[ad_1]

June was not an excellent month for the job market. Economists accuse President Donald Trump of the trade war – and warn that if he implemented his protectionist agenda, he could drag America into recession.

The Bureau of Labor Statistics' announcement Friday that the economy has created only 75,000 jobs, well below expectations, came two days after the report of the payroll processor on the private sector, announced by ADP added only 27,000 jobs in May.

"Even though the ADP report released earlier this week foreshadowed a possible failure today, it's even worse than the lower expectations of most people," said Chris Zaccarelli, director information from the Independent Advisor Alliance.

"It's a clear sign that the trade war is bad for the economy," said Mark Zandi, chief economist at Moody's Analytics. "Fingerprints of the trade war are becoming more obvious in the data."

The weakness of manufacturing jobs, which were stable in May, is an important index, he said. "The manufacturing industry recorded an average growth of 20,000 to 25,000 jobs a month last year. This year, it's barely positive. The loss of jobs in retail and transportation in May also reflects the impact of shrinking margins and shrinking global trade, he added.

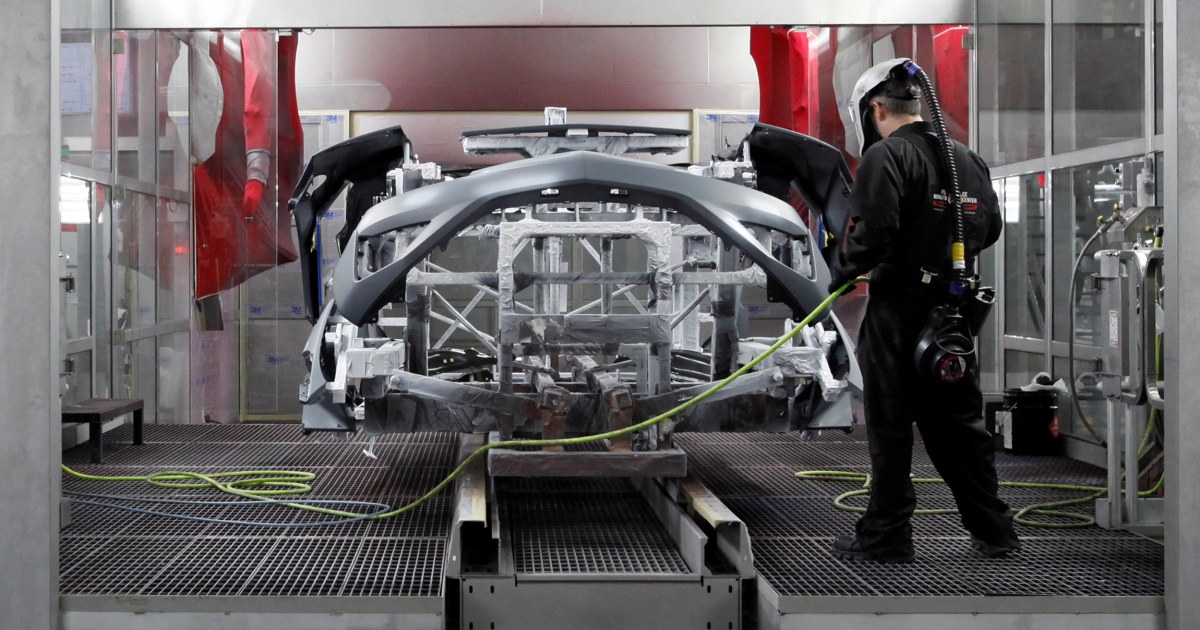

Several labor economists have focused on manufacturing in particular. Although the Trump presidency was defined by a repeated commitment to support US manufacturers, the trade war costs far more jobs than it has added, and the industry's setbacks may well have just begun, said Daniel Zhao, chief economist at Glassdoor.com.

The Trump presidency was defined by a commitment to support US manufacturers, but the trade war costs a lot more jobs than it has added, an economist said.

Zhao said that Glassdoor's internal data also related to a contraction. "We have seen a decrease in job offers, which could indicate that the slowdown in manufacturing could worsen in the near future."

While the economy was on an upward trajectory for an unprecedented decade, a slowdown was inevitable at one point. Labor market experts were expecting a gradual downturn, but trade tensions have laid the foundation for their hopes for speed and severity.

Economists have warned that a race to tariffs could quickly place job gains in the rearview mirror and send the US economy plummeting. "If the president continues to continue the war, certainly he intensifies things, I think the risks of recession are increasing," Zandi said.

Josh Wright, chief economist at iCIMS, predicted Josh Wright, chief economist of trump's strategy of using tariffs as a catch-all instrument to transform everything from global supply chains to geopolitical alliances.

"Next month is quite possible, given the seriousness of these headlines. It's a situation that is changing rapidly, "Wright said. "The situation could worsen during this month."

Wright said that this would spur the Federal Reserve to chart a course of action that links inflation and growth without being mistaken. "It makes the conversation more difficult," he said. "It makes it easier for the Fed to advocate for rate cuts, but I do not think that is enough in itself."

"Stock markets are banking on the Fed's ability to intervene and save the situation, as it has been doing for much of the past decade," said Cliff Hodge, chief investment officer of Cornerstone Wealth.

In a recovery characterized by a long period of historically low interest rates, the Fed's ability to avoid an economic slide is likely to be diminished. "The Fed has less leeway to use its monetary policy to stimulate the economy," said Zhao. "It's still possible for the Fed to work with, but if the economy slows more dramatically, it would certainly be a concern."

For the moment, employment growth remains in positive territory, although reports of BLS and ADP on job gains have proved to be unpleasant surprises. This gives market watchers a measure of hope.

"In the end, the job market is still hot enough to continue burning in the future," said Zhao. "This report indicates that employers are downsetting. They still can not slow down, but it's definitely a warning sign for the future of the economy. "

Although the unemployment rate remained stable at 3.6 percent, Zhao said the slowdown in wage growth and labor market participation was a bad sign. "These two signals indicate a ratio even lower than the numbers above," he said.

The downward revisions to the March and April reports that eliminated another 75,000 jobs combined added to Zandi's concern. "This is another indication that the economy is really turning. That's when you get these revisions down, "he said.

Ending the multifront trade war now – including Trump's threats to levy tariffs on all Chinese and Mexican imports, as well as on imported vehicles – could bring the economic trajectory back to normal, but this window closes. quickly, said Zandi.

"If he goes all the way … then we're done, play is over, I think we have a recession."

[ad_2]

Source link