[ad_1]

Now, Lyft (LYFT) is following the path of IPOs that have finally failed in recent years, such as Break (BREAK). The IPO is likely to be oversubscribed, suggesting a first entry into the stock, although the company faces major challenges to become a profitable business model in an increasingly competitive environment, such as the social messaging stock which dropped to $ 5 after the inauguration.

Image Source: Lyft Twitter

Already on the scale

The second largest on-demand carpool service plans to sell 30.77 million shares as part of an IPO this week. The company is offering 4.62 million additional shares to subscribers for exceeding quotas. In the assumption of an average price of $ 65, Lyft will earn $ 2.2 billion after deducting fees, if the additional shares are fully exercised by the underwriters.

While Reuters suggests that the transaction is already oversubscribed, the company faces significant problems of profitability that weigh more on the actions of the public markets than on private markets. In addition to this question, Lyft and Uber (UBER) have reached a level that should already offer a level of profitability that will not be greatly improved in a market where these carpool giants have more money to invest.

The challenge of holding IPO shares is the image of profit; do not rely on the nuance of the two classes of actions. Any investor in a growing business actually wants the founding management team to control the business. If not, why invest in a growing business where hedge funds can upset the management team. If you do not like the management team or the business model, investors are not obliged to invest.

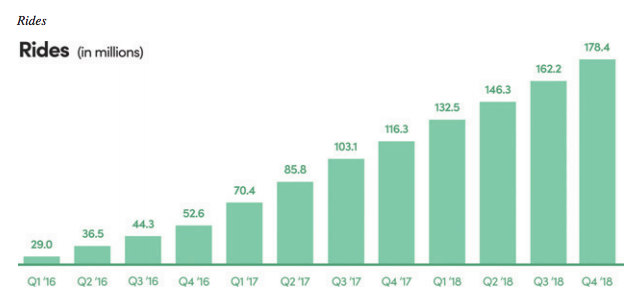

In Q4, 18, Lyft had 18.6 million passengers, for a combined total of 178.4 million trips. The average of the clients makes about 10 trips per quarter or a little more than 3 per month. The numbers are now biased to include scooter and bike rentals from the Motivate acquisition.

Source: Lyft S-1

Anyone looking at quarterly data may find that growth rates are slowing down. In the third quarter, the total number of trips increased by 15.9 million for a sequential gain of 10.9%. In the last quarter, the growth rate slowed to exactly 10.0%.

A similar analysis of biker growth can be made and the same conclusion can be made. In fact, the numbers are impressive: on this massive scale of bikers, Lyft can still generate substantial sequential growth. The carpool company can easily continue to develop additional riders and rides per rider.

The problem remains that the company reaches a scale of reservations greater than 8 billion dollars and still loses nearly 50% of its turnover. With Uber, the industry has created a major company to improve transportation options for people looking for a better system than the obsolete or vehicle-based taxi network. Yet neither company has found a way to quantify travel to make a profit.

Until now, the winner is the customer who gets better service at a lower cost and private investors who own shares well above the initial investments. That these private equity funds can withdraw their holdings at the IPO price is a different story.

Business model in check

Lyft wants to discuss the concept of transportation as a service or TaaS, but the company has no idea how to generate profits as part of such a plan where Uber and more and more Waymo (GOOG) (NASDAQ: GOOGL), among others, compete with the existing taxi network. The move to autonomous vehicles only increases competition when Lyft and Uber no longer benefit from a network of pilots in which they have invested billions.

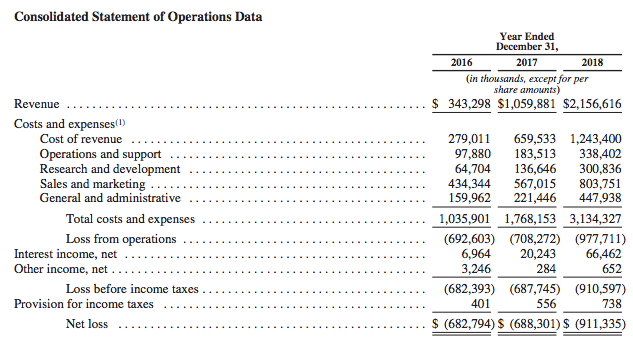

For 2018, Lyft lost $ 911 million, up $ 223 million from last year. The major problem remains that costs increase as fast as income. Some of the margins improve during the process, but investors should not be fooled by uncontrollable operating costs.

Source: Lyft S-1

The company has only lost 42% of its turnover against 65% in 2017, but the situation is not really better. Lyft still lost about $ 1.50 on each of the 619.4 million trips made last year.

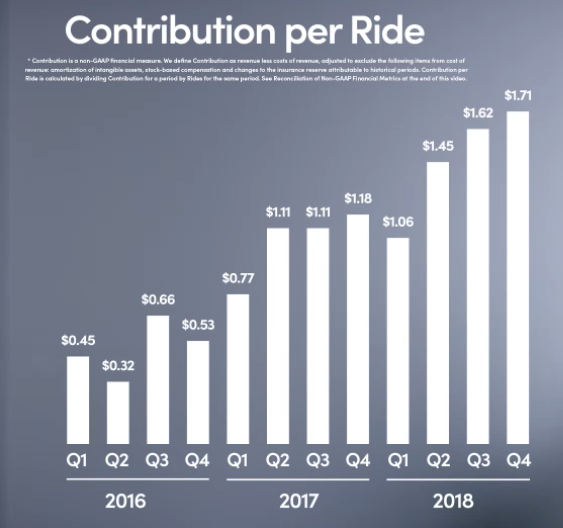

The problem is that the contribution per trip was only a meager $ 1.71. Lyft needs to double the contribution per trip in order to completely eliminate operating losses.

Source: Lyft IPO Roadshow

Lyft needs a business model generating positive cash flow to be competitive in the audiovisual world, where Waymo is already a market leader and belongs to a company whose cash balance exceeds 100 billions of dollars. Lyft will only have $ 2.5 billion in cash after the IPO and continues to spend money to quickly reduce the cash balance.

Price stretched

Although Lyft's profitability is in question, the most important problem for investors is the valuation of the IPO. The company wants a market capitalization of $ 23 billion after losing a ton of money on a turnover of $ 2.2 billion last year.

The valuation multiple adds to the potential when it is a small business, but it does not work well on public markets. Assuming a revenue target of $ 3.0 billion for this year, a growth of 36%, Lyft would trade on the following stock valuations, based on these initial trading prices, with approximately 340 million shares outstanding:

- $ 50 = $ 17 billion market value, P / S 5.7x

- $ 65 = $ 22 billion, P / S 7.3x

- $ 75 = market value of $ 26B, P / S 8.7x

- $ 100 = market value of $ 34 billion, P / S 11.3x

My initial estimate is that Lyft enjoys a big boost due to the oversubscribed IPO. The market is not likely to set the price of an IPO as hot below the mid-point of the initial range; the only option below is therefore 50 USD for analytical purposes only. The potential is for the stock to reach $ 75 and trade close to $ 100 the first week.

These price levels would become a major problem for retail investors likely to be caught off guard. Rob Sanderson, an analyst at MKM Partners, estimates that a $ 65 value with a multiple EV / S of 6x is reasonable for the Internet markets, but the number is rather ridiculous for a secondary company in a declining industry. 39; money. The multiple is much more reasonable for the main player in a market generating cash flow.

To take away

The main benefit for investors is that Lyft seems ready to produce a hot IPO. Retail investors will want to avoid this IPO unless they get shares of the IPO that are quickly returned.

The carpool company is faced with a very competitive environment with a long way to generate profits, just in time for the company to switch to audiovisual vehicles. The stock should break with initial trading, pushing valuation to 10 times forward sales for an IPO, with no real potential to create a gap around a positive cash flow business.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional information: Disclaimer: The information in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

[ad_2]

Source link