[ad_1]

1. Yuan pressure: The Chinese yuan has fallen more than 3% against the dollar in the last two weeks as tensions between the two largest economies have worsened.

The decline in the currency continued on Thursday.

Investors worry that new trade barriers may inflict significant damage to the Chinese economy, which is already showing signs of slowing down. Rising interest rates in the United States also makes dollar assets more attractive.

The Chinese authorities are aware that if the yuan falls too much, it could fuel new tensions with President Donald Trump, who could resume accusations that Beijing manipulates the currency.

Chinese stocks have also been under pressure in recent weeks. Shanghai's main stock index lost 1% Thursday, dipping deeper into the bear market.

2. EU Summit: Immigration and Brexit will feature prominently on the agenda when EU leaders meet on Thursday in Brussels.

The bloc should put pressure on British Prime Minister Theresa May to speed up progress in divorce negotiations. Businesses worry more and more about the possibility that Britain crushes the European Union without a trade deal.

3. Disney Wins: The United States Department of Justice has entered into a settlement with Disney ( DIS ) which will allow the company to buy 21st Century Fox [19659011] ( FOX ) assets.

As part of the settlement, Disney will have to sell 22 of Fox's regional sports networks. The settlement must still be approved by a federal judge, and Fox's shareholders must also vote in favor of the agreement.

All eyes are now on Comcast, who tried to spoil the case. The cable and media giant has not yet responded to Disney's latest offer for Fox.

Fox added 1.9% on Wednesday, while Disney closed down 0.3%. Comcast ( CMCSA ) fell by 1.5%.

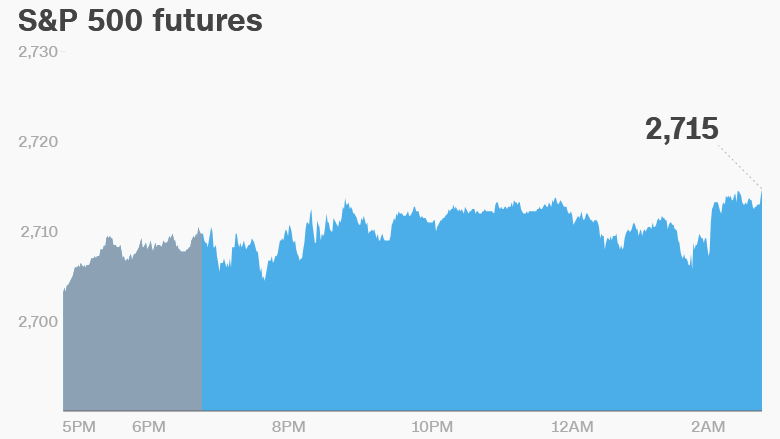

4. World Market Overview: US equity futures were higher.

European markets have been mixed, following the trend in Asia.

The Dow Jones fell 0.7% on Wednesday, while the S & P 500 lost 0.9%. The Nasdaq fell by 1.5%.

US crude futures contracted 0.2% to settle at $ 72.60 per barrel. Crude prices rose 6.4% this week due to worries about a tightening of supply.

Before Bell's News Letter: Important News of the Market. In your inbox Subscribe now!

5. Businesses and the economy: McCormick ( MKC ) and Walgreens Boots Alliance ) ( WBA ) will publish the results before opening it. Nike ( NKE ) will follow after closing.

BP ( BP ) announced the acquisition of Chargemaster, the largest electric vehicle charging company in the United Kingdom. The 130 million pound ($ 170 million) deal is the oil giant's latest venture in the electric vehicle sector.

H & M ( HNNMY ) reported disappointing results in the first half, revealing that his after-tax profits fell by 28% over the same period last year. The company said it was a difficult "first half".

The shares of the fashion company stagnated on Thursday, but fell by 20% this year.

German inflation data will be released at 8:00 am ET. The third estimate of US GDP for the first quarter will be released at 8:30 am ET.

Markets Now Newsletter: Get a snapshot of world markets in your inbox every afternoon. Register now!

6. Coming this week:

Thursday – Nike ( NKE ) Walgreens Boots of the Alliance; Foxconn ( TPE ) takes off in Wisconsin; Stress Test Results

Friday – U.S. University Feeling Report

CNNMoney (London) First Published June 28, 2018: 4:57 AM ET

[ad_2]

Source link