[ad_1]

By Prakash Sakpal, Economist, Asia

Persistent low inflation allows for some policy balance, by letting the central bank (BNM) maintain an accommodative monetary policy stance as the government has now embarked on fiscal tightening to rein in the large public debt burden

Low inflation, increased downside growth risks, and yet an outperforming Malaysian ringgit (MYR) have been the factors behind our view that the central bank (Bank Negara Malaysia) will be under no urgency to change monetary policy anytime soon.

The MYR has weakened to almost a year-low level against the USD of 4.18 on growing fiscal jitters ahead of the 2019 budget presentation next week. However, with sufficiently positive real interest rates, the MYR should retain its year-to-date Asian outperformer position over the rest of the year. We consider our end-2018 USD/MYR forecast of 4.20 subject to upside risk.

Little sales tax impact on consumer prices

The launch of the Sales and Services Tax (SST) in the last month in place of the Goods and Services Tax (GST) that was repealed in June didn’t come as a big push to consumer price inflation. Inflation of 0.3% year-on-year in September was only a tiny uptick from August’s 0.2% print and below our estimate of 0.5% and that of consensus of 0.5%.

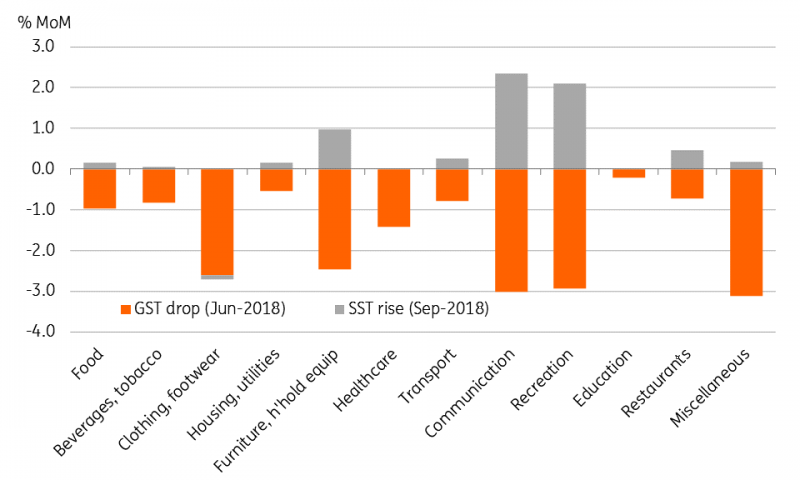

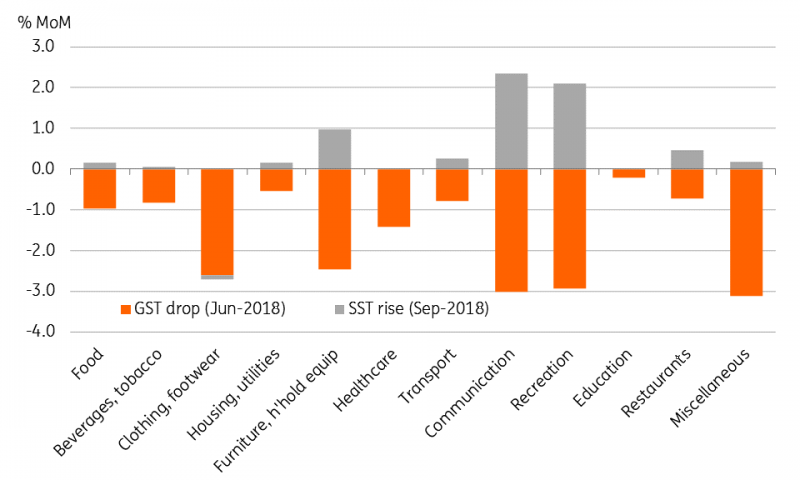

As the chart below shows, the SST impact was negligible across most CPI components, except communication and recreation, though these also failed to offset the GST related dip in June and the year-on-year increase in both these components continued to be negative.

Among other things keeping inflation subdued are the high base effects in the key CPI components of food and transport prices. Year-on-year food inflation is running at its lowest level in almost two decades, 0.5%, while transport inflation dipped to 0.3% in September from 2.1% in August. At 0.3%, core CPI inflation remained converged on the headline inflation.

Impacts of GST removal and SST implementation by CPI component

Source: Bloomberg, ING

Continued benign inflation outlook through 2019

The year-to-date inflation rate of 1.2% YoY is a significant deceleration from 3.9% a year ago. Inflation may have bottomed, though there isn’t going to be an upward thrust emerging until the consumption tax impact moves out of the base of comparison. That’s unlikely to happen until after mid-2019.

We consider our 1.0% full-year 2018 inflation forecast at risk of a downside miss. And we expect inflation in 2019 to remain close to the low end of the 2-3% official medium-term forecast. Persistent low inflation allows for some policy balance, by letting the central bank (BNM) maintain an accommodative monetary policy stance, as the government has now embarked on fiscal tightening to rein in the large public debt burden.

Disclaimer: The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. This publication has been prepared by ING solely for information purposes without regard to any particular user’s investment objectives, financial situation, or means. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published. For our full disclaimer please click here.

Original Post

[ad_2]

Source link