[ad_1]

China reacted violently to threats by US President Donald Trump to introduce more protectionist tariffs on Chinese products as part of its trade war against China, which has entered a phase of disruption that has taken place. 10 years low.

Chinese state enterprises have also been ordered to suspend their imports of US agricultural products.

US losses in stormy trade totaled $ 700 billion, including $ 162 billion from the losses of the five largest technology companies.

According to badysts, China's violent retaliation meant that it had lost all hope of reaching an agreement with the United States on tariffs between the two countries and that the situation was getting out of control.

Trump's threat

On Thursday, Trump threatened to impose new tariffs of 10% on remaining Chinese exports of $ 300 billion to the United States, unless China buys US agricultural products. Trump said the effect of these rates would come into effect early next month.

The day of incandescent yesterday began with the Chinese decision to cut the currency, Beijing has thus allowed Lyon to exceed for the first time in seven years its level of seven yuan against the US dollar. This is the lowest value of the Chinese currency against the dollar, both inside and outside China, since the global financial crisis of 2008.

In a subsequent escalation of the trade war, China also hinted at the possibility of imposing protective duties on its recent US agricultural exports.

Trump immediately denounced China's action on its currency, described as a "major breach." "China has lowered its currency to a historically low level," Trump wrote on Twitter. This is called "currency manipulation". Do you hear me, Federal Reserve? "It is a serious violation that will significantly weaken China over time."

Yi Gang, governor of the People's Bank of China, the central bank, rejected Trump's claims that China deliberately devalued the yuan in retaliation for Trump's tariffs.

"China will not engage in a competitive devaluation, will not use the exchange rate for competitive purposes, nor will it be used as a tool to deal with external troubles, such as trade disputes", said Gang.

The role of the reserve

The Trump news agency said it was determined to ask the central bank to ease its monetary policy to counteract this measure and not to urge the Treasury to step in to weaken the dollar.

Last week, the US Federal Reserve reduced interest rates by a quarter of a point in the face of the uncertainty of the global economic situation and the uncertainty engendered by the Trump trade war . The Fed has suggested that further reductions be announced if necessary.

Markets reacted immediately, with US stocks losing more than $ 700 billion at the end of a stormy day, including $ 162 billion among the top five tech companies.

Office Depo, the NASDAQ-listed company that lost 3.4%, led US companies to a loss of 8.3% yesterday. Best Buy lost 6.7%. Apple was one of the main victims, with a loss of 5.1%.

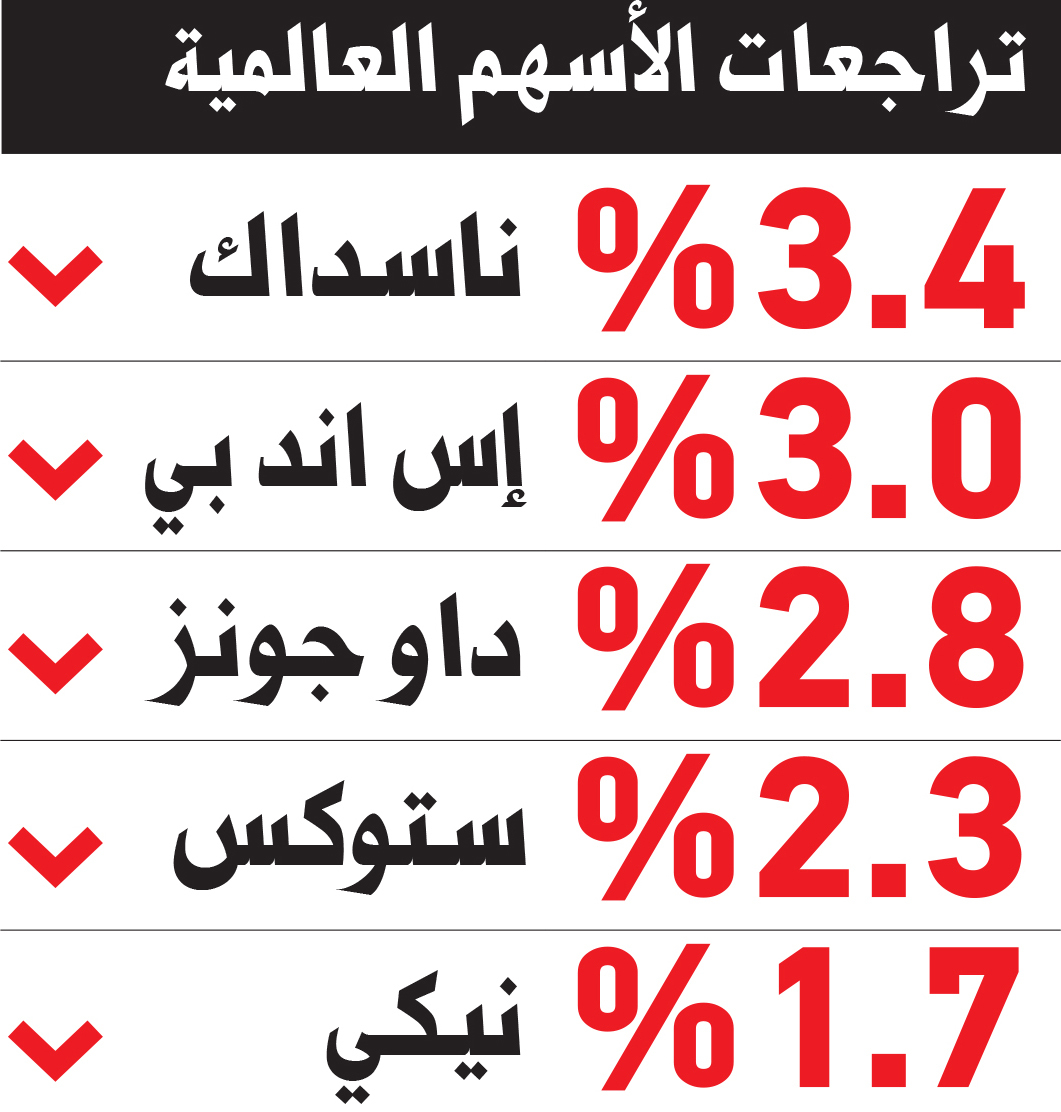

The broader S & P 500 index fell more than 0.3%, its worst performance this year. The Dow Jones Industrial Average fell 2.8%.

Japanese stocks also fell, investors worrying about the trade war and the Nikkei losing 1.7% to continue its downward trend after a big loss of 2.1% on Friday. European stocks were not spared by the intensification of overall sales: the Stokes EURO 600 index, made up of companies from 17 European countries, lost 2.3%.

In the Arab region, stock markets in the Gulf have fallen, which has led investors to safer badets.

The Qatar index was the most affected by a 4.2% drop, squandering all gains of the year, the Saudi index fell by 1.1%, the Dubai index by 2% and the Abu Dhabi index of 1.9%.

Unlike stocks, the coveted currencies, especially the "formation" on the date of the rise, with the value of "Genesis" yesterday of 9%, set at $ 11,860, the highest level in addition to Three weeks. In oil markets, Brent crude fell more than $ 2 to reach a low of $ 59.82 per barrel.

Turning for gold

Faced with the wave of stock sales, the trend to invest in gold, bonds and currencies has become a temporary alternative to equities, in light of the horror that has swept the markets after the events of the day before. The yellow metal rose 1.4% in its price, settling at $ 1,460.11 the ounce yesterday, its highest level since May 2013.

Peter Pocvar, head of investment at Blakeley Advisors Group, said: "We are now in a commercial situation where the train is down, with multiple side effects due to higher fares, and we are far from any solution with the China. "

"When China stopped defending the 7,000 yuan barrier against the dollar, it almost lost hope in any trade deal with the United States," said Julian Evans-Pritchard, director of the British consulting firm Capital Economics.

To print

E-mail

Facebook

Twitter

LinkedIn

Interest Pine

What is App

Source link