[ad_1]

Gov. Gavin Newsom and legislative leaders announced on Wednesday that they have agreed to provide low-income Californians with a stimulus payment of $ 600 from the state to help them overcome financial difficulties during the COVID-19 pandemic, in part of a $ 9.6 billion economic stimulus package that also includes $ 2.1. billions of dollars in grants for small businesses.

The “Golden State stimulus” payments provided under the state’s proposal, which will be expedited for legislative approval next week, are in addition to stimulus checks of $ 600 per person already approved by Congress and s’ would add to direct payments of up to $ 1,400 per person that have been proposed by House Democrats.

The proposed package for immediate action also provides more than $ 400 million in new federal funds for allocations of $ 525 per enrolled child for all state-subsidized child care and preschool services, which serve some 400,000. children in subsidized care statewide.

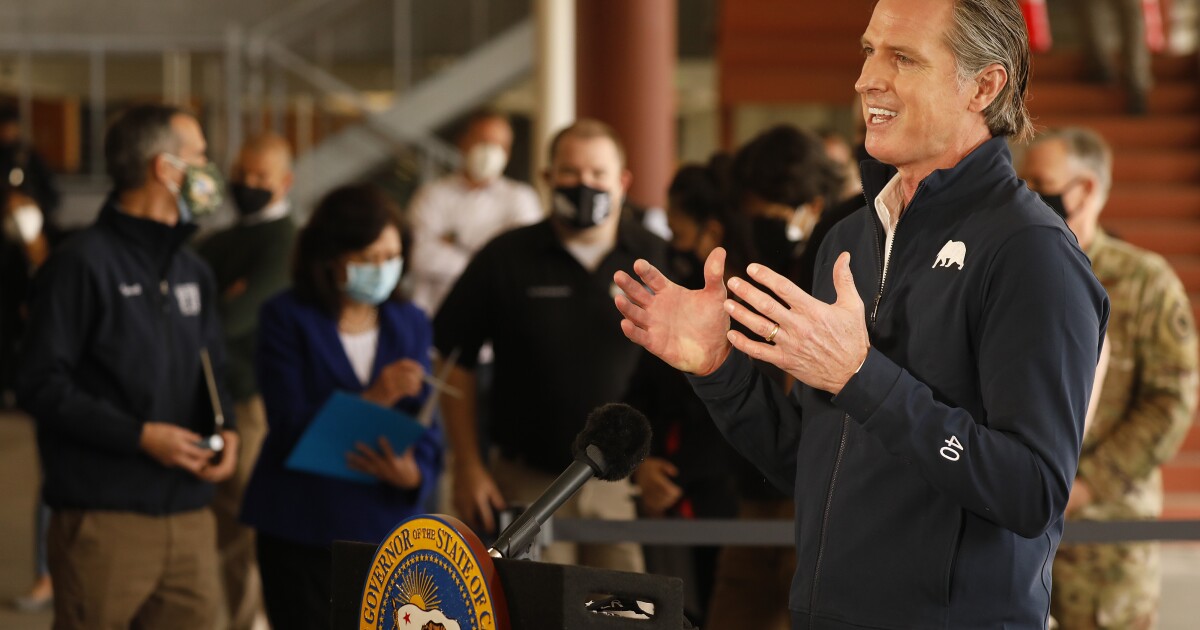

“As we continue to fight the pandemic and recover, I am grateful to the Legislative Assembly’s partnership to provide urgent help and support to California families and small businesses where they need it most,” Newsom said in a statement announcing the expedited relief program with the Senate Speaker. pro Tem Toni Atkins (D-San Diego) and Assembly Speaker Anthony Rendon (D-Lakewood).

The state has suffered significant economic losses since the start of the pandemic in March 2020, with millions of people losing their jobs due to business closures or the restriction of operations under the direction of health officials from state to slow the spread of the virus.

The new relief program comes weeks after the legislature and governor accelerated approval of an extension of eviction protections through June for tenants who pay part of their rent.

The one-time household payment of $ 600, proposed by Newsom last month, would cost around $ 2.3 billion and go to people, including those receiving the California Earned Income Tax Credit for 2020. Additionally , the deal would provide a stimulus check to taxpayers with individual tax identification numbers who have not received federal stimulus payments.

Beneficiaries would include immigrants who are in the country illegally and who complete tax forms. ITIN taxpayers who also qualify for the California earned income tax credit would receive a total of $ 1,200, heads of state said.

In all, the state would provide 5.7 million payments to low-income Californians.

California residents may be eligible for the earned income tax credit if they have an annual income of $ 30,000 or less, which last year included 3.9 million taxpayers.

The Relief Program provides a one-time grant of $ 600 to households enrolled in the CalWORKS Public Assistance Program and recipients of Supplemental Security Income and the State’s Immigrant Cash Assistance Program.

“Californians have suffered,” Rendon said in a statement. “Our response is addressing the human and economic impacts of COVID in a way that echoes President Biden’s US bailout and will help those who suffer most.”

Newsom and Democratic legislative leaders said the grants will help small businesses survive during the economic downturn caused by the pandemic.

“With billions of additional dollars, we will have the capacity to provide … tens of thousands of additional grants for small businesses, non-profits and cultural centers from $ 5,000 to $ 25,000,” he said. Newsom said at a press conference on Wednesday.

The grant proposal, which requires legislative approval, builds on a $ 500 million program that has provided financial assistance to 21,000 small businesses since December, Newsom said.

Tax relief will be provided over the next several years by exempting the first $ 150,000 of expenses paid by the federal paycheck protection program and federal disaster loan funds for economic injuries. Additionally, the package includes $ 116 million in fee waivers for two years for severely affected service industries.

Other provisions of the back-up plan announced on Wednesday include:

- $ 100 million in emergency financial assistance for qualifying low-income students carrying six or more units to community colleges in California.

- $ 24 million for financial assistance and services through Housing for the Harvest, which supports farm workers who need to be quarantined due to COVID-19.

- $ 35 million for food banks and diapers.

- $ 6 million for outreach and application assistance to students at the University of California, California State University, and California Community College were newly eligible for CalFresh, the federal food aid program.

A legislative budget committee is due to hear the bills as early as Thursday, with floor votes possible on Monday.

State leaders said they also agreed to restore funding to the California State University and University of California systems of justice, child support services and income housing. that were cut back next year before additional funding came from the federal government.

Legislative leaders said on Wednesday they were in separate and ongoing discussions about what steps could be taken to safely reopen the state’s K-12 schools.

[ad_2]

Source link