[ad_1]

Investors are excited about Big Tech again.

With renewed doubts about the strength of the post-pandemic boom, traders are returning to the tech behemoths whose dominance of high-growth industries leaves them poised to keep their sales and profits rising even as the economy slows.

This has fueled a string of outperformances since early June and marks a change from earlier this year, when so-called reflation trading was all the rage as investors invested in stocks of companies with closely tied fortunes. cyclical fluctuations in the economy. .

As a result, the market value of the five biggest tech companies – Apple Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc. and Facebook Inc. – has jumped by more than $ 1,000 billion since early June.

“100% growth cannot be sustained and, as it gets back to something more normal, it will push investors back into growth stocks,” said Jim Meyer, chief investment officer at Tower Bridge. Advisers.

The resumption of technological interest reflects the growing feeling that the rapid growth triggered by the country’s reopening will not be sustained in the long run. Such views helped push Treasury bond yields down this week, although that decline was partially reversed on Friday in a widespread rally in the stock market.

Tech industry goliaths may also have benefited from the cooling of so-called memes stocks, those that are being targeted en masse on social media by individual investors looking to pocket quick wins. With fewer places to go, some have turned to bigger tech companies instead, according to a report from Vanda Research. The company’s Ben Onatibia and Giacomo Pierantoni said they saw ‘relentless’ retail demand for the chipmaker Nvidia Corp. which spreads to Amazon and Apple, “bringing back memories of last year’s summer rally”.

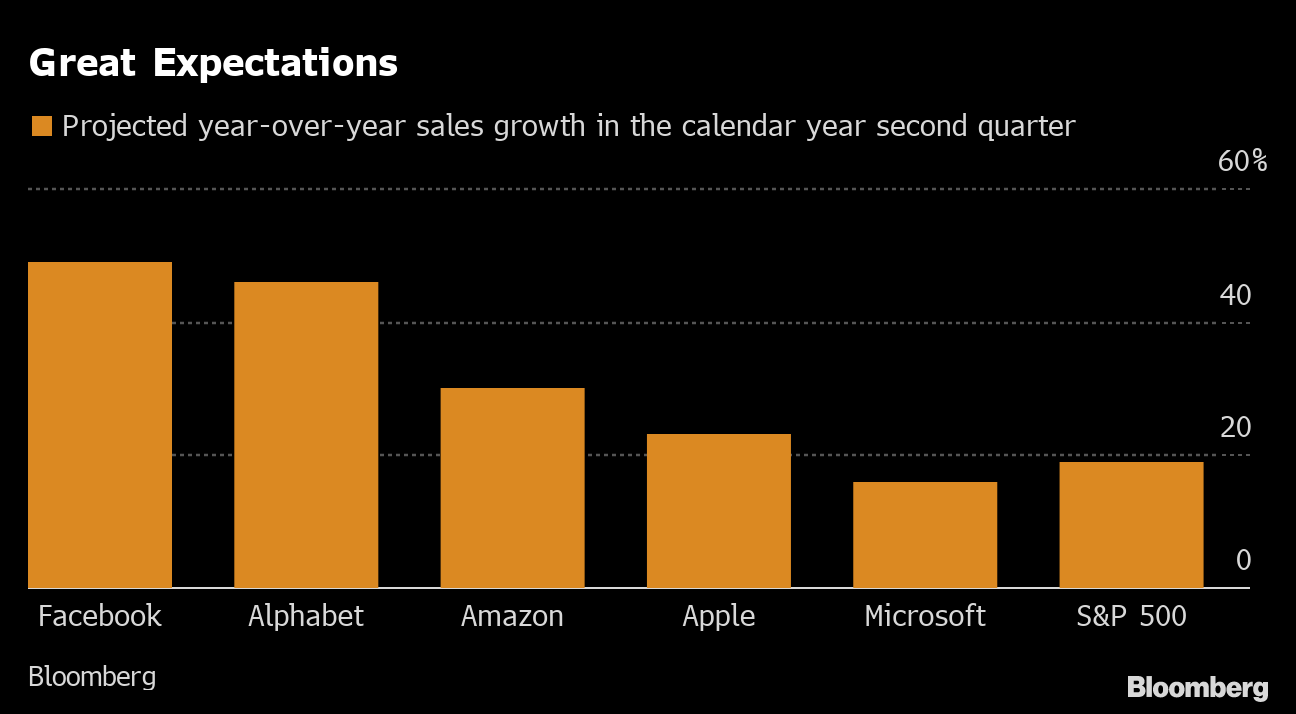

The forthcoming release of second quarter results could bolster investor optimism. The five companies are expected to post double-digit revenue growth, with a 30% increase for Amazon and 50% for Alphabet and Facebook, according to data compiled by Bloomberg. Revenues for the entire S&P 500 are expected to increase by 19%.

Great expectations

Bloomberg

“They should really be held for the long term,” said Richard Saperstein, chief investment officer at Treasury Partners, which manages $ 9 billion in assets. “You have accelerating revenue, whether it’s in the cloud, search, or e-commerce, and you only have huge capital expenditures made every year that lead to new business opportunities and growth. ‘innovation.

The fate of America’s top five tech stocks has a huge influence on the larger stock indexes: With a combined value of around $ 9 trillion, they make up nearly a quarter of the S&P 500 and are worth more than its 356 smallest companies combined, according to data compiled by Bloomberg.

So far, Apple and Amazon have led the rebound in megacap technology. Apple received a boost this week from JPMorgan Chase & Co., who said now is a good time to buy shares, as enthusiasm for the company’s next iPhone will grow in the second half of the year. Shares of the Cupertino, Calif.-Based company rose 3.7%, reaching its first record in five months.

Amazon.com posted a gain of 5.9% in its first week under Andy Jassy, fueled in part by the Pentagon’s announcement that it will cancel the $ 10 billion contract it he had assigned to Microsoft in 2019 and will divide the work between the two.

Read more: Reign of Faang Oligarchy shows no sign of usurpation of shares

China’s crackdown on tech companies like ride-sharing giant Didi in recent weeks has increased interest in U.S. companies as an alternative. And Facebook was helped when a judge recently dismissed a lawsuit brought by the Federal Trade Commission, raising the company’s valuation above $ 1,000 billion for the first time.

The recent surge has sparked a lot of skepticism. According to Bank of America Corp., customers sold in the recent rally. Technology and communications services – the industry that includes both Alphabet and Facebook – “have had record or near record sales in the past four weeks.” Bank of America strategist Jill Carey Hall said the outperformance appears to be “a headache.”

David Katz, Chief Investment Officer at Matrix Asset Advisers, doubted that the inordinate race for companies like Apple could be sustained.

“It’s a powerful company that has recreated itself a few times, but it’s not cheap,” he said in an interview. “We own it and are comfortable with it, but we think the six-week break in the value rotation will be just that: a break.”

– With the help of Tom Contiliano

[ad_2]

Source link