[ad_1]

We are at the beginning of the earnings season, but we have already had several data points indicating that prices are getting worse. Pricing is the main driver of memory business profits. Prices have a considerable leverage effect.

The prices have gotten worse, so I see no reason to look for excuses to own Micron (NASDAQ: MU). Not yet anyway. Profits influence share prices and price deterioration in memory is not a catalyst for equities.

Until here have we heard in the results season?

What did Intel (NASDAQ: INTC) say about pricing their profits?

"The reduction in memory prices has intensified." The data center inventory and capacity digestion described in January are more pronounced than expected, and the headwinds in China have multiplied; This has led to a more cautious IT spending environment and we are confident that demand will increase in the second half of the year, so we have re-evaluated our expectations for the 19 in the light of future challenges. "

"Prices have intensified" means that the rate of decline is getting worse. There is nothing better about worse.

What's crazy in my book is that they also believe that things will improve in the back half, but they admit that the situation is getting worse now.

Listen to what they said here:

"We observe that customers are becoming more and more cautious in their buying habits, with the biggest deceleration occurring in China."

"Acute" is not cute.

"Acute" is not so cute.

Customers reduce their orders so not so cute and tell everyone that you are not afraid that we will buy them later, so continue to offer us great prices. D & # 39; AGREEMENT. But that does not make sense.

I have been in this business for a little while. Worse means almost always never better. If customers withdraw orders now, do you think they say they will increase orders later?

I believe them if they gave me more orders now and said that they were going to give me more orders later. I do not believe them if they pass orders and say "nothing to fear".

So now, we have heard so many times that things seemed worse now, but they "heard" that it would be better later, as if by magic.

Everyone, whether business or investor, has hopes based on something that does not really make sense. Worse means better now.

It's a strange nuance in the markets that I have not seen. I think investors are trying to justify stock prices by saying things that simply do not make sense. This is only my opinion. Everyone is entitled to his opinion, but for me it does not make any sense.

Intel makes it clear that the situation is getting worse.

What did Western Digital (NASDAQ: WDC) say about their earnings?

WDC saw its prices fall 23% in the last quarter, compared to 18% in the previous quarter. Thus, the rate of decline, similar to what Intel says, is getting worse and not getting better.

They said they saw the demand improve, but let's put that in perspective.

WDC has put the finger on the last profit: despite the demand in volume, it is necessary to know where the prices and the margins are going. Listen to how they say it.

First, starting with sales, we expect our revenue to improve at a significant pace as we expect demand to increase, capacity to increase, and a seasonal increase in sales. the demand, from the point of view of both the hard disk and the hard disk. …

The big question you want to ask is, what will our margin level look like? "

While many companies are talking about a low demand, the main component of profits is pricing, which has fallen at an accelerated pace.

So what did WDC say about prices and margins?

We assume that we will continue to see pressures on our gross margins flash as we continue the rest of the calendar year. And the reason we do it mainly is that we want to plan for the worst and if you want to call it hope for the best. "

Bulls of memory, please, turn it positively for me, "plan the worst hope for the best !?"

You can sell a lot of things, but if you do not make a lot of money for everything, you do not have a lot of money in the end. It seems too simple. Companies are forced to produce, even if it means losses, because not producing will worsen profits.

They are therefore blocked and have no visibility on the gains being improved.

Similar to Intel, it does not sound so good. Do not hesitate to disagree with me. I was waiting for it.

But Elazar is getting worse now, that means it's better.

"Hope for the best" as WDC says.

I focus on prices and margins and what that means for profits.

What is Intel waiting for its price?

Here's what they said,

"We also expect a NAND price environment to become increasingly difficult."

They also plan the worst and hope for the best.

Pricing Matters for Micron

The two giants in memory, Intel and WDC, say in real time that prices should be bad and maybe worse. That's the key factor in Micron's revenue.

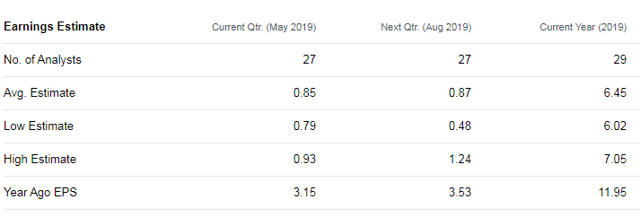

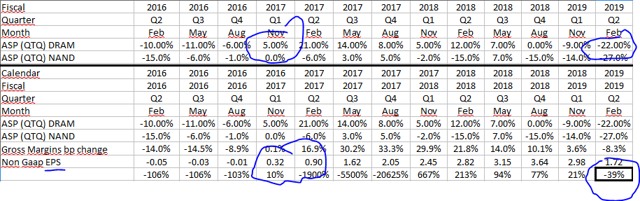

Here are the Micron ASPs for gross margins and BPA.

Source: Elazar Advisors models, data from Micron's revenues

If you notice the above when prices ("ASP") started to rise, gross margins stopped dropping and profits began to rise.

We are now witnessing an opposite trend: ASPs (average selling prices) are deteriorating and gross margins are starting to fall, which is reflected in our results.

Our full model (payment wall) could result in quarterly losses for Micron later this year, given the price trend.

Meanwhile, the street is waiting for profits.

We have three main criteria that we are looking for in our strong purchases.

1. 45% up over 12 months: we do not have one because we need profits and our earnings per share are negative.

2. Our neighborhoods online or over the street: we are well below the street.

3. Wow: We must say wow about the story. Customers are slowing down orders and prices are getting worse. It is very difficult to honestly say "wow" about it. Some might say that worsening now means better, wow, but I just can not be told that.

Conclusion

Until now, the season of results presents a message similar to that of the last seasons of results. In summary, "expect the worst, hope for the best", as just said WDC.

I would like to adjust that. I think people "see worse and expect better".

For me, that does not make sense.

Nail Tech Earnings

Wrestling moves in the greatest technological values. Every quarter we talk to dozens of the biggest tech companies to determine who has the most potential.

See what our subscribers say:

"The best stock pick site I have found so far."

"It's a home run! "

"This service has been profitable over and over again thanks to expert and enlightened advice. "

Ready to Nail Tech Gains? Start your free try aujourd & # 39; hui.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: All investments carry many risks and can lose capital in the short and long term. The information provided is for informational purposes only and may be inaccurate. By reading this, you accept, understand and agree that you assume full responsibility for all of your investment decisions, that you do your own work and that you hold Elazar Advisors, LLC and its related parties without liability. Elazar and its employees do not take individual equity positions to avoid ongoing problems and other potential customer issues.

[ad_2]

Source link