[ad_1]

Lockheed Martin Corporation (LMT) is a global security and aerospace company. Lockheed Martin works primarily with the US Department of Defense and other US federal government agencies. Lockheed also owns Sikorsky, which sells helicopters and rotary wing aircraft. The remainder of Lockheed Martin's activities include missiles and fire control systems, as well as space launches and satellite systems.

Lockheed Martin earns money, returns money and raises estimates

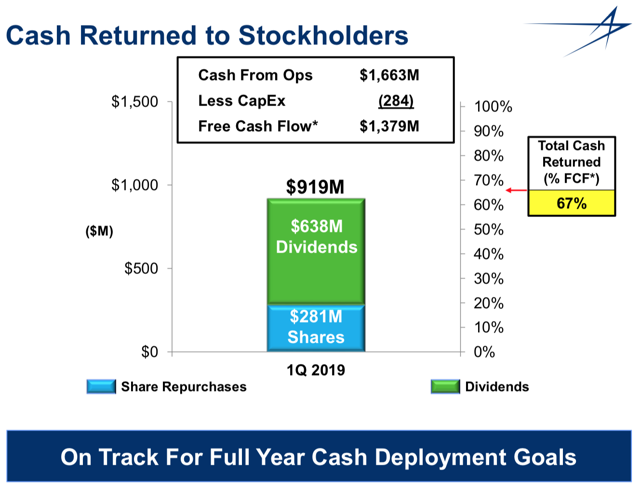

Last year, Lockheed Martin paid $ 2.3 billion in dividends and made stock repurchases for $ 1.5 billion, including an increase in fourth-quarter purchases when the market has dropped. Lockheed essentially bought twice as much during the vacation quarter as during the first three quarters.

They continued to distribute cash and buy back shares and the last quarter as well. In addition, the dividend is less than half of free cash flow, and the dividend, plus the buyback plan, is about two-thirds of free cash flow. This means that Lockheed is likely to be able to pay the dividend and continue to increase it.

(Presentation of Lockheed Martin's results in the first quarter)

Lockheed Martin has increased its dividend in each of the last 16 years. Due to the significant share buyback in 2018, it is likely that Lockheed Martin will be able to increase its dividend by more than 10% while hedging it with less than half of the company's free cash flow. This is also because the company is doing well, with rising revenues and rising estimates.

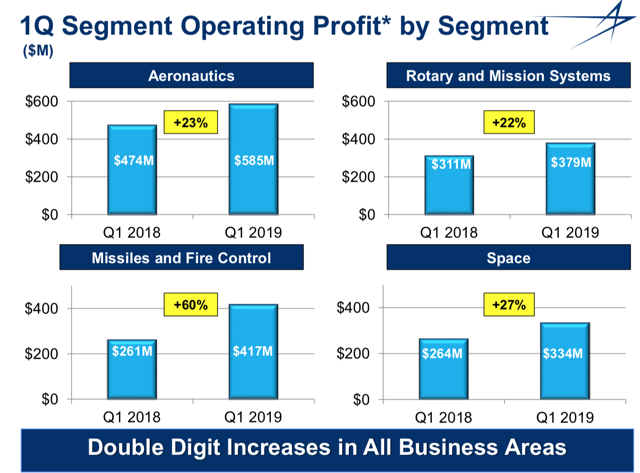

Last quarter, Lockheed Martin saw double-digit earnings growth in all four segments. (Presentation of Lockheed Martin's results in the first quarter)

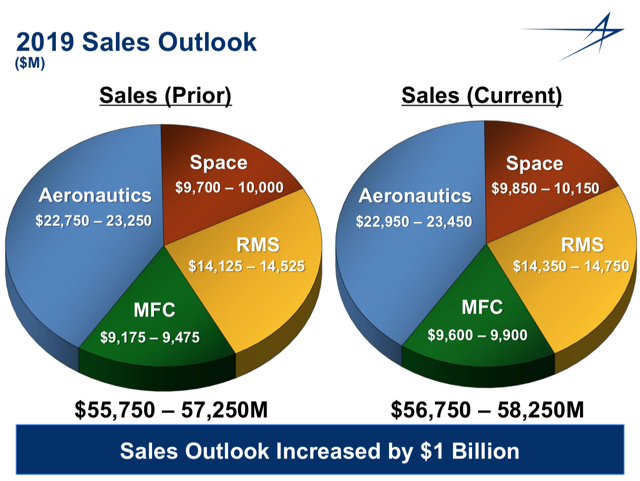

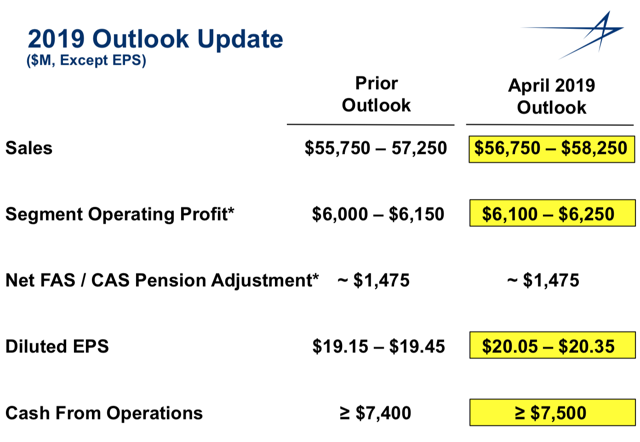

Lockheed Martin has also raised its sales forecast for three of its four core businesses, representing an estimated total revenue increase of approximately $ 1 billion. (Presentation of Lockheed Martin's results in the first quarter)

The company also increased its $ 100 million earnings guidance when updating its outlook. (Presentation of Lockheed Martin's results in the first quarter)

The F-35 goes up well

Lockheed has delivered 91 F-35 aircraft to the United States and international customers in 2018 and hopes to deliver 130 F-35 aircraft in 2019. The additional production increases will increase LMT's F-35 capacity to 160. 2021. The price of these devices was $ 94 million (F-35A) $ 122 million (F-35B) per unit, and operational efficiencies can be expected to result in increased productivity. higher margins.

These aircraft also require maintenance, modifications, upgrades and related maintenance. This increase in production and delivery also helps to develop this secondary source of income. The plane should remain in service for about 15 years. These relationships are therefore very long.

At the same time, the former LMT F-16 fighter program continues to be a source of revenue through both new sales and the necessary upgrades. These devices are in the process of being bought and modernized internationally, notably as part of a recent program to upgrade Greece's 85 F-16s to a more advanced system. In addition, Slovakia recently bought part of the F-16V configuration. Similarly, Bahrain bought the F-16V last year. Lockheed just continues to hay.

concerns

Germany has decided not to buy the F-35. This decision was probably due solely to the fact that they wanted to support the European effort to produce a new Eurofighter aircraft, designed by Airbus (OTCPK: EADSY) and the Dassault project (OTCPK: DASTY). This significantly reduces the likelihood of new contracts with some European countries and could also become a competitive threat in other markets. Nevertheless, it is unlikely to be a short-term concern and it is possible that the whole project remains in the bureaucracy.

There is also concern that the Russian S-400 air defense system may be a superior missile system or at least comparable to Lockheed's THAAD, but at a much lower price. The S-400 could be a dual problem in that it not only competes with the THAAD system, but can also complicate jet fighter sales. The main concern is that some countries will have access to both F-35 fighter jets and the S-400 defense system, lest both devices be used to test jets for exploitable weaknesses. . This issue was raised when Turkey announced that it would buy the S-400 system.

I think the F-35 will benefit from sufficient national support to ensure its success, but also from significant international support. Much of the financing and manufacturing of F-35 project components is international. Moreover, thanks to the operational efficiency, the cost of the F-35A could be similar to that of the F-16V, which should keep it competitive.

The space will be the main border of Lockheed

Lockheed Martin has some very interesting activities. Beyond these F-16 and F-35 aircraft, as well as missiles and helicopters, they are manufacturing even more sophisticated technologies, such as being the master builder of the NASA Orion Probe construction, designed for long-term exploration of deep human space.

Lockheed Martin will probably be a major player in space activities over the coming decades. Lockheed already provides and will continue to provide governments and businesses with space asset management systems, including battle management with debris. Many of these systems will be needed perpetually.

Several opportunities for space exploration and protection could become more important activities than aerospace and ground defense. Lockheed Martin is the master builder of NASA's Orion Project, the only spacecraft designed for long-distance space exploration in the long space.

Orion is only one element of a larger program that will be rolled out over the next decade. As Lockheed Martin explains on his website:

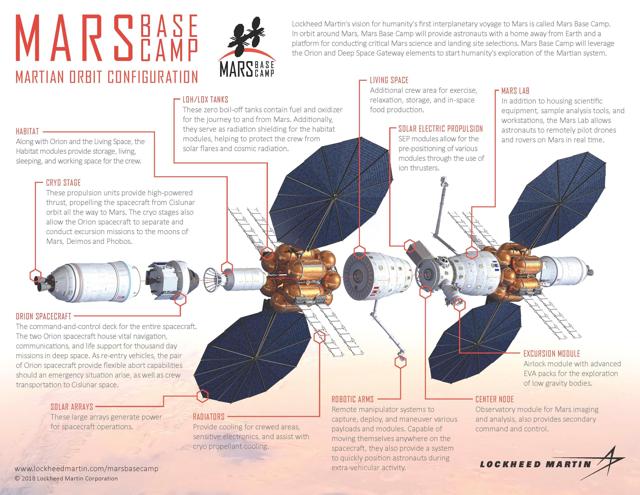

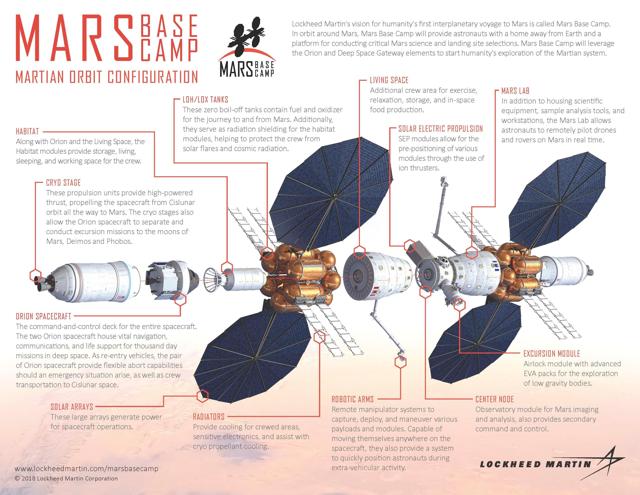

March's base camp is Lockheed Martin's vision of sending men to Mars in a decade or so. The concept is simple: transport astronauts from the Earth, via the Moon, to a scientific laboratory orbiting the planet Mars, where they can perform real-time scientific exploration, analyze Martian rock and soil samples, and confirm the ideal location of men on the surface. the 2030s.

(Source: Lockheed Martin Corporation website)

Conclusion

Lockheed Martin performed very well, particularly with respect to earnings, which recently increased and accelerated the share buyback in the fourth quarter of 2018. Lockheed has a strong dividend, well covered by free cash flow and likely to grow over the next few years. The company is just starting to increase production of F-35, which is expected to remain in demand over the next decade, and is well positioned to become a major competitor in space exploration. Lockheed Martin is a solid company that should outperform in the long run.

Disclosure: I am / we are long LMT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link