[ad_1]

Asian equities reduced their losses and US futures rebounded after US stocks fell the most in 2019, after the dollar surpbaded US $ 7. China has taken steps to stabilize the yuan after the Trump government has called the currency maneuver. .

Having exposed in the Orbex Code of our previous article the impact of the escalation of the trade war (After Trump again triggers the hell out of a trade war!Level 7 RMB is a psychological barrier that could push the PBoC to move.

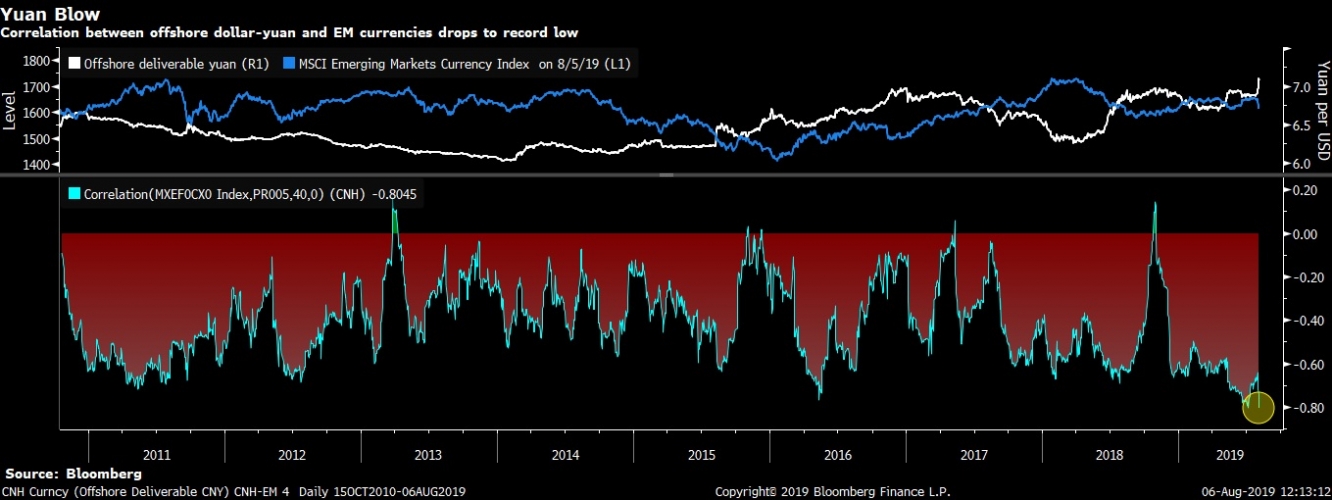

Emerging market currencies are increasingly vulnerable to concerns that China is using the yuan as a weapon in escalating its tariff war against the United States. While the dollar-yuan-dollar exchange rate against its counterparts in emerging market currencies hit a record high.

The markets that followed the escalation of the trade dispute in Trump have resulted in a fall in equities and currencies in emerging markets, fearing that the lingering superpower conflict is affecting global economic growth. Safe haven badets, including the Japanese yen, US Treasuries and gold, rose.

The People's Bank of China is moving!

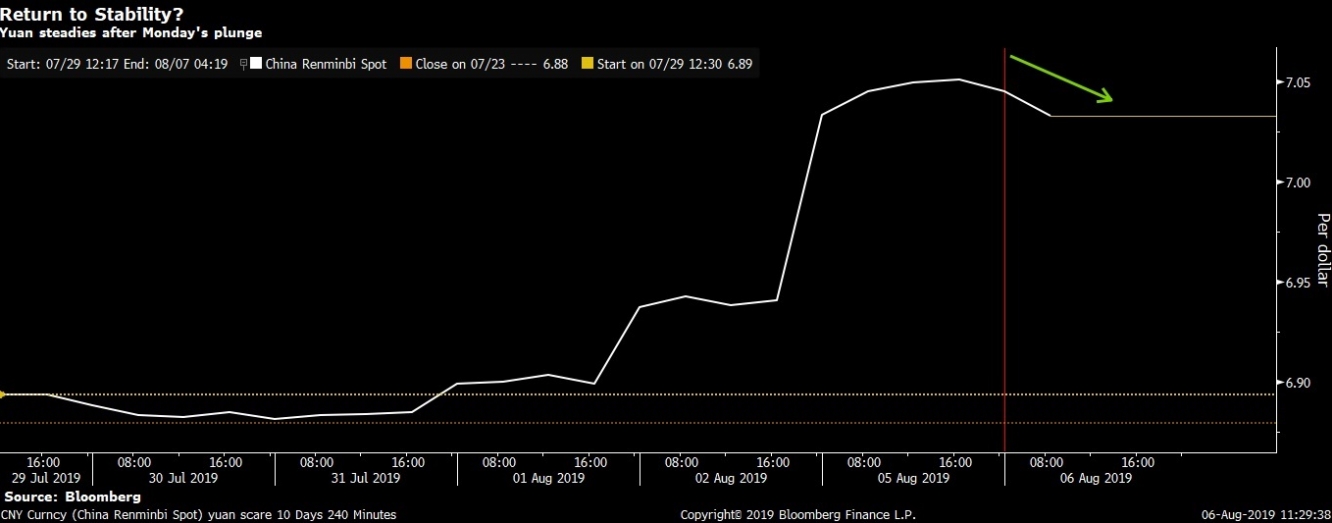

After the sharp decline of the Chinese yuan and the US Treasury attacked China, the manipulation of the currency. BEIJING – China will not use the yuan to settle its trade disputes, said yesterday the chairman of the People's Bank of China (Yi Jian). "I am very confident that the yuan will remain a strong currency despite recent volatility due to external uncertainty," Yi Yi said in a statement.

But after the announcement, the government again attacked President Donald Trump in a currency tweet that said the yuan's devaluation of $ 7 per dollar would have been manipulated.

While the People's Bank of China decided on Tuesday to fix the yuan exchange rate at a higher rate than expected, the daily reference rate was set at $ 6.9683 per dollar. Although the yuan reform has somewhat relieved investors, the world's two largest economies remain stuck in a reciprocal and endless spiral.

The People's Bank of China has decided to sell 30 billion yuan (4.2 billion US dollars) of Hong Kong bonds on Aug. 14, according to a statement released Tuesday by the People's Bank of China. This step usually removes cash abroad, which makes the depreciation of the Chinese currency expensive.

L & # 39; oil,

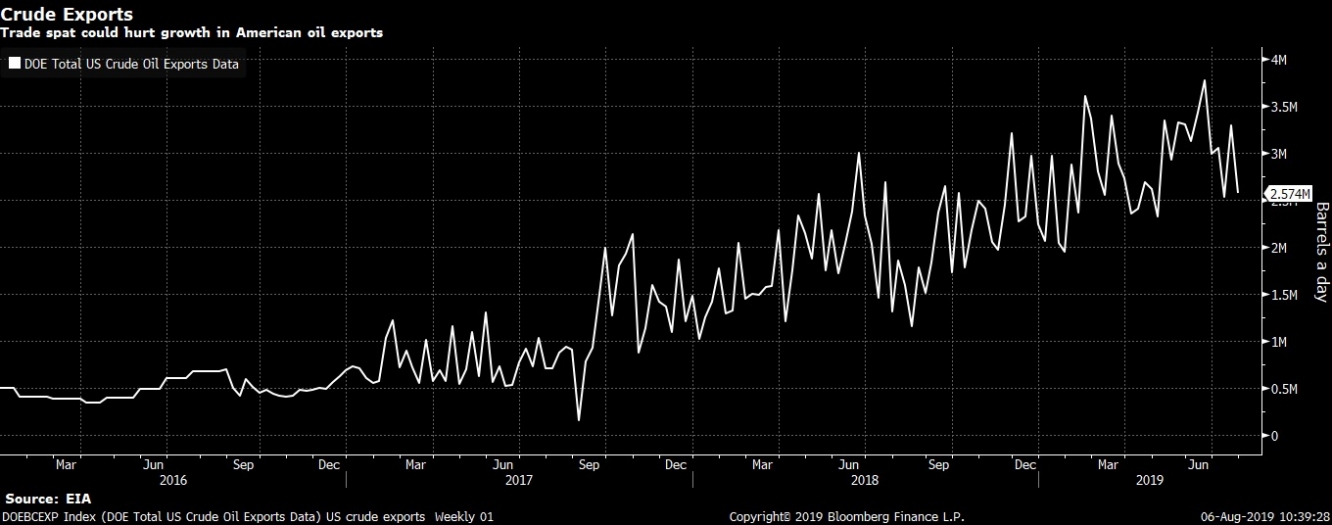

Oil has declined due to escalating tensions in the trade war, as high tariffs can reduce demand to the point of exceeding market supply, lowering prices and curbing investment in the country. drilling.

So far, sanctions against Iran and Venezuela, as well as cuts in OPEC production, have isolated US producers from the ongoing trade dispute. But the deep trade war between the United States and China will ultimately reduce US crude oil production and exports.

Yesterday, the international oil index closed below the $ 60 a barrel mark for the first time in nearly two months. Since Trump's tariff escalation, oil has dropped more than 5%, reaching its lowest level since mid-June. Also dropped more than 7% to its lowest level since last January.

A reform that has cooled the nerves of investors has reversed the current trend of oil, after the fall of oil and other risky badets, including shares and copper, China has allowed the sharp depreciation of the yuan to strengthen fears of monetary war.

In general,

At a time when oil prices benefited from the support of the yuan exchange rate, this rise could be limited. Concerns about declining demand will continue to weigh on prices because of tensions between the United States and China.

These additional fees, already imposed, create a headwind for global oil demand of 100 million barrels per day. This is a much greater concern than the threats of disruption to the flow of crude oil in the Strait of Hormuz, accounting for about one-tenth of that size, according to oil carrier tracking data compiled by Bloomberg.

In addition, if China decided to evade US sanctions and start buying Iranian crude, oil prices could fall again.

Technically, crude oil is expected to maintain a weekly close above $ 54.00 a barrel, which could further consolidate its gains back to $ 60 a barrel. While crude oil has had a daily close below the 54 level, it could put pressure on prices to bring them down to $ 50 a barrel.

@ Abdelhamid_TnT @

[ad_2]

Source link