[ad_1]

The KAMCO report indicates that global market movements remained limited in a narrow range in July 2019. The MSCI World Index rose only 0.4% during the month, as markets already forecast that the Fed would reduce its interest rates for the first time since 2008. The Federal Reserve has reduced its main interest rate by 25 basis points, or 2% and 2.25%. US equities rose 1.3% on a monthly basis, while market sentiment was mixed as operators wanted to cut interest rates at a higher rate. Emerging markets fell 1.7%, mainly due to concerns about capital flows, as it was unlikely that the Fed's decision marks the beginning of a long cycle of monetary easing.

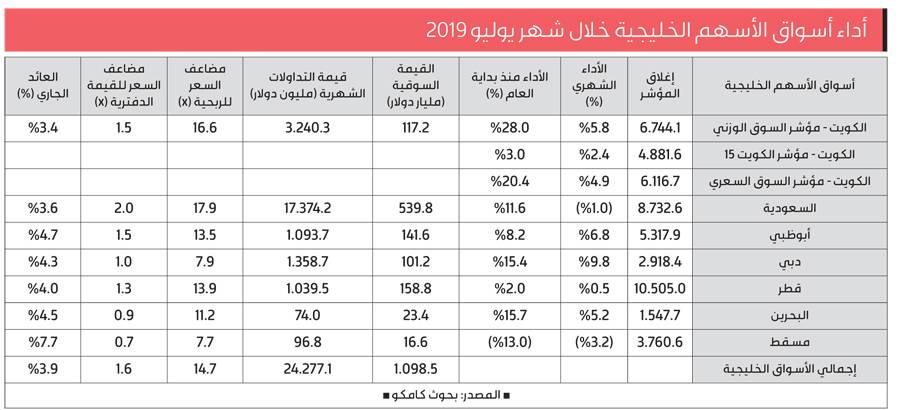

Most central banks in the GCC countries, with the exception of Kuwait, followed similar steps for the Fed and cut their interest rates in order to maintain their currency linked to the US dollar, the main banks Central banks such as the Central Bank of the United Arab Emirates reducing their interest rates by 25 basis points on certificates of deposit, while the Saudi Monetary Agency has reduced the redemption rate of 300 basis points at 275 basis points and the repo price 250 basis points at 225 basis points. On the CCG stock market, the MSCI GCC index rose 0.5% on a monthly basis in July 2019, while the market is still up double digit (+ 10.3%) since the beginning of the year. The United Arab Emirates indices outperformed the other regional indices in July 2019. The Dubai financial market (+ 9.8%) and the Abu Dhabi Securities Exchange (+ 6.8%) closed the month with the better performance of the GCC markets. This superior performance was fueled by the selective acquisitions of some of the leading companies, pushing several headlines to double-digit growth.

The first stock market index of the Kuwait Stock Exchange (+ 5.8%) maintained its strong performance in a still positive climate, due to the expected negative inflows of the modernization of the market to join the MSCI Emerging Markets index and continued growth in corporate profits. On the other hand, the performance of the Saudi market decreased and lost 1.0% of its value in July 2019. Bank securities declined by 1.8% on a monthly basis, despite the fact that they are among the largest in the world. the best performing sectors since the beginning of the year (+ 18.7%). . The negative business sentiment in the banking sector is largely due to the possibility of lower margins after interest rate cuts. Commercial activity in the region decreased slightly by 5.1%, with total sales of $ 24.3 billion.

Kuwait

The main indicators of the Kuwait Stock Exchange have continued to outperform their regional counterparts since the beginning of the year and have maintained their positive performance for the seventh consecutive month. Trading activity continued to increase, in contrast with the seasonal slowdown. In July 2019, the volume of shares traded increased by 78%, from 2.63 billion in June 2019 to 4.68 billion shares. The value of shares traded increased by 48.3% to 0.98 billion KD in July 2019, compared to 0.66 billion KD in June 2019. The average daily business activity in 2019 more than doubled compared to 2018 , reaching 33.5 billion dinars against 14.3 billion dinars in 2018.

The three major indices rose in July 2019, with the first market index rising 5.8%, while the benchmark rose 2.4%, resulting in an increase of 4.8%. % of the general market index. Shares of large cap companies were the main beneficiaries of the modernization, as evidenced by the rise of the first stock market index of 28% in the first seven months of 2019, while the main stock index rose by 3%. % compared to the previous year. The general market index has risen 20.4% up to July 2019 since the beginning of the current year, the first market shares accounting for 74% of the total market value.

In terms of sectorial performance, the telecommunications sector performed best in terms of monthly performance with growth of 8.4%, followed by the banking and manufacturing sectors with gains of 5.2% and 4.8%, respectively. . Regarding the profits of the big banks, the National Bank of Kuwait recorded a net profit of 209.1 million KD in the first half, an increase of 12.5% compared to the first half of 2018. Total badets were increased by 3.4% to 27.9 billion KD. Net operating income amounted to KD 451.9 million, up 2.2% from the first half of 2018. Loans and advances increased by 6.5% compared with the previous year. previous year, to reach 16.2 billion KD.

Saudi Arabia

Saudi Arabia's performance in July 2019 fell 1.0% in one month after posting the best performance of the GCC in June 2019. The Tadawul index closed at 8732.62 points because of sharp declines in key sectors such as banks and commodities. However, the performance of the Tadawul market since the beginning of the year is still good, the index recording double-digit growth (+ 11.6%), due to the influx of negative funds resulting from the inclusion of the market in Morgan Stanley, FTSE Russell and Standard & Dow Jones emerging markets, as well as the government's reduction of regulations governing foreign ownership of shares.

Sector performance was mixed, with many sectors ending in July 2019, but declines in key sectors detracted from the broad-based index. The banking sector, which performed best in the first half, recorded a monthly decline of 1.8%, with most banks in the index ending the month down, while the Samba Financial Group lost 8.3%. Monthly. Followed by Riyad Bank (-3.5%), Saudi British Bank (-2.7%) and Saudi Arabia Fransi (-2.7%), while Al Rajhi Bank lost 1.3% on a monthly basis. The index of basic materials decreased by 2.8%.

United Arab Emirates

The Abu Dhabi Stock Exchange (ADX) and its Dubai counterpart, the Dubai Financial Market (DFM), posted the best performance of the GCC in July 2019. The Abu Dhabi Securities Market Index increased by 6, 8% on a monthly basis. The index closed at 5317.90 points and the sectorial performance was positive. The real estate sector posted the best performance, with an increase of 21.4% over a month, thanks to the 22.2% rise of Aldar. , Monitoring the consumer goods sector, which rose 21% on a monthly basis and fish stocks by 56.8% on a monthly basis in July 2019. The banking sector index rose 7, 1% year-on-year, the first 7.6% on a monthly basis, while the Islamic banks of Abu Dhabi and Abu Dhabi Commercial Bank recorded growth of 8.2% and 7.5%, respectively.

The Dubai financial market (DFM) dominated the list in July 2019, with the leading index up 9.8% and closing the first seven months of 2019 as one of the best performing markets since the beginning of the year. year. The index ended the month at 2918.4 points, with all sector indices closing higher. The market spread to winning stocks, with only two shares in the Dubai financial market, declined at the end of the month. The real estate sector posted the best performance, with a monthly increase of 18%, supported by the good performance of Emaar Properties (+ 2.7%), from Emaar Properties (+ 18%). , 8%) and Arabtec Holding (+ 16.5%).

Qatar

Qatar's performance remained stable (+ 0.5%) in July 2019, following the rise of the previous month. The Qatar Exchange index closed at 10505.00 points. The quantitative easing index, which covers a larger number of markets, also confirmed market stability of 0.1% during the month. The market spread coefficient was relatively balanced and mainly dominated by the decline in equities, with 20 stocks having higher prices and 26 in July 2019. The telecom sector index was the best performing, registering a rise 5.8% on a monthly basis. Supported by Oridu's share, up 9.3% on a monthly basis. Then came the transport sector, which grew by 2.1% on a monthly basis, with Qatar Navigation (+ 3.3%) and Qatar Gas Transport Co. Ltd. (Nakilat), by 2.2%. In contrast, the real estate sector index continued its decline in July 2019. The sector lost 1.0% of its value on a monthly basis. The industry and insurance sectors also posted a negative performance, down 3.5% and 1.2%, respectively. The banking and financial services sector was the most active in terms of value in July 2019, accounting for 41.9% of the total value of trade, followed by the industrials and consumer goods and services sectors, with their acquisition accounting for 20.1% of total value. % and 12.7% of the total value of the monthly exchanges, respectively.

Bahrain

The Bahrain Stock Exchange continued to post a strong performance and maintained its second best performance position in GCC countries since the beginning of the year (+ 15.7%). The index rose 5.2% on a monthly basis in July 2019 and closed at 1547.68 points. The performance of the sector was mainly affected by that of the commercial banking sector, with the sector index rising 8.1% on a monthly basis and 31.9% since the beginning of the year. The sector's performance was driven by the growth of Ahli United Bank and BBK, which rose 9.2% and 14.3% respectively on a monthly basis. The services sector was also positive with monthly growth of 3.7%, with Zain Bahrain rising 11.4% on a monthly basis, while Batelco grew 6.1% on a monthly basis. On the side of declining businesses, the index for hotels and tourism and the insurance sector respectively lost 3.7% and 0.8%.

Amman

The Muscat Securities Market index fell 30 points in July 2019 for the tenth consecutive month, reaching a new record low at the end of the month, falling 3.2% in the month and closing the month at 3760 , 63 points. The beginning of 2019 to date is the lowest level of the GCC, recording growth of 13.0%. All sector indices fell without exception at the end of the month: the industrial sector lost 4.5% of its value monthly, followed by the services sector with a monthly loss of -4.0% and the sector index with a decline of 2.8%. Monthly.

[ad_2]

Source link