[ad_1]

"It is a mistake to believe that soothing emotions have been soothed by" reassuring "words of optimism about the ultimate resolution of the trade dispute," former businessman Richard Breslow said in his daily column on Tuesday morning. ill-advised to "indulge in the game of a junior psychologist on everyone's motives while he's playing the game" ".

You can not blame financial reporters for being a little tired. Over the past six days, they have made an inherently sterile effort to develop a coherent market discourse based on conflicting messages and a ceaseless commercial joke from both sides of the Sino-US conflict. After a week of that, it's tempting to use lines like this, taken from the Bloomberg market wrap on Tuesday:

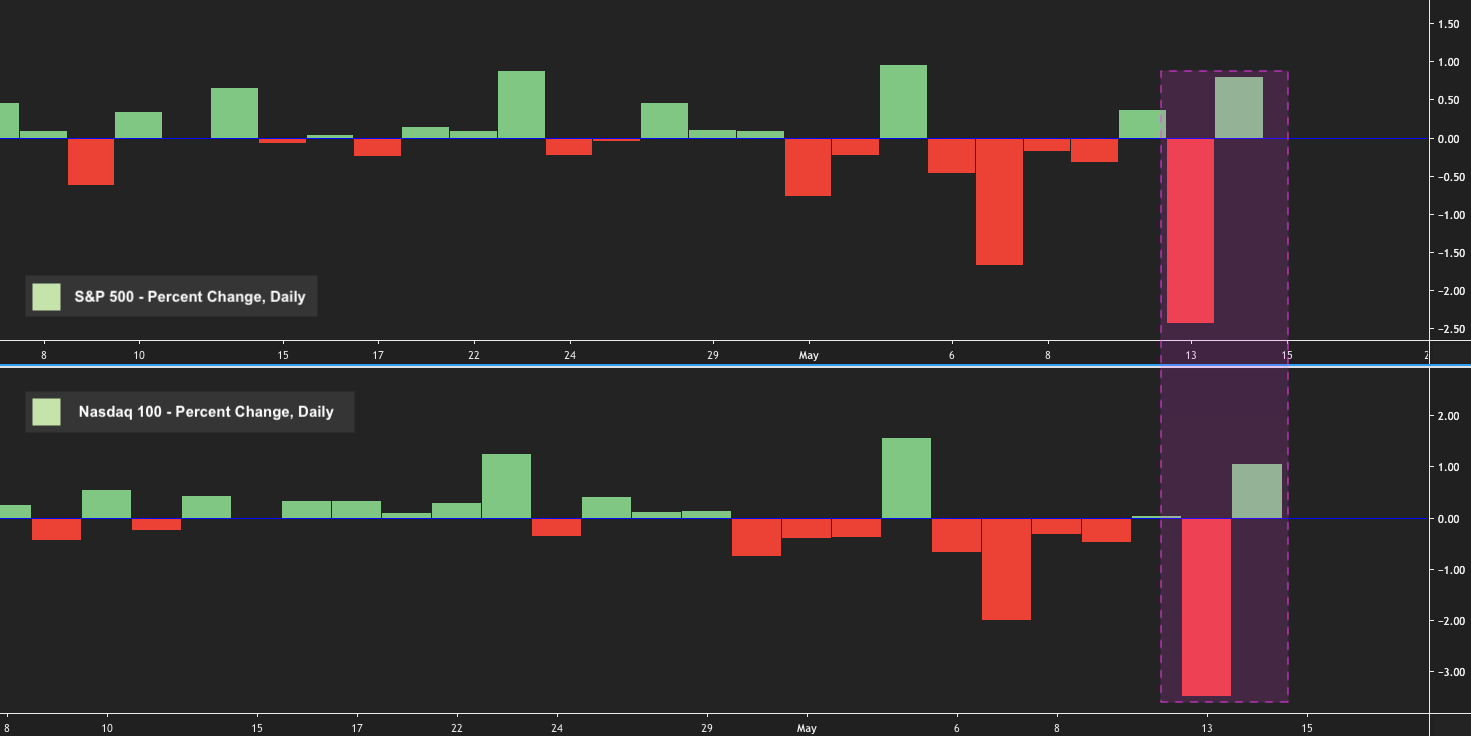

US stocks rebounded after the worst defeat in the last four months as President Donald Trump had taken steps to reassure the markets that he was going to conclude a trade deal with China.

While Breslow wrote hours before the US opening, relying on the idea that since risky assets were under commercial concern on Monday, these concerns must have subsided because stocks were higher. Tuesday is a ridiculous race.

President Trump said Monday afternoon that he would meet his Chinese counterpart at the G-20. In an address to the White House Monday evening, he said he was convinced that the talks with China "would be very fruitful". It's great. But the President's Twitter feed was stuffed with sometimes contradictory rhetoric Tuesday and there was a lot of irony in the fact that Trump's comments on Monday night's night came just hours after the USTR published a list of 300 billion additional dollars in Chinese products. The publication of this list was expected, but there is something a little off the mark (not to say funny) to give an optimistic tone to the commercial discussions two hours after you have published a list of goals. potential tariffs including everything from "live foxes" to "false beards".

Regardless, market participants will take it – and by "that", I mean everything they can get after Monday's terrible rout.

One thing to note is that we could well be caught in the middle with respect to CTA signals (trend followers), with levels that would trigger additional deleveraging well below the threshold and re-optimizing levels at the distance of the signals. cries on the rise. . At the same time, profit taking by asset managers (in a significant notional market in US equity futures) may have followed their course in the near term, while volatility-controlled funds may well having withdrawn from their system (that is, risked further) on Monday. In the future, it is possible that newly placed hedges will be monetized, which will give the necessary boost to a tactical rebound, as Nomura pointed out on Tuesday.

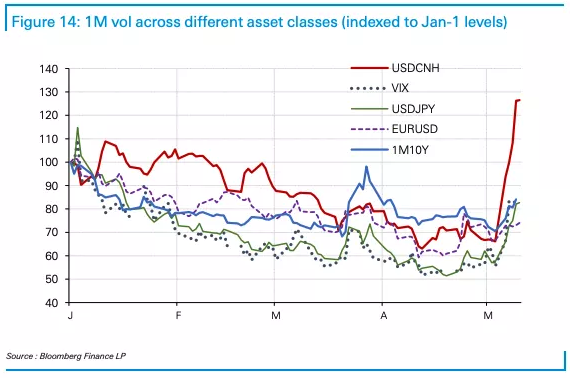

Importantly, the USDCNH fell for the first day out of seven on Tuesday. The PBoC has fixed the fix stronger than expected for five consecutive days, a move that suggests that Beijing's tolerance of weak currency could decline. Sudden drops in the yuan are destabilizing, not just for China. One month implied vol. on USDCNY has organized one of the most important weekly movements since the devaluation last week, and as Deutsche Bank wrote Sunday, "compared to [the yuan]the reaction of other markets remains moderate. Here is an additional excerpt from Deutsche's note:

It depends largely on the nature of the problem. No view of either rates or risk assets will likely be expressed until the underlying tensions in the currency channel are resolved. The mode of propagation of tariffs may be significantly different depending on the adjustment of the currency, especially the CNH.

Tuesday morning, President Trump has used Twitter to suggest the Fed to "match" the PBoC to reducing rates. As I quickly pointed out, China has not really reduced reference rates (as opposed to the RRR) since 2015, but this "little" detail aside, Trump's point of view is simply that Chinese monetary policy (and liquidity provision) has been moved to account for trade tensions. It is therefore difficult to credibly accuse Beijing of monetary "manipulation". When the tariff threat became more real last year, markets began to forecast a softer monetary policy and a weaker economy. These expectations have materialized in the currency, as they are now.

Capital Economics summed up the situation on Tuesday, noting that the yuan was "a victim" of the trade war, not a "weapon". Look at the interbank rates in the offshore market in yuan. Rising borrowing costs suggest that Beijing may be on the brink of organizing a brief compression if the yuan does not exceed.

UBS today suggested that the yuan could plummet at 7:30 am if the Trump government decided to introduce tariffs on the remaining Chinese imports. China's GDP would fall below 6% in this scenario, the bank said. It's hard to imagine 7.30 CNY, and even less to imagine that Beijing lets this happen as long as it is still possible to reach an agreement with Trump, since a depreciation of this magnitude would probably make furious White House. For what it's worth, it's not the basic case of UBS.

In any case, the fact is that any sign that the PBoC would be willing to tolerate a substantially weaker currency (when it would mean that the yuan would drag in a serious way without being hindered by extremely aggressive patches and / or apparent intervention spot market) would probably spell out problems for the markets. One of the things I've been saying all the time over the last year is that China could, in theory, let the yuan fall sharply to offset the effects of additional tariffs and then cite an "irrational" action. markets ("herd behavior", as the PBoC calls it) as an excuse for dumping American treasuries in the defense of the currency. That would kill two birds with one stone, the only problem being that, as we saw in 2015, it is virtually impossible to protect things and avoid collateral damage, including on the ground. Chinese stock market.

To quickly go back to some of the points mentioned above, if you're hoping for a tactical rebound, you'd ideally like to see more systematic vendor re-engagements and, as noted, a blanket monetization suddenly in place. -The money after the sale would help too.

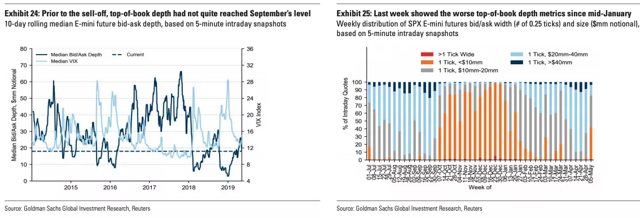

Thanks to Tuesday's rally, there is probably some room for maneuver between the current SPX spot and the additional deleveraging of ACTs, but a problem that does not disappear is the poor liquidity. As Goldman wrote on Monday, the depth of the market did not even manage to return to September levels during the recent rally (left flap below) and liquidity quickly dried up during the tumult of last week (far right bar in the right panel below).

(Goldman)

Low liquidity is now an integral part of the markets and, given the exponential relationship of volatility with the depth of the market and the proliferation of flight-sensitive strategies, it is still possible that the fund will disappear, given the way in which dominoes are set up. awful mixed metaphor).

Finally, if you are wondering what would be the conflict between the worst business scenario and S & P's profits at a time when there is still talk of a "revenue recession", even if the first quarter results generally erase the lower bar, very useful passage of Savita Subramanian from BofA:

In a trade war scenario, where a 25% rate is applied to all remaining Chinese products, we estimate a direct impact of 2% on BPA, for a total direct impact of -3% (1% from [the recent] higher tariffs and 2% on new tariffs) – which could reduce the growth of EPS 2019 to 1% / fixed level. The indirect economic effect would pose a significant loss risk for earnings per share, where the average decline in earnings per share in the event of earnings recession is 20%.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link