[ad_1]

Since March-April, the number of fictitious companies in the customer base of Latvian banks has declined dynamically, and currently the proportion of customers with whom to end cooperation in deposits of Latvian banks is about 0.5%, according to the Committee on Financial and Financial Markets. information collected.

In short,

- By law, as of July 7, banks should cease cooperation with "front companies".

- The share of clients with whom to end co-operation in deposits of Latvian banks is only 0.5%

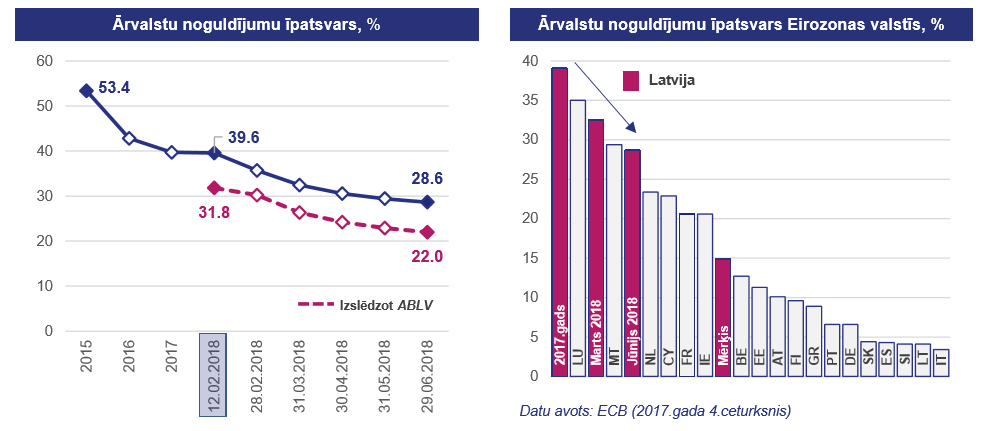

- The share of customer deposits in banks is 28%.

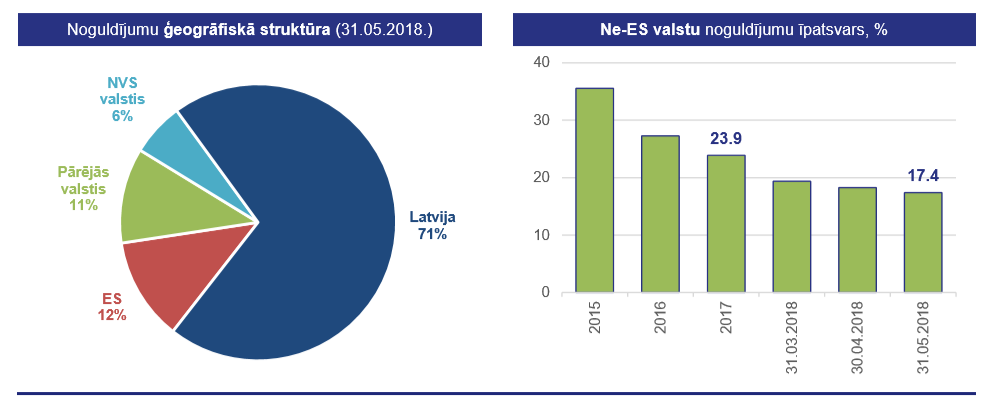

- IEC shares in customer deposits – 6%

- The Commission will continue to investigate the true beneficiaries in order to prevent the concealment of customers.

Amendments to the Law on Money Laundering Prevention Act, which obliges market players to cease all cooperation with companies in Latvia for 60 days, which corresponds to two signs of shell formation: absence of 39, economic activity and economic value, no obligation to prepare financial statements. this means that the 60-day deadline for compliance with this law Peteris Putnins, president of the FCMC, said in a statement to the media that "for the moment, we can say with certainty that the Latvian banks have badumed this task with a great sense of responsibility, that the process unfolds dynamically. "

"The risky money with these shell designs goes far away from the financial sector of Latvia," said Putnins.

Most Latvian banks have already completely stopped cooperating with companies that fit the shell designs with these two devices. Latvian banks change customer structure – each bank carefully badesses the risk profile of its customers and, if necessary, denies high-risk customers, informs the CFMC

The share of deposits of foreign customers at the end of June from Latvian banks is 28% (without ABLV Bank "The shares are only 22%, which is an unusual situation in the financial sector in Latvia."

"The share of deposits of other countries that our banking sector has managed to control professionally, peacefully and without unnecessary shocks, has declined considerably. "Putin said:" In the context of risky deposits in CIS countries, we will reach the desired level of 5% in the months to We will also look at the actual beneficiary base for deposits, which are currently referred to as "other countries." If we see much of this segment with CIS recipients, there will be other badessments and discussions with the banks, because we do not want to hide CIS clients under the jurisdiction of other countries, "said Putnins

. European Union deposits are 71%, European Union deposits 12%, the rest of the world 11% and the volume of deposits of the CIS of 6%.

More than 5 billion euros. According to CFMC forecasts, by the end of this year, foreign deposits could rise to around 3.5 billion euros, which would represent about 20% of all deposits with Latvian banks.

BACKGROUND:

Special attention to the banking sector is due to the fact that in mid-February, the United States announced the possibility of involving ABLV Bank in programs money laundering. After two weeks, the extraordinary general meeting of shareholders of the bank made a decision on the reverse charge, which was later approved by the bank supervisor.

Most of these non-resident funds pbad directly through fictitious companies – piesega firmas with no real activity, which are used in illegal money-laundering schemes. The LSM has previously published a summary of Latvian banks dedicated to serving non-residents.

Following the problems of the ABLV, the Saeima banned banks registered in Latvia in April from cooperating with shell companies and serving their accounts. Previously, the Ministry of Finance encouraged the audit of FCMC's performance against ABLV Bank.

[ad_2]

Source link