[ad_1]

The S&P 500 Index hit a record high Friday for the 15th time this year, but stock market futures indicate a quieter start to the trading week.

While stocks may continue to rise, the rise will be very limited, said Matt Maley, strategist at investment firm Miller Tabak + Co., in our report. call of the day.

Maley said there is “no doubt that the stock market could rise further from current levels,” but his team believes more of the gains will not be due to fundamentals.

This is largely because the market has already factored in fundamental growth expectations over the next 12-18 months. Some of these main projections include estimates of year-over-year economic growth of 8% for 2021 and profit growth of 25% this year.

And the strategist said these bullish growth projections were not on target. “These are amazing numbers, but if you compare them to a normal year, they’re not as impressive as they initially seem,” Maley said. The year-over-year estimates are comparisons to 2020, when the global economy virtually shut down and corporate profits were battered by the COVID-19 pandemic.

“More importantly, they don’t justify another rally in the stock market,” Maley said. “Something else is going to have to fuel an important rally.”

Valuations are “extreme,” Maley said, and this expensive market “tells us that the upside is very limited”, with risks “quite high” that a full correction is ahead.

The main concern of the investment company at the moment is the divergence between the S&P 500 SPX,

indices and technology stocks. The blue chip index may hold up if there is weakness in the tech sector, but “once that weakness becomes more pronounced it has always had a negative impact on the broader stock market,” said Maley said.

Whenever the Nasdaq COMP,

fell between 12% and 14% over the past 40 years, it has created a “material pullback” in the S&P 500, the strategist said. “If that correction goes above 15% on the Nasdaq, the S&P has always fallen by at least 10% as well (and usually just over 10%),” Maley said.

The divergence between the S&P 500 and the Nasdaq is reasserting itself once again, Maley said. If the high-tech index moves much lower, it will “raise a serious warning flag” for both the Nasdaq and the broader stock market.

The buzz

The massive container ship that blocked the Suez Canal and disrupted world trade last week is still stranded, but perhaps not for long. The Ever Given was successfully refloated early Monday morning and the tugs are working to right the vessel.

The end of last week was marked by massive block trades worth around $ 30 billion, triggered by a margin call from US investor Archegos Capital Management. The sale pushed the actions of media groups ViacomCBS VIACA,

and Discovery DISCA,

down more than 27% on Friday and hit some Chinese internet stocks.

And banks linked to the Friday fire sale are feeling the heat. Shares of the Japanese company Nomura 8604,

and Credit Suisse CSGN suisse,

plunged on Monday, after the two groups granted credit to a major customer who could not meet his obligations. The Swiss group said losses resulting from exiting positions could have a “very significant and material” impact on results.

It’s a light day on the economic front, with the Chicago Fed’s National Activity Index for February at 8:30 a.m. EST, followed by existing home sales data for February at 10 a.m. .

Albany lawmakers struck a deal on Saturday to allow the sale of recreational cannabis, opening the door for New York to join the growing list of states that have legalized marijuana. A vote on the bill could take place on Tuesday.

British online car retailer Cazoo is set to go public on the New York Stock Exchange in a listing valued at $ 7 billion, after agreeing to a merger deal with an acquisition company for use special (SPAC) blank check. Cazoo’s planned merger with AJAX I will bring billionaire SPAC investor Dan Och to the company’s board of directors.

The steps

US Stock Market Futures Point Down YM00,

ES00,

NQ00,

set for a low open to start the new trading week. Bank stocks remain under pressure in fallout from Friday’s Archegos rollout, with Deutsche Bank DBK,

and UBS UBS,

among the fallers and shares of Goldman Sachs GS,

and Morgan Stanley MS,

further down in the pre-market.

The European indices were mixed UKX,

DAX,

PX1,

while Asian stocks NIK,

HSI,

SHCOMP,

ended Monday in the green.

Table

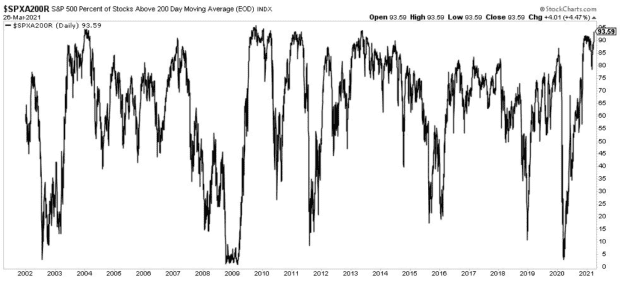

The market “is in a very healthy situation right now,” said Michael Batnick of the financial blog The Irrelevant Investor. In our chart of the day, Batnick shows that 93% of S&P 500 stocks are above their 200-day moving average – the highest reading since 2013 levels.

Random readings

There is a game about the ship stuck in the Suez Canal and you are the bulldozer.

Life on Mars: This is what the first city on the planet could look like.

Need to Know starts early and is updated until the opening bell, but register here to have it delivered to your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Subscribe to Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link