[ad_1]

As bitcoin continues to get scarcer every day, the most popular physical bitcoin set, designed by Mike Caldwell from 2011 to 2013, has become much rarer than its digital counterparts. As of September 18, 2021, there were now less than 20,000 active bitcoins in the Casascius physical bitcoin collection.

Casascius’ physical Bitcoin collection becomes scarce

Bitcoin has become a well-known technology and in the early years a number of people and companies deployed concepts called “physical bitcoins”. Essentially, a group or individual would make a coin with the bitcoin symbol engraved on it and the coin would also contain digital BTC hidden within the body of the coin.

It is safe to say that the Casascius physical bitcoin collection created by Mike Caldwell is the most popular collection to date, and these rare physical bitcoins are sold for far more than the face value of the digital bitcoin they hold.

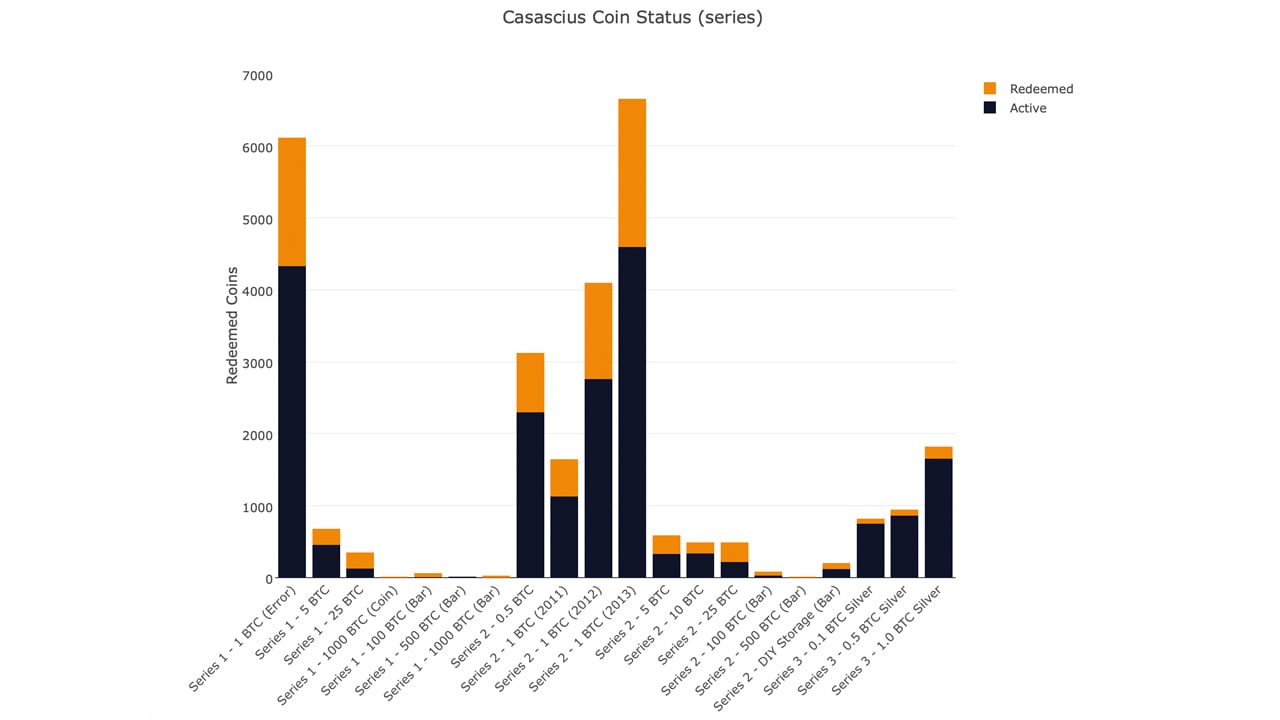

Casascius bitcoins feature a tamper-evident holographic sticker on one side of the coin, and if the sticker is peeled off, the digital bitcoin’s private key is revealed. Caldwell made both coins and bars containing loaded bitcoins (BTC) and created series 1 (1 to 1000 BTC), series 2 (0.5 to 500 BTC + DIY storage bars) and series 3 (0.5 to 1 BTC).

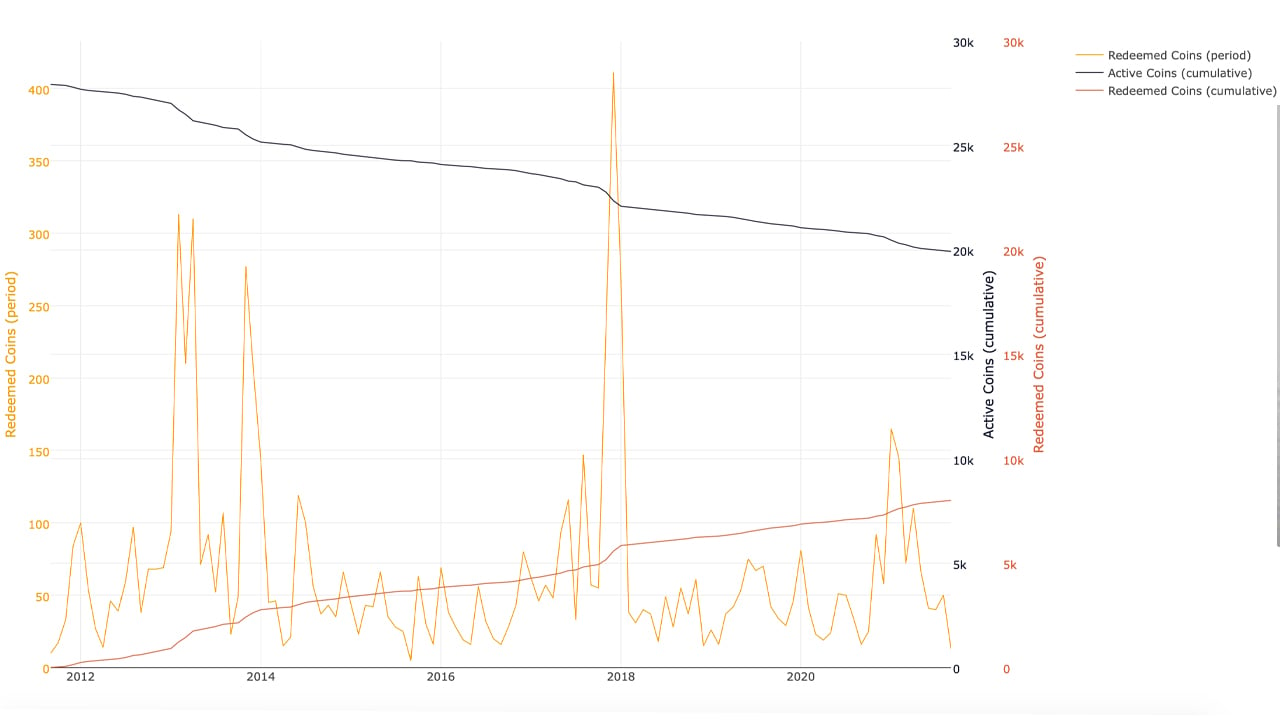

Unfortunately, the US government forced Caldwell to stop minting Casascius bitcoins with BTC loaded on it. By the end of Caldwell’s tenure in making these coins, he managed to strike around 27,920 Casascius bitcoins with various BTC increments loaded. Over the years, the owners have redeemed the loaded value held on these Casascius bitcoins in a process called “peeling”.

On December 23, 2019, Bitcoin.com News reported on a 100 BTC gold bar that was peeled or redeemed. This means that the BTC numeric value has been spent by the owner and the physical bar is empty and there are no numeric values left. Ten years after the first Casascius bitcoins were minted, there are less than 20K assets left with BTC loaded.

19,920 Casascius physical Bitcoins left to peel

According to statistics from casasciustracker.com, as of September 18, 2021, approximately 19.92,000 active Casascius bitcoins are waiting to be peeled. So far, 8,009 coins or bars have been redeemed in the last ten years and there are around 43,000 unshelled BTC worth over $ 2 billion.

48,169 BTC worth $ 2.3 billion was spent through the peeling process. In addition, some lucky owners have yet to peel 1,000 BTC bars or coins worth $ 48 million using today’s exchange rates. For example, of the six 1000 BTC Series 1 Casascius bitcoins, only 2 have been traded so far.

In that same round, Caldwell hit 16 bars of 1,000 BTC and so far 87.50% or 14 bars have been redeemed. There were 81 Series 2 100 BTC coins (worth $ 4.8 million each) minted by Caldwell and to date 47 coins or 58.02% of BTC have been redeemed from that set hit.

Today, Casascius’ physical bitcoin collection has acquired significant numismatic value and coins and bullion are considered coveted bitcoiner collectibles. Even the peeled Casascius bitcoins are still valuable and some of them are sold for $ 1,999 (for a 2012 coin). A physical Casascius silver bitcoin loaded with 0.1 BTC ($ 4,834) from 2013 sells for $ 20,000 today. A rare uncharged set of 125 Casascius physical aluminum bitcoins sells for $ 4,995.

What do you think about the fact that there are now less than 20,000 Casascius Bitcoins left active today? Let us know what you think of this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons, casasciustracker.com

Disclaimer: This article is for informational purposes only. This is not a direct offer or the solicitation of an offer to buy or sell, nor a recommendation or endorsement of any product, service or business. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use of or reliance on any content, good or service mentioned in this article.

[ad_2]

Source link