[ad_1]

Subscribe to the New Economy Daily newsletter, follow us @economy and subscribe to our podcast.

European Central Bank President Christine Lagarde asked investors to prepare for new guidance on monetary stimulus in 10 days, and signaled that new measures could be put in place next year to support the eurozone economy after the end of the current emergency bond program.

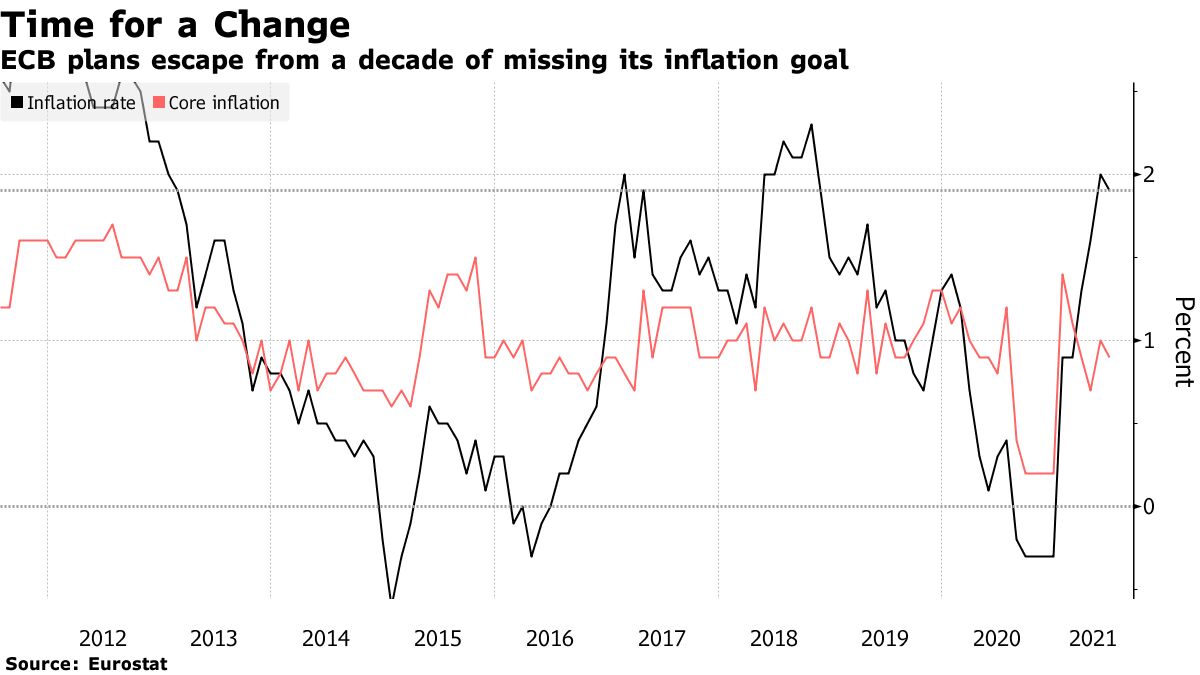

Speaking to Bloomberg Television days after the ECB raised its inflation target to 2% and acknowledged that it could exceed the target, Lagarde said the July 22 Governing Council session – which was previously expected be relatively uneventful – will now have “interesting variations and changes.” . “

“It will be an important meeting”, she declared Sunday in Venice, after a meeting of the finance ministers and central bankers of the Group of 20. “In view of the perseverance which we must show to keep our commitment, the forward-looking orientations will certainly be reviewed. “

The premature and unexpected conclusion of the ECB’s Strategy Review last week immediately fuels speculation about the central bank’s plans as the eurozone the economy is starting to recover from the pandemic. The review also brought climate change considerations into policy, and officials said they would start factoring in the cost of owner-occupied housing.

Lagarde has said she expects the ECB’s current € 1.85 trillion ($ 2.2 trillion) bond purchase plan to run “at least” through March. 2022. This could then be followed by a “transition to a new format,” she said, without further details.

Still, she dismissed the need to discuss when emergency stimulus measures might be removed, saying she was only “cautiously optimistic” about the recovery, as the delta variant of the coronavirus poses a threat to efforts to return to normal life. While inflation will accelerate this year, the central bank expects this to be temporary.

“We have to be very flexible and not start creating the anticipation that the release is in the next few weeks, the next months,” Lagarde said.

His colleague on the Governing Council, François Villeroy de Galhau, the head of the Banque de France, expressed a similar sentiment on Sunday, saying that the policy can be adapted to any monetary meeting and that “we have at least four meetings of this type by the end of the year. “

The euro was down 0.1% to $ 1.1867 at 7.49 am Frankfurt time.

The ECB’s approach sets it apart from some of the world’s largest central banks. U.S. Federal Reserve officials are already discussing when to start cutting back on their stimulus package as growth and inflation accelerate.

A growing chorus of economists also expects the Bank of England to raise interest rates as early as next year.

The 25 members of the ECB’s Governing Council agreed in June to continue to make emergency bond purchases at a high pace this quarter, although the minutes of the meeting showed divergent views. Some governors have also publicly stated that they do not expect the program to be extended beyond March.

Lagarde said the immediate task is to revisit parts of the ECB’s guidance on future interest rates and asset purchases that are tied to the previous inflation target of “lower, but close to 2% “. The Governing Council chose not to address these changes last week.

“We’re going to look at the circumstances, we’re going to look at the forward directions that we need to revisit, we’re going to look at the calibration of all the tools we use to make sure they’re aligned with our new strategy,” she said. .

She also agreed that the new inflation target “might take a little longer” to achieve, but said the most important issue was “acceptance and tolerance” that a transient and moderate may be required as part of the price recovery commitment. stability.

“We have to use the tools, and we have a big toolbox, to actually deliver that 2%,” she said. “We need to.”

| Digital Euro, climate change |

|---|

|

– With the help of Libby Cherry, Allegra Catelli and William Horobin

(Updates with Villeroy’s commentary, markets starting in eighth paragraph)

[ad_2]

Source link