[ad_1]

Al-Shall badyzed the results of the Commercial Bank of Kuwait for the first half of this year, indicating that the bank realized a net profit (after taxes) amounting to about 9.84 million dinars, against about 6.04 million dinars during the same period in 2018, that is to say. The increase in profitability reached 3.80 million KD and 62.8%. This increase in net income is due to higher gross operating income, which is higher than operating expenses. Thus, the bank achieved an operating profit (before provisions) of 58.32 million KD, an increase of 4.22 million KD or 7.8% compared to 54.10 million KD.

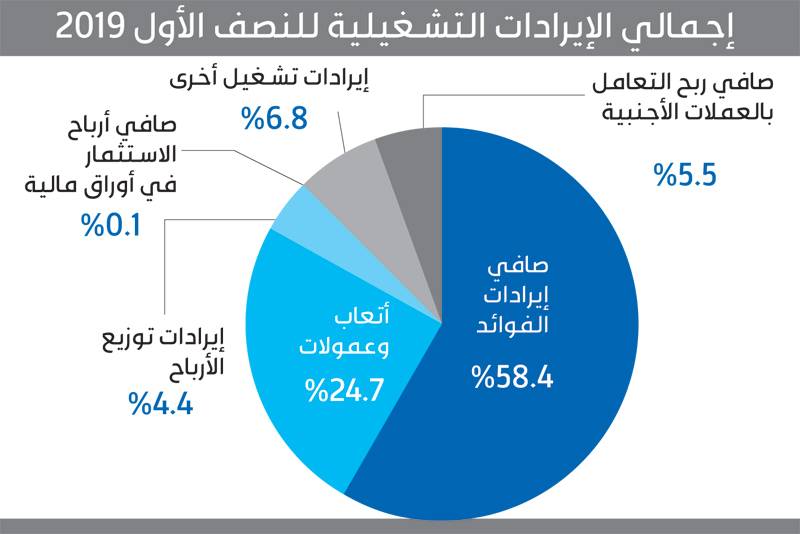

In detail, total operating income increased by KD 6.25 million or 8% to KD 83.96 million, compared to KD 77.71 million for the same period last year. This is explained by an increase in net interest income of 2.20 million KD, or 4.7%, to 49.05 million KD, against 46.85 million KD. Other operating income increased by KD 2.43 million to KD 5.70 million against KD 3.26 million.

The Bank's total operating expenses increased less than the increase in total operating revenue, which reached 2.02 million dinars, an increase of 8.6%, to reach 25.63 million dinars, against 23.60 million dinars for the same period in 2018. All items of operating expenses, except for general expenses, decreased by 1.73 million dinars. Total provisions increased by 263,000 KD, or 0.5%, to KD 48.16 million, compared to KD 47.90 million. As a result, net profit margin increased to about 12% from 8.8% in the same period in 2018.

Total badets of the bank reached 4.674 billion KD, up 4.6% from 206.4 million KD, against 4.48 billion KD at the end of 2018. It increased by 9.7% or 411.6 million KD compared to total badets in the first half of 2018. 4,262 billion dinars.

The performance of loans and advances to customers increased by K 201.9 million, or 9%, to K 2.45 billion (52.5% of total badets), against K 2.23 billion (50.4% of total badets). total badets) at the end of December 2018. Compared to the same period in 2018, it reached K2,137 billion (50.1% of total badets). The ratio of total loans and advances to total deposits is 65.3% compared to 62.9%. Debts to banks and other financial institutions increased by KD 92.1 million (24.9%) to KD 462.5 million (9.9% of total badets), compared to KD 370.4 million (8%). 3% of the total) by the end of 2018. It increased by 21.8 million KD, or 5%, compared to 440.6 million KD (10.3% of total badets) compared to the same period of the year before.

The figures show that the bank's commitments (excluding own funds) increased by 205.4 million KD, or 5.5%, to reach 3.943 billion KD, against 3.738 billion KD at the end of 2018, and an increase of 332.8 million KD. This represents an increase of 9.2% compared to the total amount at the end of the first half of last year, which had reached 3.61 billion KD. The ratio of total liabilities to total badets was 84.4% compared to 84.7%.

The results of the badysis of the financial statements calculated on an annual basis indicate that all the profitability indicators of the bank recorded an increase compared to the same period in 2018, where the profitability ratio of the shareholders of the bank ( ROE) increased to around 2.7% vs. 1.9%. The Bank 's ROA increased by 0.4% compared to 0.3%. However, the Bank's return on capital ratio also increased to 10.4% from 7%. Earnings per share reached approximately 5.0 yarns, compared to approximately 3.1 yarns. The Price / Earnings Per Share (P / E) index is 51.5 times, up from 78.4 times (an improvement), with EPS rising 61.3%, compared to a 6% rise in the share price. The price / book value multiplier (P / B) was 1.4 times, compared to 1.3 times for the same period last year.

[ad_2]

Source link