[ad_1]

We thank readers for appreciating the first article in this series. In addition, we would also like to highlight some pointers based on the reader's questions and comments:

- This analysis is limited to actors listed in the public space and does not extend to the application companies. For example, Salesforce.com (NYSE: CRM) has a privileged partnership status with Amazon (NASDAQ: AMZN), Web Services (AWS), and Adobe (ADBE) running on Microsoft (NASDAQ: MSFT) Azure. While Sales Cloud and Adobe Experience Cloud are leading products, they are applications and the underlying cloud belongs to public cloud companies. Thus, for the purposes of this analysis, none of the application companies were included.

- Cloud computing companies have generated some interest among readers. Some of them represent remarkable investment opportunities, but others have been limited due to various factors, including slowing spending by cloud service providers. In addition, these "downstream" companies in the cloud value chain (like the "upstream" application companies) deserve a separate discussion.

- The most prominent foreign names in the public cloud market are those of China and possibly SAP (NYSE: SAP). With Chinese companies, let's take for example Alibaba (NYSE: BABA). The company mainly addresses a Chinese audience. Last year, Alibaba's cloud revenues reached approximately $ 2 billion and, for the nine months of that year, approximately $ 2.5 billion. In addition, the complex ownership structure of the company (read variable-interest entities, etc.), the role of Jack Ma (who left the leading position but who remains a key player in the scheme of things and which tends towards philanthropy), the risk inherent in the current situation. The tariff war and the need to understand the state of the Chinese economy do not lend us the attraction of watching Alibaba Cloud and other Chinese players at this stage. Regarding SAP, the company is in an aggressive mode of mergers and acquisitions to strengthen its cloud business. Considering the size of the players mentioned here and the risk inherent in SAP's inorganic strategy, we want to see the company enter this market for a few more quarters before expanding further.

- Hybrid cloud management has become an important category in the cloud market, due to the combination of on-premise and cloud assets that companies have built over the years. Since a large number of companies still have to fully embrace the cloud concept, it may be a bit early to separate hybrid systems by category.

- It is interesting to note that only one (Microsoft) of the "old guard" is in the top 3 of the cloud, while the other two (Amazon and Google) are newcomers in a market characterized by the evolution of storage and traditional computing.

We start by going back to understand what the cloud really is and the implications of the growing need for a cloud-centric approach.

Cloud basics

The cloud refers to the outsourcing of storage and / or computing functions by leasing capacity from cloud providers. Cloud providers typically have a distributed presence and storage or computing is delivered over the Internet to cloud clients.

The cloud was initially seen as an inexpensive way to test the market for new products, regardless of capacity or cost constraints. After the test phase, customers have better visibility of requirements and can easily switch from a public cloud to a private cloud (in a public cloud, all management of hosting is outsourced, which changes in the case of a private cloud under the responsibility of the client, management and hosting). Since in the long run rental is always more expensive than owning an asset, private clouds make more sense for large, stable businesses seeking to increase margins through cost control rather than s primarily rely on revenue growth.

Over the last decade, the reluctance of IT departments to adopt the cloud has given way to extreme enthusiasm for the cloud. While the initial reluctance was due to the expected complexity of managing another element of the IT portfolio, this enthusiasm was driven by expectations of promoting innovation while significantly reducing costs. Over the last few quarters, the two reasons have converged to give rise to the multi-cloud paradigm: the need to manage disparate (acquired or in-house) cloud assets, as well as the complexity of their management that results from them, have led the rise of the hybrid cloud. management solutions or systems integration services for multiple clouds (private and / or public).

Another trend that dominates the need for the cloud is that of advanced computing, motivated by the adoption of the Internet of Things (IoT). Peripheral computing refers to data processing closer to the edge (or to network nodes, where the data is generated), as opposed to data transformation in the cloud. Cases of use of periphery computing include real-time decision-making (games, autonomous driving, algorithmic trading, etc.), where even a minimal delay in processing (resulting from the lack of time). sending data to the cloud and receiving information processed) can have serious consequences.

The expected increase in the number of connected devices (mainly IoT devices) and the need to manage an on-premises and cloud-based asset network are giving additional impetus to cloud management. hybrid.

VMware's management (NYSE: VMW) has been credited over the last few quarters with its foresight about hybrid cloud growth and CEO Patrick Gelsinger said:

And the other thing I notice is that in the history of computer science, it's my 39th year in technology, hard to say out loud, but we've seen the shift in the technological forces of centralization to decentralization during the history of technology. The industry and the cloud will force the centralization, Edge and IoT will be a force of decentralization as we move forward and we do not see this world topple in one way or the other. 39, another.

Source: Barclays TMT Conference (Dec 2018)

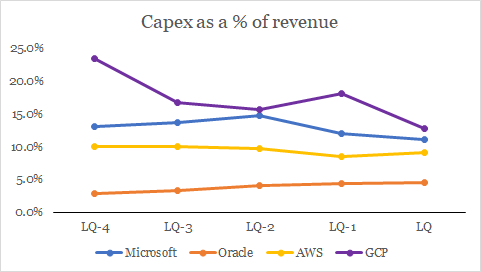

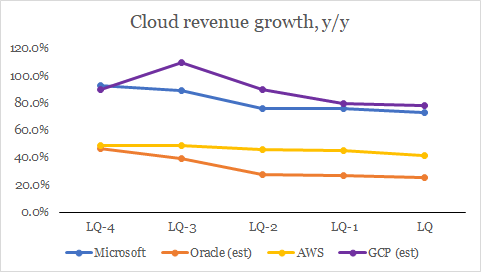

What corroborates it is the slowdown of cloud revenues over the last three or four quarters for most of the major players. Although the reasons vary, the underlying theme is that of reduced investment and slower growth rates.

Source: Company filings and author estimates. Note: LQ refers to the last quarter reported; LQ-1 to a quarter before and LQ-4 to four quarters before

Interestingly, Oracle is the only provider to have seen a steady increase in capital expenditures.

Source: Company filings and author estimates

It seems that the broad market has slowed down at least in the last two quarters, probably because providers are gradually focusing on a hybrid cloud to seize opportunities. At the same time, cloud providers could also prepare for cloud expansion to provide a more standardized abstraction of leased and owned resources. Some providers have invested in the creation of assets, some players have opted for collaborations and others have embarked on the more ambitious path of mergers and acquisitions.

Microsoft

Azure uses all the cylinders at the back of the vast Microsoft enterprise and its own end-user applications at the top of Microsoft's cloud. In addition to Office 365, games have become important for the company. Microsoft generated more than $ 10 billion in gaming revenue last year, about 10 percent of the company. And about 7% of the gaming market of $ 150 billion a year.

In March of this year, Microsoft has bundled all of its game development tools under the "Game Stack" umbrella and will be hosted on Azure. In addition to trying to provide game developers with a complete toolkit, Microsoft is also trying to tackle the most complex part of the game in the cloud: latency issues. In early April of this year, Microsoft also announced a partnership with Akamai (AKAM), one of the leading content delivery network (CDN) providers.

Akamai is perhaps one of the largest CDN networks (or distributed networks) in the world and has a long history of collaborating with streaming companies, reducing latency in games and live sports broadcasting.

As recently as the end of April, Akamai's management said that although latency management is possible, the problem is that of a large-scale economy: a growing volume of traffic makes it a rather expensive proposition for Streaming cloud games is profitable. And yet, Microsoft has linked with Akamai.

Microsoft had introduced the subscription to its gaming products some time ago, while recognizing the shift from a "per device to a per user" model, allowing users to play games on a whole range of devices (from consoles to cell phones). Management had also expressed a desire to invest in its gaming product in order to capture a larger share of the gaming market of $ 150 billion a year. In this context, the collaboration with Akamai appears as an investment (even if economic considerations currently have no meaning) to enhance Microsoft and Azure's advanced capabilities.

In addition to the Akamai Edge Network, Microsoft also maintains formal relationships with VMware and Red Hat (NYSE: RHT) – IBM (NYSE: IBM) for hybrid capabilities. Best of all, Microsoft CEO Satya Nadella was executive vice president of Microsoft's Cloud and Enterprise group before being promoted to CEO.

Satya particularly emphasized that the architectural advantage of Azure is the key to its success. After a slight lag, a few quarters back, due to the change in the product mix, the cloud sector seems to be at its best, with revenue growth and rising margins showing gains in shares.

Oracle (NYSE: ORCL)

After the release of Thomas Kurian, Larry Ellison oversaw the company's cloud activities. He discussed the reported differences in Oracle's strategy of selling its own cloud rather than offering more software on public clouds. The importance of this executive departure can be assessed from the following elements:

- he was bunny by none other than Google (NASDAQ: GOOG) to lead Google's cloud commerce

- Thomas worked for more than two decades at Oracle, climbing the ladder and reporting to Larry

- Oracle had started commercializing its Generation 2 cloud in the last two years

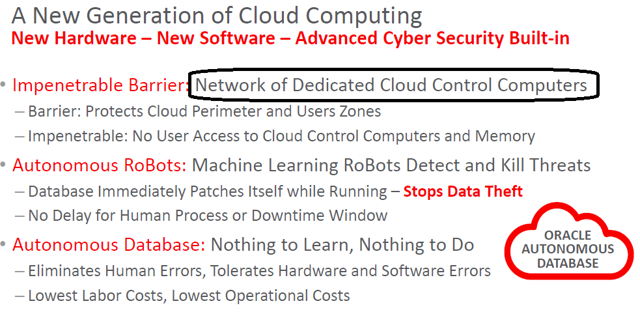

From a market perspective, Oracle claims that Generation 2 is a better architecture because it separates cloud control from user code, making it a safer and technologically superior bet.

Source: 2018 Oracle Analysts Day

While Oracle held a prominent position in the database market, its aggressive sales tactics often deterred adoption of its products. In addition, the Oracle cloud is relatively new compared to those of existing players. Despite these limitations, the company is trying to encourage its customers to migrate their databases to the Gen 2 cloud.

But in terms of technology, there is no way to move a person: a normal person would move from an Oracle database to an Amazon database. It's simply incredibly expensive and complicated and you have to be willing to give up tons of reliability, security, performance to go from the front. But we have a huge technological advantage. Again, do not believe me reading the Gartner Report. We've never had – the Oracle standalone database has the biggest technological advance we've ever had in the world of the database from the technological point of view. The problem is that we need to provide this stand-alone database on a premier cloud infrastructure to succeed in the cloud market. We need more than just a database. We have the best database, but we also need a first class infrastructure to run it. And we finally have that with our second-generation cloud, and I think you'll see the combination of the Oracle stand-alone database in the second-generation cloud.

Source: Oracle's Call for Results for the Second Quarter of 2019

In particular, AWS always uses Oracle database products. Oracle also seems to have generated a lot of buzz with its standalone database.

The introduction of our highly secure second generation infrastructure, including the Oracle stand-alone database, has been very well received. In the third quarter, we had close to 1,000. More than 4,000 active trials.

Currently, 20% of our customers on Standalone Data Warehouse, Standalone Database, are new to Oracle. We did not have them before.

Source: 2019 Oracle T3 Results Call

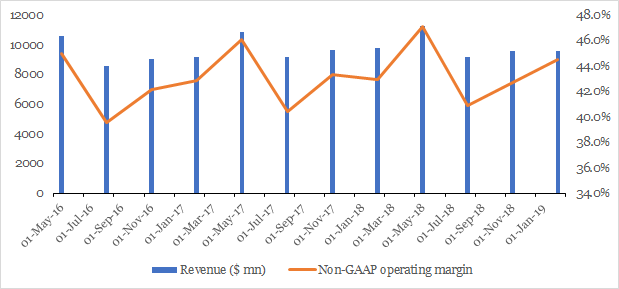

However, the decline in the company's traditional business has not allowed the growth of the cloud business to be sufficiently reflected in revenue. Although margins improved, the composition of sales was increased.

Source: Company filings and author estimates

It should also be noted the many acquisitions that the company has undertaken in 2018 to flesh out its cloud feature set, especially on the side of artificial intelligence.

The intention to produce more features in a cloud that can support an on-premises database seems like the right solution. The only catch is that the person responsible for these acquisitions is no longer part of the company. The departure of Thomas Kurian also raises the question of whether 2019 can still be a year of inflection for the ambitions of the Oracle cloud. There are two ways to think about this:

- When Larry Ellison was referring to 2019 as a year of inflection, he was always opposed to the idea of his cloud leader to introduce Oracle software available in the database. other public clouds. So, with Thomas leaving, all the limited resistance the president faced was gone and the month of inflection should now be advanced. Or,

- Oracle was waiting for the skirmish to calm down and for both parties to reach a compromise, which will ultimately benefit the company.

What goes against Larry is the long wait of the market for Oracle to experience growth, driven by the cloud. However, the company bought back many of its own shares. In addition, we must not forget that Larry Ellison has already supported visionaries, including Steve Jobs.

IBM

IBM is a bit of a unique case, given the disengagement of the portfolio that the company has been facing. IBM seems to be straddling between a incumbent and a competitor, and has finally imposed itself as a major player in cloud integration (hybrid cloud space), still eager to sell a part of his own cloud. IBM shocked the markets last October with the announcement of its deal with Red Hat. The surprise was more related to the size of the transaction entered into by IBM and the asset purchased by the company.

The cognitive solutions industry was IBM's flagship; With the purchase of Red Hat, IBM has gained notoriety in the hybrid cloud market. Recognizing the importance of separating technology services activities from its core cloud business, IBM has transferred its core cloud computing business to technology services and has partnered with the Cognitive Solutions business. The combination of Cognitive and the cloud will likely help IBM transform much of its technological prowess into its own cloud. The factors that favor IBM's position in the evolving cloud market are:

- The company's long history of business relationships (which is extremely critical for extending the cloud and related information system work), especially as IBM helps its customer overcome the challenge poses beyond the "fruit of the job" migrations to the cloud.

- IBM's commitment to the cloud (the acquisition of Red Hat is by far one of the biggest contracts in the technology industry) seems to be quite serious and aligns with that of a company looking for to reinvent itself.

Some aspects that may contribute to IBM's position in the general order of the cloud are:

- The acquisition of Red Hat will likely move IBM's business model from a leading provider of enterprise software, hardware and services to a cloud-based solution provider and less complex cloud solutions model. . Changes in the business model will likely also require changes in management to maintain the momentum. At the time this article was written, Arvind Krishna, an IBM veteran for three decades, was at the helm of Cloud and Cognitive Software. Sincerely from Microsoft's history, IBM could significantly strengthen its position in the cloud / hybrid field, if the cloud manager were also to lead the company's broader portfolio of assets to better align them with the cloud. the global philosophy of society. The absence of Ginni Rometty in recent calls for results may well be the first sign of imminent change. However, clarity of management will be paramount for IBM to convince its customers that its technological vision is that of a marathon rather than a sprint.

- With the acquisition of Red Hat, IBM is targeting the $ 1 trillion hybrid cloud market and it might make sense not to compete with the big players in the public cloud. However, as the world becomes more and more multi-cloud, customers are trying to avoid vendor blockages. IBM's cloud is a great alternative for customers who want to increase the diversification of their underlying asset base while trusting IBM for the abstraction to be delivered (hybrid management), to ensure standardization and smooth operation. However, to adopt this strategy, management may need to improve its messaging and avoid becoming a competitor to become one of the top three providers in the public cloud provider market.

Since the first half of last year, IBM management has been trying to build a story about the potential of its hybrid cloud strategy. Subsequently, even though the main Cloud activity slowed down a bit, Is reservations remained relatively strong. The expected conclusion of the Red Hat deal in the second half of this year and IBM's messaging strategy around its cloud strategy could enable IBM to stand out in the hybrid cloud world.

VMware

If hybrid cloud management is a good thing, VMware is there. The company is a recognized leader in virtual machine software and integrates more and more software into private cloud management.

A few quarters ago, VMware began to leverage its partnership with AWS.

We continue to see customer interest and engagement with VMware Cloud on AWS. The service designed to integrate the VMware software-defined data center into the AWS cloud enables customers to run applications in private, public and hybrid cloud environments based on VMware vSphere, with operational consistency, with access optimized for AWS services.

Source: VMware Results Call for Q4 2018

In return for AWS 'authorization to access VMware's customer base, it gained an advantage over its margins by not having to host.

We also note that, since this is a subscription market, the direct tax impact will also be delayed. As we said before, it's a net business for us. We do not support hosting costs in our income statement. So, this gives us a pure deal of subscription licenses.

Source: VMware Results Call for Q4 2018

Over the past year, this focus on AWS, and possibly on IBM's proximity to Red Hat, has led AWS to replace IBM's central role in the VMware Partner Program (VCPP). VMware wanted to go beyond selling AWS to its own customers and beyond the growth of this business.

We are largely selling VMware customers from the existing installed base as a starting point, but we are clearly anticipating that we will move to Phase 2 and beyond.

Source: VMware Results Call for Second Quarter 2019

And the beginnings of Phase 2 seem to be the launch of the AWS outposts.

In addition to the AWS partnership that points to the potential for healthy margin growth for VMware, VMware's dominant position in the hypervisor space will likely dictate similar partnerships that allow other players to survive and grow. The relationship between VMware and AWS may have inspired the IBM-Red Hat agreement.

Where VMware also links with virtually all major players. In a world where multi-cloud environments are becoming the norm, VMware's partner network of more than 4,000 cloud partners gives it a leading position. It should also be noted the potential benefits of these relationships for Dell, the parent of VMware, and an influential group.

There is no doubt that VMware's role in the hybrid cloud market is likely to shape the market to a large extent; the proximity of the company to AWS can lead to friction in its relationships with other large corporations of cloud.

AWS

AWS may not have the best technology stack, but Amazon's customer focus has allowed AWS not only to drive the public cloud market, but also to fund the mainstream business d & # 39; Amazon. Interestingly, the consumer sector Amazon is known to be one of the largest AWS customers.

AWS 'partnership with VMware is potentially an investment for Amazon, with a much higher return on investment potential. AWS no longer needs to inform customers about the benefits of the cloud. Instead, the company must manage its costs in order to increase margins while reducing costs (what AWS did with almost unrealistic efficiency). AWS announcements about deep storage, competition, etc. indicate that the company has reached a point where the marginal cost of incremental data processing and storage has become minimal. Thus, the decline in Amazon's investments is well linked to the company's desire to enter the private cloud space with VMware: AWS must host and the company has reduced its hosting costs. Since VMware claims to have hundreds of thousands of customers if AWS continues to play well, it is possible that both continue to exploit the private and hybrid cloud markets.

While AWS 'continued investments in research and partnerships will likely contribute to maintaining the company's competitive edge in the cloud sector, the risks come more from the inside.

- Amazon's presence in many related areas has caused many AWS customers to consider AWS as part of a competitor. Anecdotal evidence suggests that Microsoft could have benefited in some cases. If Amazon were to continue to expand into new business areas, its competitors could benefit from this move because of the competitive threats that Amazon would have access to customer data.

- AWS has become quite important, and as the hybrid cloud market continues to grow, companies are looking for alternative providers in their portfolios to cover their risks.

- While AWS's focus on a partnership-based model has allowed capital spending to remain low, in recent quarters growth rates have moderated. In addition, the price reduction had an impact on margins. More recently, management has noted a sequential weakness due to the size of the business. Either AWS undertakes massive transformation projects (according to AWS standards) that cause a bulky mass, or the benefits of the anticipated capitalization of investments in investment spending in 2016-2017 begin to fade. In either case, AWS would not want to sell a significant market share to one or the other of its competitors, because the cloud is ultimately a large-scale enterprise.

Google Cloud Platform (NYSE: GCP)

In addition to the usual difficulties related to technological superiority, the relative lack of concentration on the customer in its business activity compared to other players in the cloud and the disappointment of management in the face of the opacity of its business in the cloud, GCP must also be considered as a progressive activity.

- GCP has come a long way since the sale of its product to its customers with the slogan "working like Google" to make concerted efforts to make the Google Cloud consumable usable by users of its business. What is commendable in Google's efforts is that GCP was designed to allow developers to develop software and not companies to migrate legacy workloads. Despite everything, the company has always conquered large companies. In addition, GCP has introduced new products to meet customer expectations. For example, the company has launched an identity management tool, which Googlers may consider boring, but is a necessary requirement for traditional businesses.

- The hiring of Thomas Kurian by Google was no less an event than the one with IBM with Red Hat.

- In addition to Thomas Kurian's proximity to Larry Ellison at Oracle, Thomas is also an outsider for Google (not only from a business point of view, but also from a cultural perspective). Microsoft's Satya Nadella, IBM's Arvind Krishna, Patrick Gelsinger of VMware, and Andy Jassy of AWS (and even Sundar Pichai of Google) are all veterans of the company who have climbed the ladder. Thomas Kurian too, at Oracle. Another glaring problem for the enterprise product manager will be whether he manages to break the stereotype of "successful local business leaders" in one of the world's most engineering-driven companies in the world. one of the fastest growing businesses in the group.

- Much of the criticism of Google for failing to provide enterprise-level support for its cloud client was because Google had reoriented its own cloud to sell it. Thomas Kurian was the cloud manager at Oracle, whose second-generation cloud was restructured to go beyond the traditional cloud approach. So, the new CEO should be faced with one of the following questions: although he has the experience of seeing the Gen 2 cloud evolve, can he add enough features to the existing cloud product of Google to make it easily adaptable to the needs of traditional or traditional businesses? ?

- Le changement de l’orientation opérationnelle de GCP de codeurs vers les entreprises peut également poser un défi potentiel pour l’entreprise. Le succès d’AWS est dû au fait que le cloud de la société a été créé sur mesure pour aider les entreprises à dépenser des efforts considérables pour informer le public des avantages du cloud par rapport aux solutions sur site des clients. GCP pourrait être juste derrière la courbe. Dans les débuts du cloud, les entreprises souhaitaient une approche non migratoire de la migration. Au fil des années, alors que les gens comprenaient mieux le cloud, non seulement les startups pilotées par un codeur (qui avaient été intégrées à GCP grâce à son offre conviviale pour les codeurs), mais également les responsables informatiques des entreprises ont commencé à valoriser GCP. Toutefois, la vente du produit au DSI par opposition au PDG sont deux aspects différents et Thomas Kurian sera sur la bonne voie pour concilier ces deux exigences, souvent contradictoires.

- Le lancement de Stadia, un service de jeu sur cloud, est une autre initiative de Google visant à fusionner les frontières de son entreprise et de ses activités grand public. Ce qui augure bien pour Stadia, c’est sa forte intégration à YouTube, où plus de 50 milliards d’heures de contenu de jeu ont été visionnées en 2018. Il existe potentiellement deux défis auxquels Stadia pourrait être confronté:

- Le premier concerne les obstacles techniques liés à la diffusion en flux de graphiques haute définition avec des exigences de faible latence, et cela à une échelle aussi grande. Par rapport au streaming de films ou de vidéos, où les périphériques locaux peuvent stocker les données, la latence des jeux devient beaucoup plus importante car les joueurs attendent de réagir au prochain coup de l'adversaire.

- Le deuxième défi est plus subtile mais susceptible d'être tout aussi important. Stadia permettra également de vérifier dans quelle mesure Google a tiré des leçons des erreurs commises lors de la vente de son cloud. Stadia est basé sur le cloud et le CDN de Google, ce qui est en quelque sorte le reflet de la façon dont la société a commencé à vendre son activité cloud, une ressource interne ouverte à la consommation de masse. Bien entendu, les personnes qui traitent avec Stadia sont beaucoup plus proches du codage que les responsables informatiques au tout début du début des ventes dans le cloud public. Alors que les clients de Stadia sont à la recherche de temps de latence et de coûts économiques, ce qui a été structurellement difficile pour les jeux sur le cloud, l’adresse de Google sur ces aspects sera un élément clé à surveiller.

Conclusion

Le marché du cloud computing a été marqué par une myriade de changements dans les entreprises et les dirigeants, dans le but d'accroître leurs parts de marché. Hybrid et edge semblent être les nouveaux objectifs louables, avec des investissements allant des acquisitions aux partenariats. Cependant, la revendication d'obtenir une tranche de la base installée sur site existante est inévitablement claire.

À mesure que nous progressons vers la troisième partie de cette série, Masters of Cloud: A Dark Horse, nous invitons les lecteurs à nous aider à distiller à travers les entreprises discutées. En nous appuyant sur nos recherches et les commentaires des utilisateurs, nous visons à identifier les stocks qui peuvent fournir le meilleur rendement avec le risque le plus faible.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link