[ad_1]

Strategic Resource Group Managing Director Burt Flickinger on supply chain issues affecting U.S. retailers.

Levi Strauss & Co. says his business is immune to soaring cotton prices until at least the middle of next year.

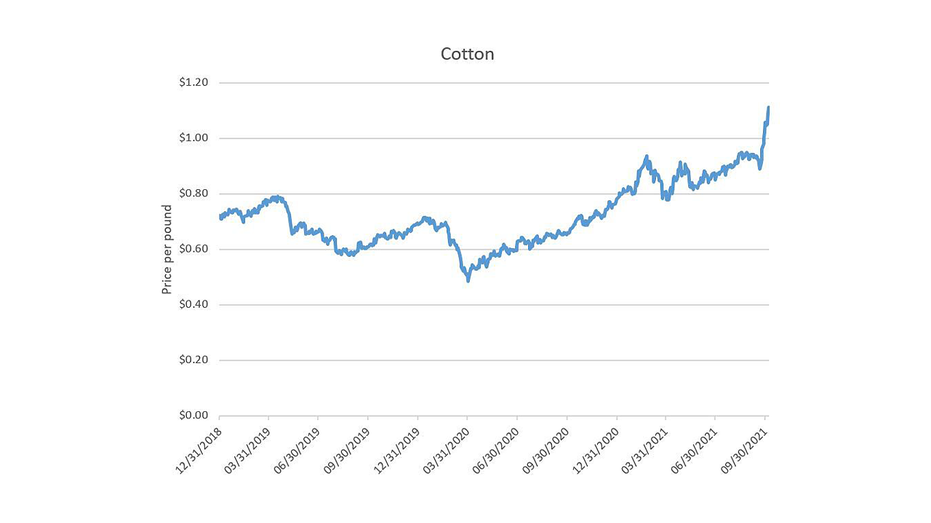

Cotton prices have climbed more than 20% since mid-September as a number of factors, including drought and regulations, created an imbalance between supply and demand.

The higher costs of cotton are expected to cause clothing companies to raise prices in an attempt to offset the blow to their bottom line. Levi Strauss, however, says actions taken earlier this year will allow the company to navigate more efficiently.

“We negotiated most of the costs of our products through the first half of 2022 at a very low single digit inflation rate,” Levi Strauss CEO Charles Bergh said on the third quarter earnings call. company quarter Wednesday night. “And for the second half of the year, we anticipate an average single-digit increase, which we will offset by the pricing actions we have already taken.”

COTTON PRICES ARE ON THE RISE. WHAT IT MEANS FOR YOUR NEXT SHOPPING TRIP

The San Francisco-based denim jeans maker increased prices 5% across all areas in the second quarter, leading to a roughly 1 point increase in gross margins. The increase came as more Americans needed to restock their wardrobes after months of closures that led to a larger waistline.

| Teleprinter | Security | Last | Switch | Switch % |

|---|---|---|---|---|

| LEVI | LEVI STRAUSS & CO. | 26.29 | +2.05 | + 8.46% |

Cotton, which accounts for around 20% of Levi’s denim costs, has seen its price soar this year as the drought has impacted global production.

Additionally, demand from China has been off the charts since former President Donald Trump banned imports of clothing and other products made from China’s Xinjiang Province, an area where Beijing has labor camps. for the Uyghur ethnic group. This has led China to use cotton from the United States and elsewhere to produce its products which are then shipped overseas.

This is not the first time Levi Strauss has grappled with soaring cotton prices.

Bergh joined the company in 2011 when cotton hit $ 2.14 a pound, an increase of more than five times from its 2008 low. It is difficult to assess the business impact of Levi Strauss because the company was private at the time.

However, Bergh says the company is in a much better situation this time around.

“Much of our business is now international overseas resulting in higher gross margin, more retail, stronger brand especially in Europe,” he said, adding that the brand is also stronger.

Levi Strauss on Wednesday evening announced profits and revenues above Wall Street estimates as back-to-school purchases gave a boost.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The company earned $ 193 million, an adjusted amount of 47 cents per share, as revenue rose 41% to $ 1.5 billion. Analysts polled by Refinitiv expected adjusted earnings of 37 cents per share on revenue of $ 1.48 billion.

Levi Strauss shares are up 21% this year through Wednesday, beating the S&P 500’s 16% gain.

[ad_2]

Source link