins in which oil and natural gas are produced. This is a good position for the company because there are different dynamics in each of these basins. For example, the Permian recorded much higher output growth than other US basins in recent years. At the same time, other regions, such as the Marcellus and Utica shales in the Appalachians, do not produce crude oil. Their development therefore does not depend particularly on crude oil prices. In addition, each of these basins is expected to increase production at a different pace in the future. For example, here is the current projection of the growth of natural gas production by basin for the next decade:

Source: Kinder Morgan

By operating in these different basins, Kinder Morgan is able to take advantage of the various opportunities presented to it.

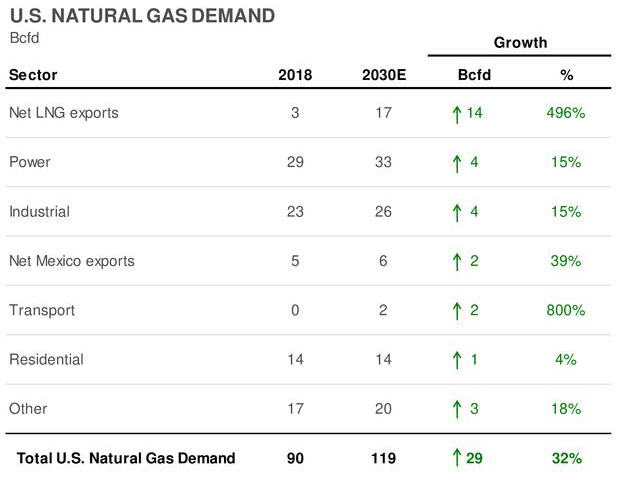

Of course, this growth in production would be useless if there were no demand for additional production. Fortunately, this is not the case. One of the main drivers of natural gas demand is the export market, which is expected to increase its natural gas consumption by 496% over the next ten years:

Source: Kinder Morgan

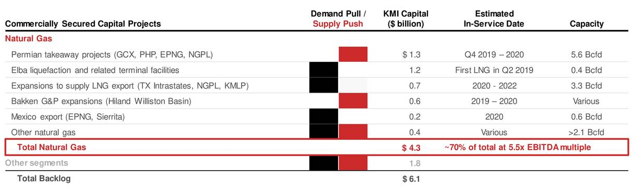

In the United States, natural gas consumption, including the export market, is expected to increase much more than oil consumption. This is mainly due to the perception of natural gas as a cleaner burning fuel, which is pushing the world to use it instead of oil and coal as a source of energy. Kinder Morgan moves to take advantage of this request. As we can see here, the company currently has $ 6.1 billion in new growth projects under construction or planned, including $ 4.3 billion to increase its footprint in the natural gas sector:

The largest of these projects is the $ 1.3 billion that the company invests in Permian take-away projects. These include pipelines such as the Permian Highway Pipeline and the Gulf Coast Express Pipeline, which will allow natural gas to move away from the huge Permian Basin in western Texas to the export facilities located in the area. along the Gulf Coast. Naturally, the purpose of these projects is to increase the amount of natural gas that Kinder Morgan is able to carry out of the Permian Basin, taking into account the increasing level of its production. As KMI's business model results in higher revenue and cash flow as volumes increase, these projects will drive the company's financial growth. That's what investors like to see.

Kinder Morgan may be working on a much more interesting project in the natural gas field, the $ 1.2 billion Elba liquefaction plant. This facility is being built on the island of Elba, a private 840 acre island located near Savannah, Georgia. This makes it one of the few liquefied natural gas plants being built outside the Gulf Coast. Once fully operational, the plant will have a capacity of about 350,000 mcf / day of natural gas, or about 2.5 million tons per day. Royal Dutch Shell (NYSE: RDS.A) (NYSE: RDS.B) is aggressively positioned as a natural gas supplier in Europe and has already agreed to buy all of the production from the factory. This is a good sign, as it will allow Kinder Morgan and its partners to generate a positive return on the project from the very beginning of its operation. It also ensures that companies do not invest all this money to produce LNG that nobody really wants. The plant began operating earlier this quarter and will be gradually commissioned over the next nine to ten months. Thus, we will see a slow increase in Kinder Morgan's revenues for the rest of the year.

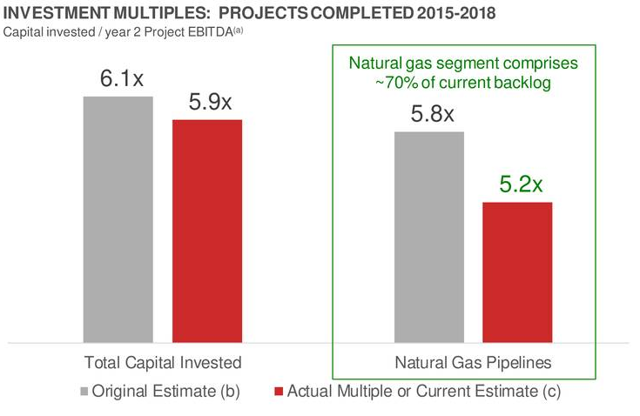

Earlier this week, I published an article about partner company Magellan Midstream Partners (MMP), in which I described the company's expected performance on its growth projects as rather disappointing. Kinder Morgan works much better in this regard. Over the 2015-2018 period, projects put online by Kinder Morgan had an EBITDA multiple of 5.9. However, its pipelines had a much better multiple of 5.2x:

This means that it takes an average of just over five years for a pipeline to become profitable. This is certainly much better than what Magellan Midstream has achieved and clearly indicates that Kinder Morgan is much better at controlling construction costs or is able to obtain more profitable contracts from its customers. Either scenario is good for the company and its shareholders.

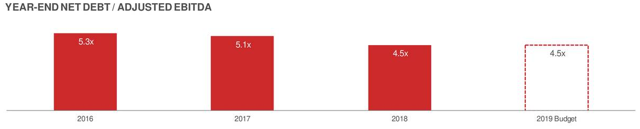

For some time, one of my biggest problems with Kinder Morgan has been the debt level of the company. Fortunately, this is an area in which the company has improved. We can see this clearly by looking at the ratio of net debt to adjusted EBITDA, which indicates the time it will take to pay off debt if the company dedicates all of its pre-tax recurring cash flows to it. :

As we can see, the company's ratio is currently 4.5, which is significantly lower than the 5.3 at the end of 2016. It seems likely that the company will attempt to maintain its leverage about that level. The target level of long-term direction is 4.5x. I'll admit though that I usually like to see this report under 4.0x. This is because debt limits the flexibility of a company if an event results in a decline in cash flow. Of course, mid-market companies such as Kinder Morgan have very stable cash flows. So it's hard to see what kind of event could cause such a drop in cash flow. In addition, Kinder Morgan is less indebted than some other mid-market giants like Enbridge (NYSE: ENB). Thus, the company probably has sufficient financial flexibility to take advantage of opportunities as they arise.

In conclusion, the natural gas space is likely to be one of the North American energy growth segments over the next decade, and Kinder Morgan is well positioned to capitalize on this by providing the necessary infrastructure to bring this market to market. natural gas. It is also well positioned to take advantage of growing demand from export markets. The company also has several space growth projects that offer attractive returns and have the financial flexibility to do so. Overall, it's easy to understand why Kinder Morgan is a favorite among middle-income investors.

At Energy Profits in Dividends, we aim to generate more than 7% income by investing in a portfolio of energy equities while minimizing our risk of capital loss. By subscribing, you will have access to our best ideas sooner than they are disclosed to the general public (and many of them are not at all), as well as to more research. thorough than everyone else. We are currently offering a free two-week trial for the service, so come see us!

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link