[ad_1]

The agribusiness group reduced the value of its Kraft and Oscar Mayer brands by $ 15 billion, recorded a loss of $ 12.6 billion, reduced its dividend by 36% and revealed that its accounting practices were under investigation by the US Securities and Exchange Commission.

Customers were not the problem: sales rose about 1% in the fourth quarter. Instead, CEO Bernardo Hees blamed the company's operations. Higher than expected manufacturing and logistics costs weighed on the company. Kraft Heinz expected its 2015 merger to help reduce costs, but these efficiency gains have dried up.

The company said US regulators were studying issues "including, among other things, agreements, side agreements, as well as changes or modifications to its agreements with suppliers." The SEC issued a subpoena on this subject in October 2018.

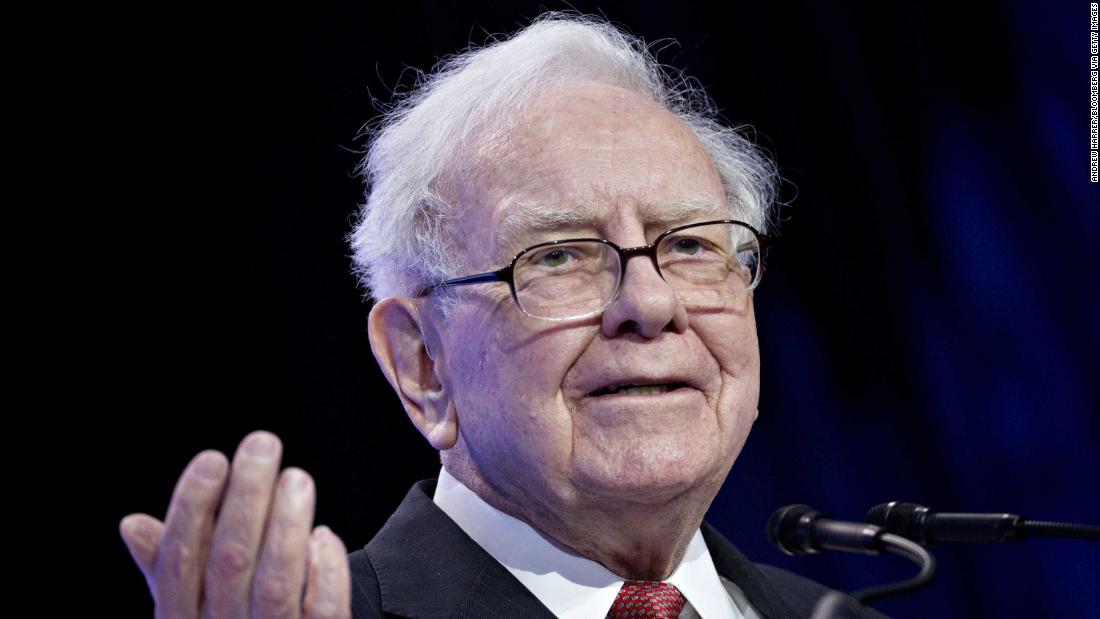

Buffett's letter is read closely for his investment advice.

This year, the memo will be used to better understand the slowdown in economic growth in the United States and around the world and what it means for businesses and markets.

3. The worries of the economy: US investors released their shares on Thursday after receiving disturbing news about the global economy.

Durable goods orders in the United States grew less than expected in December and existing home sales declined in January. The surveys revealed a new weakness in manufacturing in developed countries.

"US data has clearly taken a turning point recently," said Simon MacAdam, a world economist at Capital Economics. "While the economy is expected to lose much more momentum this year, it is unlikely that the Fed will raise rates again this cycle."

US crude futures prices rose 0.4% to trade at $ 57.20 a barrel.

Oil prices have largely recovered after Thursday's losses caused by a report from the Energy Information Administration that crude oil production in the United States reached 12 million barrels a day last week.

Friday – Berkshire Hathaway (BRKA) earnings

[ad_2]

Source link