[ad_1]

From: Sally Ismail

Mubasher: Last week, global markets were plunged into dramatic drama, raising higher risks of disobedience and anger at the movements of the Fed President and US President.

Although Global markets were Is waiting for additional support from the central bank in the world's largest economy in the face of uncertainties at all levels of trade, economic and geopolitical, but the Fed's decision was disappointing and accompanied by fluctuations important.

He decided central America At its last meeting, the interest rate had been reduced by 25 basis points and announced the end of the budget reduction program two months before the original date, but excluded new measures to reduce interest in the near future.

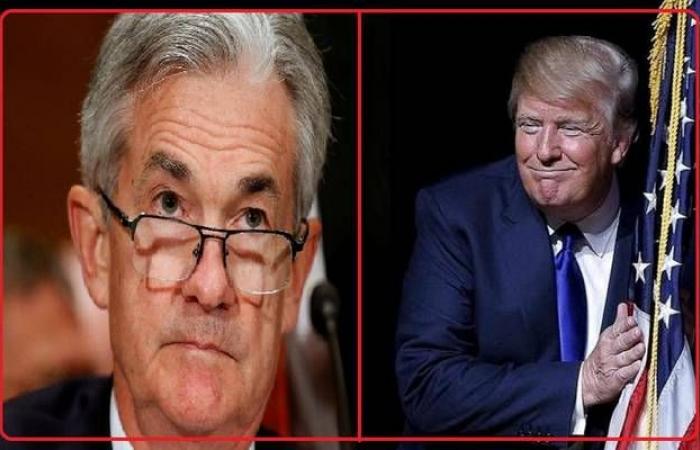

He explained President of the Fed Jerome Powell explained the reasons for the Fed's decision to adopt this limited cut in order to protect a strong economy against the risks of deterioration as well as protection against global and commercial developments and given the low rate of growth. 39; inflation.

The Fed's decision was followed by many The confusing signals A surprise gesture by President Donald Trump Broke a trade truce with China And announced its intention to impose tariffs on the rest of the goods from Beijing.

Trump said that the United States could impose tariffs of about 10% on Chinese products worth $ 300 billion. May last.

And between this and that, signed Strong changes in the markets The market's refusal to make a slow decision on the part of the US central bank, as investors wait for further interest rate cuts, suggests that trade frictions will again diminish.

And come Commercial developments Despite a series of trade talks held in Beijing early last week in which the US president accused China of procrastinating in order to delay the trade deal until the next election presidential election in 2020.

These feelings of anger have led investors willingly to Safe haven currencies Such as the Swiss franc and the Japanese yen in order to protect themselves in times of high trade uncertainty.

With a statement Economic data The US economy, which created 164,000 jobs as a result of accelerating wage growth, has been a source of frustration for investors, as these solid numbers reduce the scope for further rate cuts.

according to Federal tool To monitor CMMA futures, investors had a 96% chance of a 25 basis point cut and a probability of less than 4% for a 50 basis point cut.

And a continuation of the trend towards investors Safe marketsGold prices, which suffered heavy losses to lose around US $ 20 in value as a result of the Fed's decision, led to sharp gains, with trade rising by US $ 25 for the single session. Friday, after the spot price for the yellow metal rose $ 28 on Thursday.

In return, engaged Oil Jerome Powell said that there would be no long-term easing policy and Trump's comments on escalating trade, which threaten economic growth and crude demand. ensuing.

He threw a sharp decline in Crude prices eclipse other badetsWhile the Russian ruble fell by more than 1% on Friday, Moscow was a major player in the rough market and losses were attributed to the Norwegian krone, which had paid to record the worst performance of 2019.

In addition, the yield on US Treasuries has fallen to its lowest level since 2016, as investors Capital Market Given the inverse relationship between bond prices and debt yield.

The situation did not stop there, the wave of anger continued, Risky badet markets Such as the sharp downtrend when investors fled to lose the Dow Jones index by 700 points a week, European stock markets also suffered losses after falling 2.5% and the Japanese Nikkei closed to his lowest level in a month and a half.

According to a report released by the US Bloomberg agency, the difference in opinion between Wall Street experts on the "Standard and Pors 500" index has reached its highest level since 2004.

Economist Mohammed Al-Erian wrote in a tweet on his official Twitter account: "This wide gap is already the largest since 2004, but one possible explanation could be investor confidence in the central bank.

Considering the The strongest and most used currency in the worldThe situation has resembled a rebound in two days, with the US dollar having risen sharply after the Fed's first decision since the global crisis, accompanied by signs of further interest rate cuts, which has reached its peak. highest level in two years.

A few hours later, the greenback has reduced its gains on negative data (which means that the Fed could further relax its monetary policy) before turning to the red band, Trump announcing its intention to impose duties additional customs on Chinese products.

Although the US employment report has contributed to the erasing of US dollar losses, it has declined again with more economic data. The US trade deficit declined less than expected in June and the US consumer confidence index from the previous month showed Outlook.

And with Large variations in the US currencyThe euro managed to recover after a 26-month low and the pound reduced its losses after falling below $ 1.21 for the first time in two and a half years.

[ad_2]

Source link