[ad_1]

That's one reason they call it March Madness.

The NCAA Division 1 Men's Annual Basketball Tournament can be crazy from every angle. Really, it is rather designed to be. Because … well … why not?

The March Madness competition focuses on the preparation, prowess and "providence" of 68 different Division 1 university basketball teams, all played over a period of about three weeks for the National Championship. Collegiate Athletic Association (NCAA). Title.

That's why he's called what he is. The levels of activity and emotion dumped during such a short period can be completely crazy.

On the side of the players, coaches and other participants of the schedule, they try to double their usual playing time, hopefully. Instead of playing about four games a month, winners earn an average of two a week.

It's quite intense alone. There is no physical time out for these gentlemen. This switch must remain on.

Enter the game

Then there is the feeling of being in March Madness. It's electric in addition to being exhausting. Each of these young men knows that they have to play their first game. They know what is at stake.

Which makes it even more "crazy" for them from start to finish.

As for spectators and sports fans, we do not even pretend that there is a comparison between being part of one of the participating teams and watching the participating teams. It is obviously not there.

While they experience every game involved physically, mentally and emotionally in real time, we can bask in our comfy sofas and recliners La-Z Boy while we scream on TV. Of course, we could feel the pressure to beat our colleagues and our friends to win the collective pot set aside. However, it's not really the same thing, no matter what we are thirsty fans – and we know it.

We know that, but there is still pressure in the spectator seats, which takes into account the increase in television time, the creation of our media, the monitoring of our media and (hopefully the) to boast of our supports.

It may not be exhausting, but it takes time. It's certain.

And yes, there is always this electricity that we can not help but feel.

Photo source

The sweet field 16

As you probably know now, March is endangered and its madness is progressing steadily. So far, we have managed the first four games, as well as the first and second complete rounds to reduce the number of these initial 68 teams to a mere Sweet 16.

Whether you focus on your alma mater, which is very favored, or at the school of your choice, is rather the story of Cinderella, the action only intensifies as the tournament progresses. There has been no real inconvenience so far, but there have certainly been some close ones, including with the often favored Duke blue devils.

United States today described the Blue Devils as simply "surviving" their last fight against the University of Central Florida, adding that "even coach Mike Krzyzewski has acknowledged that his team should have lost."

This is what happens when a well-trained team like UCF plays urgently and forces Duke to shoot outside … The near-surprise of Sunday showed how duke is beatable, and the chances of title under the Blue Devils are suddenly much more difficult.

Of course, do not count them out of the competition yet. Do not count any of the remaining teams. You'd better believe there are still plenty of opportunities on the field for the 16 players when they managed to get that far.

So what will happen and how it will happen is to guess. (Go Tar Heels!)

A contest that really means something

As much as I could go on and on about March Madness, it's not a sports column, I know it. You are here to learn about a different kind of playground. So let's start already.

If you followed the March Madness version of the REITs I started to install last month by preparing this month's letter from the editorial staff, you'll know that I've already published screening reports on several brackets "of the REIT:

- REIT Health Care

- REIT Shopping Center

- Net Leaseback REIT

The purpose of all this is to test the different sectors and sub-sectors against each other and see which ones stand out the strongest … and which is the strongest this year.

It's a fascinating process to do it on my side. And I know from some of your comments that you found it as informative and engaging as yours.

It may not be as "electric" as watching a fast paced college basketball game. But as much as we love our NCAA favorites, let's face it …

REIT rewards can be much more useful.

That's the pot that counts.

So, in this article, we looked at our REIT lab (with more than 150 companies) to manually select 16 of our favorite teams (so to speak). Recognizing that many of the most defensive names (ie, Realty Income and Store Capital) have become expensive, we have decided to include actionable purchases or strong purchases in the future. range of "Sweet 16". So let's start the party …

Photo source

Sweet 16 REITs

American Campus Communities, Inc. (ACC) is the only real estate investment fund owned by publicly traded companies, "pure play". Fully integrated, self-managed and self-managed company – with expertise in design, finance, development, construction management and operational management of student housing. At the end of 2018, the American Campus portfolio of 204 third-party, third-party managed properties totaling approximately 133,900 beds achieved its 14th consecutive year of comparable rental rate growth, revenue growth rental and NOI. In 2019, ACC expects an acceleration in net operating income growth per store, due to both higher revenues and lower operating expenses compared to 2018 The company's debt-to-equity ratio (for Q4-18) was 34.6%, compared to the total value of assets. amounted to 36.5% and EBITDA at the current rate of 6.3x. Despite the uncertainty in the macroeconomy, the fundamentals of the student housing industry remain healthy and the stability of the business model will continue to make student housing one of the most sought after investments in the world. The shares are trading at $ 46.71 with a dividend yield of 3.9%.

We maintain a BUY on ACC.

Source: Yahoo Finance

Brookfield Real Estate Partners (BPY) is one of the world's largest commercial real estate companies, with total assets of $ 87 billion. It is managed externally by Brookfield Asset Management Inc. (BAM), one of the world's leading alternative asset managers, with over $ 350 billion in assets under management. BPY owns, operates and develops one of the largest portfolios of office, retail, multi-family, industrial, hotel, triple net, self storage, student housing and prefab homes. Their core portfolio includes 142 office buildings totaling 96 million square feet in major cities around the world; and 124 Class A + shopping centers spread across 121 million square feet in the United States. Last year, SSNOI (comparable store net operating income) grew by 5.3%, with 94% occupancy; retail sales were $ 746 per square foot, up 5.8% from the previous year. BPY aims to generate an annual return on equity of 12% to 15%, based on stable cash flow and asset appreciation. with annual distribution growth of 5% to 8%. [Note: BPY is an L.P. that uses a K-1 tax form; its 1099 counterpart is Brookfield Property REIT (BPR).]

The shares are trading at $ 20.16 with a dividend yield of 6.1%.

We maintain a strong purchase on BPY.

Source: Yahoo Finance

CyrusOne (CONE) is a high-growth data center REIT that specializes in highly reliable, enterprise-class, and carrier-neutral data center properties at more than 45 locations worldwide. The company's strategic assets protect and ensure the continued operation of the IT infrastructure of approximately 1,000 customers, including more than 205 Fortune 1000 companies. CONE's strong balance sheet, helped by S & P credit revaluation in September the latter, offers significant financial flexibility and growth financing capacity: no short-term debt maturities, fully unsecured debt and liquidity of approximately $ 1.6 billion. For 2019, CyrusOne plans to invest $ 400 million of the capital expenditure budget in European and British projects, in order to become competitive with other powerful data players, such as Digital Realty (DLR) and Equinix (EQIX). In Q4-18, normalized EPSs (EPS) of 86 cents exceeded the estimate of 82 cents, while revenues of $ 221.3 million missed the consensus of $ 223.5 million. And, even though the forecast cash flow from operations per share for 2019 is below the consensus estimate, I am confident that CyrusOne has set the stage for growth in 2020 and beyond, with potential disproportionate to generate double-digit returns. The shares are now trading at $ 51.70 with a dividend yield of 3.6%.

We maintain a strong purchase on CONE.

Source: Yahoo Finance

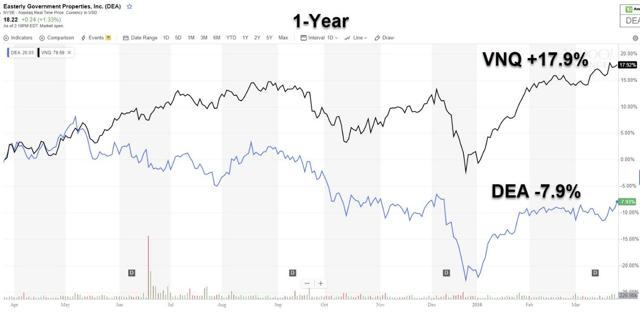

Easter Government Properties (DEA) is an acquisition, development and management agency for Class A commercial buildings leased to US government agencies, whose critical missions are undisputed, including the FBI and ICE (Immigration and Customs Enforcement). Easterly is the only government-run "pure play" REIT with the best credit ratings and stable outlook in the US (S & P, Moody & # 39; s, Fitch, DBRS) and the fact that the US government is the largest the largest employer in the world – and the biggest tenant of offices in the country. The 65 Easterly properties cover 5.6 million square feet and are 99% leased. Fourth quarter 18 (adjusted, fully diluted) cash flow from operations was $ 0.29; full year $ 1.03. Until December 2017, Easterly modestly increased its dividend, but chose to freeze growth in 2018, likely due to the payout ratio exceeding 100% of the FPAA; Analysts expect a recovery in dividend growth in 2020. Although this high payout ratio is revealing, I am encouraged by the potential for higher price appreciation, with growth expectations of about 5% , by the diversification efforts pursued by the Company and by the fact that DEA's senior management holds approximately 14% of the assets. shares, providing a strong alignment of interests with shareholders. The shares are trading at $ 17.98 with a dividend yield of 5.8%.

We maintain a purchase on DEA.

Source: Yahoo Finance

Hersha Hospitality Trust (NYSE: HT) is a self-advised housing REIT that owns and operates high-end, luxury and high-quality lifestyle hotels in urban gateways and coastal destinations markets. . The company's 48 hotels, with a total of 7,644 rooms, are located in New York, Washington, Boston, Philadelphia, South Florida and some West Coast markets. In 2018, the net loss on common shares was $ 14.2 million or $ 0.38 per diluted common share, compared to 2017 net earnings of $ 75.7 million, or 1, $ 79 per diluted common share. The decrease in 2018 is mainly due to lower gains on disposals of hotel assets. Last year, the company also completed an asset recycling campaign, providing nearly $ 90 million for the repositioning and renovation of many existing hotels to support its long-term growth potential. The vast majority of operationally disturbing projects were completed by Q4-18. The portfolio's revenue potential is expected to continue through 2019. The fourth quarter 1998 available room business (RevPAR) figure in 37 comparable hotels increased 2.8% for the same period last year. set at $ 189.82, the average daily rate (ADR) of the comparable set increasing by 3.2% to settle at $ 233.21, and occupancy rate down from 27 base points at 81.4%. The shares are trading at $ 17.26 with a dividend yield of 6.5%.

We maintain a purchase on HT.

Source: Yahoo Finance

Healthcare Trust of America (HTA) is a leading real estate investment firm in the healthcare industry that focuses on acquiring, owning and operating high quality medical office buildings (MOBs) on campus systems. nationally recognized health care. With an investment of $ 6.8 billion, HTA is the largest owner of MOB with a portfolio of 433 buildings at the end of the year 2018, spread across 32 states and leasing more than 23.1 million feet square. The goal of HTA's investments is to reach a critical mass of 20 to 25 major access markets, typically with leading academic and medical institutions, resulting in superior demographics, high quality intellectual talents and job growth. Strategic Markets HTA invests to support strong, long-term demand for quality medical office space. In 2018, the company reduced its leverage and increased its liquidity by selling more than $ 300 million of non-core assets, using the majority of the principal to repay its mortgage debt, reducing its debt (net debt / EBITDA 5.4) and maintain a cash position of more than $ 125 million in the market. balance sheet. Over the next three to five years, HTA believes it has a stable and reliable compensation model. and we believe that investors can expect total returns above 10% over the next twelve months. The shares are trading at $ 28.57 with a dividend yield of 4.3%.

We maintain a BUY on HTA.

Source: Yahoo Finance

Iron Mountain (MRI) is an "other" REIT misunderstood with a much broader strategy than simply storing boxes. This highly diversified business model represents 80% of the benefits of storage, 20% of services – information management, digital transformation, secure storage, secure destruction, data centers, cloud services, artistic storage and logistics … more than 225,000 customers around the world. Iron Mountain's core business is Document and Information Management (45% of sales), Secure Shredding (10.1%) and Data Management (8.7%). and data centers (5.8%). MRI's real estate network is more than 90 million square feet, spread over more than 1,450 sites in approximately 50 countries. The operations generate the value of the business, transmitting increases to customers and reducing the impact of rising interest rates. Iron Mountain has only 2% of customer turnover in a given year, which means that 50% of the boxes stored 15 years ago remain. The company also has a higher leverage effect than most peers: the adjusted lease leverage ratio at the end of 2018 was 5.6 times. Also in 2018, Iron Mountain generated 16% growth in adjusted working capital, which reduced the dividend payout ratio to 78%. We believe that MRI could generate above-average returns in 2019, with high double-digit numbers. The shares are trading at $ 35.17 with a dividend yield of 6.9%.

We maintain a purchase on MRI.

Source: Yahoo Finance

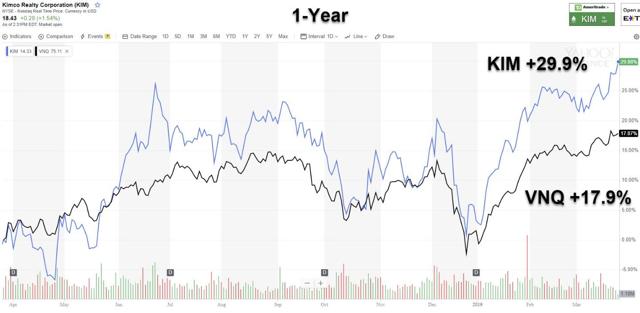

Kimco Realty (KIM) is a real estate investment trust that I consider "very cheap". This is not so bad for one of the largest owners and operators of open-air shopping centers in North America. The Company has 437 properties, with a leasable area of 76 million square feet, located primarily in the 20 largest markets in the United States, which provide 80% of the annualized base rent (ABR). These markets predict a population growth of 6.3 million people over the next five years. Fourth quarter results in 2018 and year-end results were solid, with a 2018 pro rata occupancy of 95.8%. In 2018, Kimco completed a number of development and redevelopment projects, including its first large-scale, mixed-use development of the Signature Series – and exceeded the divestment targets. Kimco's balance sheet is in excellent health and ends in 2018 with a ratio of net debt to recurring EBITDA of 6x. Total consolidated debt stands at $ 4.87 billion (about $ 605 million less than in 2017) and no debt maturities are expected in 2019. Liquidity is excellent, with more $ 2.1 billion available under revolving credit facility and cash on hand. Key successes of the company's business model for the coming years: quality and location of the portfolio, numerous sources of untapped value embedded in the portfolio, balance sheet strength and security. Future development will be a key growth driver as ongoing projects are completed and the pipeline with carefully selected redevelopment opportunities is exhausted. We expect Kimco to achieve strong double-digit returns in 2019 and 2020 (up to now, the share in 2019 has yielded ____%). The shares are trading at $ 18.15 with a dividend yield of 6.2%.

We maintain a strong purchase on KIM.

Source: Yahoo Finance

Kite Realty Group (KRG) is another shipping center REIT that is expected to deliver a promising alpha. At the end of the fiscal year, the Company held interests in 111 retail and neighborhood properties in operation and redevelopment in 19 states, totaling approximately 22.0 million square feet (plus one development project in 2009). construction of 0.5 million square feet), occupying 94.6% of the total. The 25 largest tenants, TJ Maxx, Publix, Bed Bath & Beyond and PetSmart, accounted for approximately one-third of Kite's total ABR 2018, with no commercial tenant exceeding 2.6%. Three states (Florida, Indiana, and Texas) accounted for just over half of the 2018 ABR – a record $ 16.84 per square foot. Kite has a strong balance sheet, investment grade, abundant liquidity and a well-timed schedule – its only line of credit could cover all debt maturities up to 2022. The company has announced plans to sell between $ 350 million and $ 500 million of core assets, to improve portfolio quality, reduce debt and focus on preferred geographic markets. The shares are trading at $ 15.50 with a dividend yield of 8.2%.

We maintain a strong purchase on KRG.

Source: Yahoo Finance

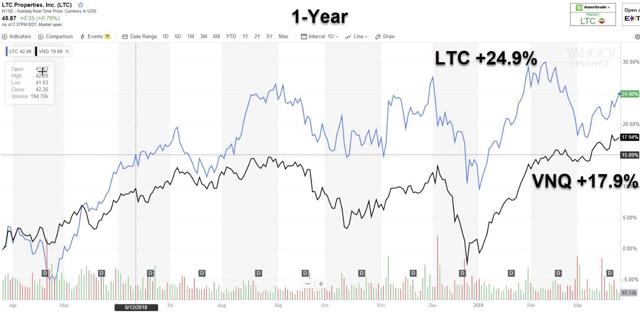

LTC Properties (LTC) is a health REIT that invests in seniors' housing (approximately 48%) and specialty nursing properties (approximately 49%), primarily through sale and leaseback arrangements, financing mortgages, joint ventures and structured finance solutions, including preferred shares and mezzanine loans. LTC holds more than 200 investments in 28 states and 28 operational partners. Cash flow from operations for Q4-18 was $ 32.1 million, up from $ 30.4 million in Q4-17. (Cash flow from operations per diluted common share was $ 0.81 and $ 0.77 for the fourth quarter respectively.) Excluding non-recurring revenues of $ 3.1 million for 2018, cash flow from operations decreased by $ 1.4 million, compared to the fourth quarter of 2017, due to non-payment of December rent by the Senior Care Partner, following their bankruptcy in Texas. The majority of LTC's assets are concentrated in Texas (17.5%), followed by Michigan (14.8%) and Wisconsin (8.6%). I have several concerns – and although the company pays dividends monthly, it has not increased its dividends by 2018. And although I was surprised by the bankruptcy of Senior Care, I'm I was happy that LTC had the upper hand, and put Senior Care in default. . I also appreciate the fact that the company retains a much needed leverage effect and that as the cycle improves, investors in long-term care facilities will be rewarded for their strict discipline. The shares are trading at $ 45.52 with a dividend yield of 5.0% (paid monthly).

We maintain a purchase on LTC.

Source: Yahoo Finance

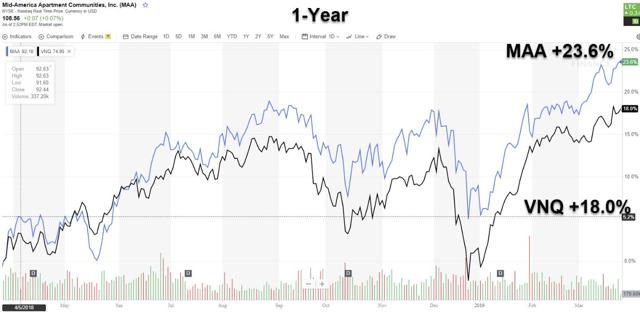

Mid America (MAA) is a Tennessee-based company that strives to provide high quality apartment living experience to residents of the Sunbelt area of the United States. As an active buyer and developer of apartment communities, the company is currently the largest owner-operator of apartment buildings in the country and is part of the S & P 500. The portfolio includes 101,441 apartments, including commercial space in certain properties, four other commercial properties and partial ownership in a multi-family property. The portfolio is focused on strong job growth in the Sunbelt region, diversified across multiple markets. Attractive attractive prices for the largest segments of the real markets continue to position MAA for solid performance. The balance sheet is in a strong position and can support external growth opportunities (more than $ 490 million in combined credit capacity under the credit facility with a net EBITDAR of less than 5x.) After two years of The MAA platform appears to be stable and stronger than ever before, with shares trading at $ 108.49 with a dividend yield of 3.5%.

We maintain a purchase on MAA.

Source: Yahoo Finance

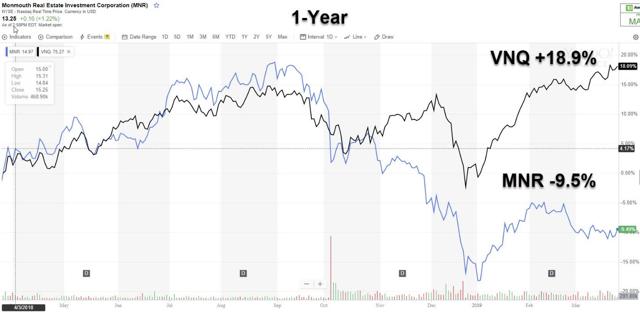

Monmouth Real Estate (MRN) is an industrial REIT that operates a real estate portfolio of 113 industrial properties, representing approximately 21.8 million square feet. The geographically diversified portfolio covers 30 states from coast to coast and focuses on major seaports, major intermodal ports and major airports. Monmouth's involvement with FedEx is highly concentrated, with over 59.6% of annual rent and 48% of the space leased to the logistics giant. Monmouth shares are trading poorly due to weaker demand (related to FedEx) and pressure on operating margins (FedEx). Monmouth has new buildings with 80% of rental income derived from long-term leases granted to investment-grade tenants. Historically, the company has seen very high tenant retention rates of 90% on average. As a result, the Company has also been able to generate highly predictable cash flows, less influenced by the risk of turnover and tenant retention. Our expectations suggest that Monmouth could generate considerable price appreciation if FedEx rebounded. Although the REIT's portfolio of securities remains a concern, the Monmouth dividend looks safe (well covered) and we can not resist an entry position at the current price. The shares are trading at $ 13.09 with a dividend yield of 5.2%.

We recently upgraded the MRN to a strong purchase.

Source: Yahoo Finance

QTS Realty (QTS) is the most enigmatic and perhaps the least understood of the five data center REITs. This is largely due to the fact that in February 2018, the company's management announced that it would turn away from its cloud-based and managed non-centric services to focus on very large scale solutions. (utilities, software, content, social media giants) and on hybrid hybrid computing colocation. Analysts and investors first felt blinded and confused, and QTS stocks were hammered. The company is now much more "clean" and we feel that the valuation is compelling for private equity or a consolidator such as Digital Realty (DLR) or Equinix (EQIX). In addition, CyrusOne (CONE) could also play (for QTS) but is less likely, in our opinion, given the more recent focus at the international level. Shareholders can expect single-digit average dividend increases. The increase in QTS shares in 2019 offers many opportunities for appreciation if management continues to record strong orders and adjusted EBITDA margins. The shares are trading at $ 44.25 with a dividend yield of 4.0%.

We maintain a strong purchase on QTS.

Source: Yahoo Finance

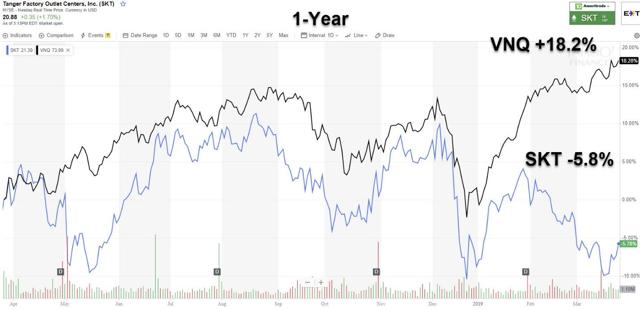

Tanger Outlets (SKT) is a real estate investment trust with a portfolio of 44 branded centers with 15.3 million square feet of gross leasable area in the United States and Canada. The company is trying to cede its space to branded retailers: food and services come next. The success of the Tanger centers has a lot to do with the brand image it has been producing for more than 26 years and which has given the name "TangerOutlets®" as a source of popular labels at advantageous prices. Although Sanger recently reviewed BBB + at BBB, Tangier recorded sufficient free cash flow in 2019 to reduce its debt. The dividend is well covered (an annual increase for 26 years), which allows investors to be paid to wait until Tangier rents its centers from retailers who thrive in an omnichannel environment. Given that free cash flow is expected to remain above $ 100 million / year, with the balance sheet optimized, the Company has the financial capacity to deal with rent reductions and store closures for one to two years, or until the tenant the mix is optimized. The shares are now trading at $ 20.53 with a dividend yield of 6.8%.

We maintain a strong purchase on SKT.

Source: Yahoo Finance

Simon Property (SPG) is a premier shopping center REIT that holds a total or partial interest in 235 Class A shopping centers in North America, Europe and Asia, totaling over 190 million square feet of space. sale to detail. Approximately 80% of the REIT's net operating income comes from its traditional US shopping centers, which are highly diversified, but are almost all located in dense, prosperous and prosperous cities, mainly in Florida, California and Texas. 20% of its NOI comes from its super premium Mills and its international properties, offering American investors diversification that is both enjoyable and safe. Simon's cost of capital is only 3.5% (thanks to one of the two "A" credit ratings), which allows the company to borrow huge amounts of money at low interest rates. of very low interest. In addition, the Company has access to revolving credit facilities with residual liquidity of more than $ 7 billion in the event that it wishes to exploit the short-term credit markets to fund its growth. Simon does not even need it because it generates $ 1.35 billion in annual adjusted operating cash flow (operating cash flow minus maintenance costs). Simon's shares are trading at $ 177.98 with a dividend yield of 4.6%.

We maintain a strong purchase on SPG.

Source: Yahoo Finance

VICI Properties (VICI) is a casino REIT that raised approximately $ 1.4 billion (one of the largest IPOs in 2018 and one of the largest IPO REITs ever) after the spin-off of Caesars Entertainment Operating Co ., une filiale du géant du jeu Caesars Entertainment (CZR), qui a émergé de la protection de la faillite du chapitre 11 en octobre 2017. VICI est l'un des plus grands propriétaires de destinations de jeux, d' hôtellerie et de loisirs du pays, avec un portefeuille géographiquement diversifié comprenant 21 sites de jeu, dont le célèbre Caesars Palace, et quatre terrains de golf de championnat. . Les propriétés sont louées à Caesars Entertainment et sont exploitées sous des marques renommées telles que Caesars, Horseshoe, Harrah’s et Bally’s. Ensemble, les propriétés couvrent une superficie d’environ 39 millions de pieds carrés, 15 000 chambres d’hôtel et plus de 150 restaurants, bars et discothèques. La société a augmenté son dividende annualisé en juin 2018 de 9,5%, soit 1,15 dollar par action après seulement deux trimestres de versement de dividendes, et a clôturé l'exercice avec environ 1,1 milliard de dollars de trésorerie à court terme, procurant une excellente liquidité pour la croissance future. VICI se négocie à 21,91 $ avec un rendement en dividendes de 5,2%.

Nous maintenons un achat fort sur VICI.

Source: Yahoo Finance

En guise de conclusion: Comme beaucoup d’entre vous le savent, j’ai abandonné mes baskets contre un ordinateur portable il ya de nombreuses années. C’est pourquoi j’appelle maintenant le commentaire comment procéder pour le secteur des FPI. En raison de son expérience (plus de 25 ans dans l’investissement immobilier) et de sa passion pour le jeu (aider les investisseurs), j’ai aidé des milliers d’investisseurs du monde entier à choisir des titres de REIT solides. Dans les mots de Jerry Maguire (joué par Tom Cruise), "aidez-moi à vous aider."

Sweet 16 REIT Alignement

Note from the author: Brad Thomas is a Wall Street writer and that means he's not always right with his predictions or his recommendations. This also applies to his grammar. Please excuse any typos and be assured that he will do his best to correct any mistakes.

Finally, this article is free and its only purpose is to help research, while providing a forum for second-level thinking.

Invest with the best REIT and the first financial analyst looking for alpha

"Your articles should be mandatory in high schools and colleges, as a separate topic on real estate investments."

"Always well written, factual and very fun, and you've done it the hard way."

"Brad is the key REIT specialist, and he provided great ideas, which I read and interpreted on my own DD."

"Brad Thomas est l'un des auteurs les plus lus sur Seeking Alpha et il a développé une marque de confiance dans le secteur des FPI."

We offer this special offer so you can sleep well at night …

![]()

Disclosure: Je suis / nous sommes depuis longtemps ACC, KIM, BPR, SPG, SKT, CONE, HTA, LTC, DEA, IRM, QTS, KRG, VICI. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link