[ad_1]

Microsoft (NASDAQ: MSFT) is one of the most reputable companies in the world. In a perpetual race against Apple (NASDAQ: AAPL) and Amazon (NASDAQ: AMZN) for "Most Valuable Company," Microsoft has made itself known over the past 44 years through its product line and its openness to growth. . and innovation.

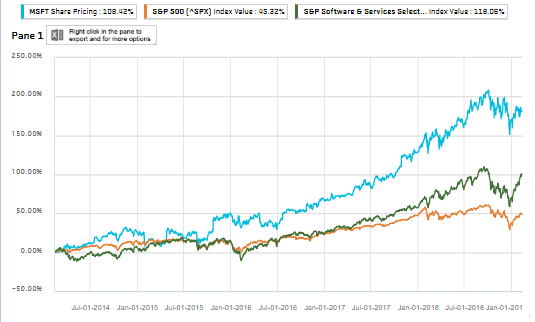

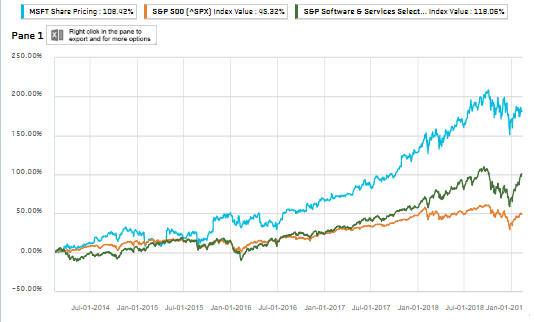

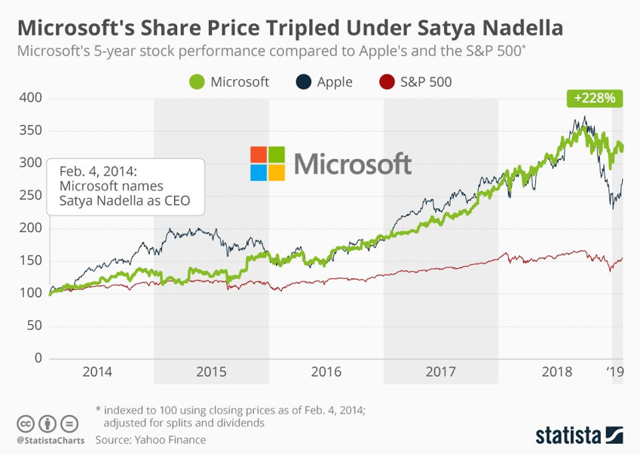

As a company, it has aligned itself with the broad software and services index and has outperformed the S & P 500 by 65% over five years. The industry itself offers promising growth opportunities, with growth estimated at 4% in 2019.

CompTia notes that "the product mix will be a particularly important factor, as the high growth rates of the emerging categories should more than offset the low-growth mature categories" if we refer to the technology sector. This is part of Microsoft's strategy, which offers slow-growing product lines within its More Personal Computing segment, while being heavily exposed to emerging categories such as the Cloud.

As technology continues to integrate into our daily lives and as advanced technologies become more competitive, it is important to pay attention to the key factors that will drive growth in the sector. Artificial intelligence and the cloud are two major market opportunities, as well as strategic alliances, both inside and outside the sector.

MSFT is highly exposed to each of these three growth factors. Cloud demand, which is constantly evolving, will be a huge game as Microsoft continues to fight to gain market share. Artificial intelligence, as well as all the applications it offers in the health sector and in other areas, will be another important growth driver. Finally, the company has established partnerships and collaborations between companies as they continue to manage their economies of scale.

MSFT: Gain a place in the industry through partnerships

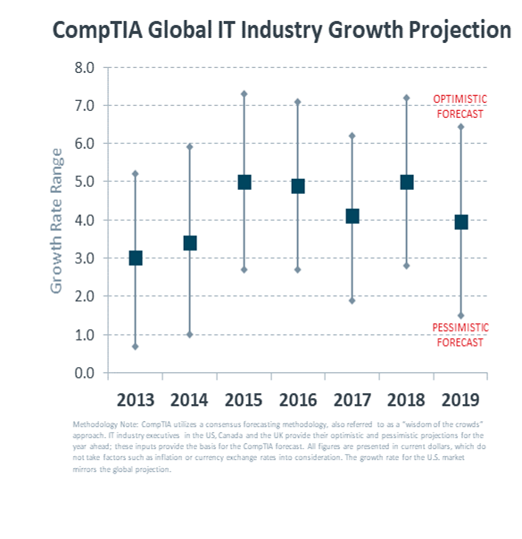

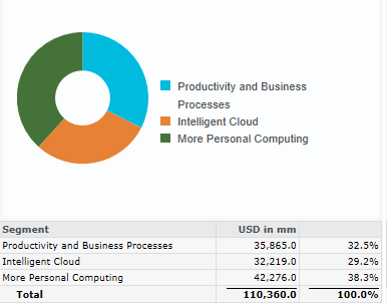

MSFT has managed to create a niche in this $ 5,000 software and services sector. They operate in three key business areas: productivity and business processes, smart cloud and more personal computing. Their business ecosystem is rather complex and continues to grow through acquisitions and partnerships.

In the past month alone, MSFT has entered into several agreements to improve its position in the sector. On February 4, they bought the DataSense platform. On January 15, they entered into a seven-year agreement with Walgreens to provide digital health opportunities. On Jan. 7, it was announced that they had begun working with Kroger to work on data-driven connected store experiences.

They teamed up with MasterCard in early December to work on the management of digital identity. They opened a joint engineering office with Walmart in early November. Finally, they bought GitHub Inc. in a $ 7.5 billion acquisition in October.

The company is preparing for growth and is seizing every opportunity as it goes. Satya Nadella is a key factor in the performance of the company in recent years. Since taking office in 2014, the stock price has risen by 228%, a bigger gain than Apple and the S & P 500. Overall, the company's governance is strong, itself led by a diversified board of directors with only two outside directors. They achieved the highest possible score on three of the QualityScore pillars, in the areas of Audit, Advisory and Shareholder Rights.

Source: Los Financieros

Consider the possibilities: growth of artificial technology

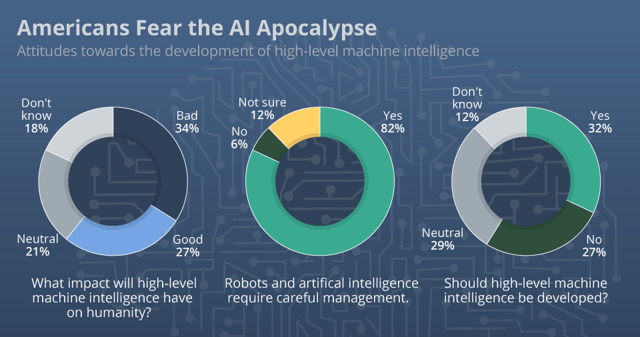

People are afraid of a takeover of artificial intelligence. More than a third of those surveyed in a survey published by the Amnesty International Center for Governance believe that high-end artificial intelligence will have a "bad" effect on the world. humanity. More than 80% of respondents believe that robots and artificial intelligence require careful management. And nearly a third think that high-level machine intelligence should not be developed at all, another third being totally neutral in their opinion.

Source: Statista

Despite the uncertainty, MSFT is the company in which people have the most confidence for the development of artificial intelligence. The fact that consumers have the most confidence in MSFT to do this job is extremely promising, especially since artificial intelligence is a key growth driver of the industry.

Microsoft is also implementing artificial technology in the healthcare sector, as evidenced by its recent partnership with Walgreens Boot Alliance. They have several key alliances in the industry, highlighting the previous point on partnerships, ranging from Veradigm, a clinical research company, to ThoughtWire, an EarlyWarning app that can detect the risk of heart attack.

Artificial intelligence carries a significant risk, and companies developing the software have ensured that consumers are aware of the risks it entails. However, Microsoft is working to "democratize the AI" with aggressive investments at all levels.

Artificial intelligence as a market is expected to experience a CAGR of 62.9% between 2016 and 2022, rising from $ 8 billion in revenue to nearly $ 50 billion in 2020. Microsoft will also implement its Azure API to share health data on the cloud. The cloud has become a priority for many large companies, with Amazon in the lead and Google (NASDAQ: GOOGL) spending $ 25.5 billion in investment spending in 2018 in an attempt to gain market share.

The cloud: a clear sky

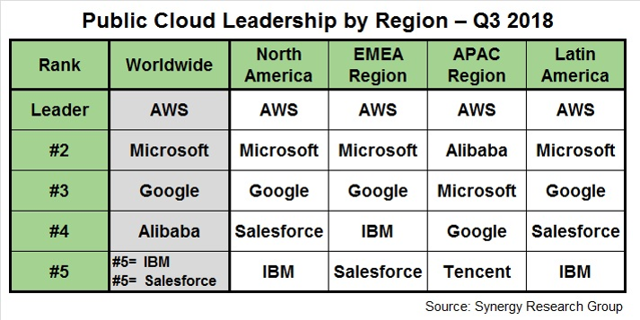

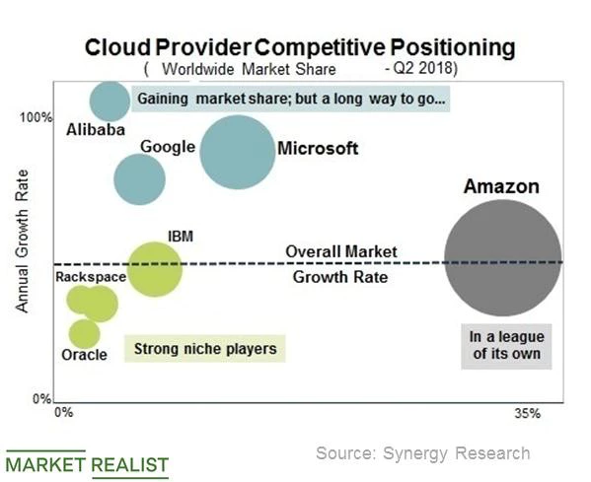

Amazon is a dominant player in this space with its product, Amazon Web Services. They dominate all regions and despite the 76% growth in sales of MSFT Azure in the last quarter, this domination is not going to disappear any time soon.

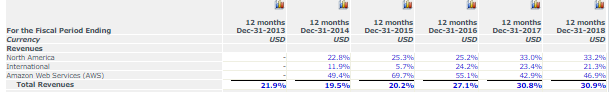

Microsoft is right behind, as evidenced by its second place in most geographic regions. MSFT is leading Enterprise SaaS and also has a leg up on Amazon in the private cloud. But this segment of the industry is very competitive.

Source: Realistic Market

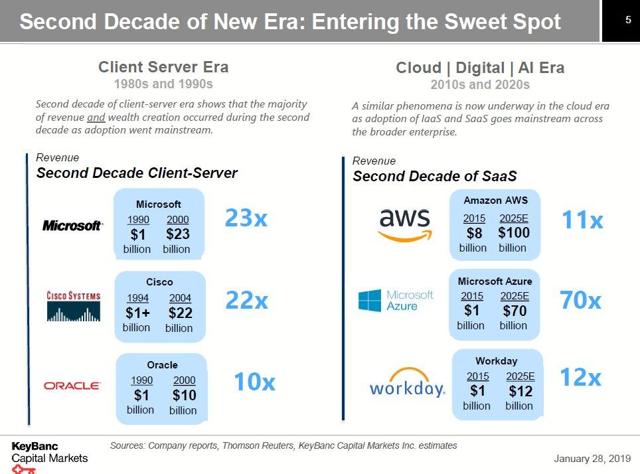

The cloud itself is set for tremendous growth. Over the past three years, IaaS + SaaS revenue has grown by $ 80 billion. These are variants of cloud platforms, IaaS being more convenient for users, and SaaS. completely managed by an outside company.

Over the next five years, IaaS + SaaS revenues are expected to grow by $ 300 billion, representing growth of $ 60 billion a year compared to annual average growth of $ 26.7 billion over five years. years. Market Penetration in $ 1.8T Technology market should rise to 24% in the coming years, compared to 7% in 2018.

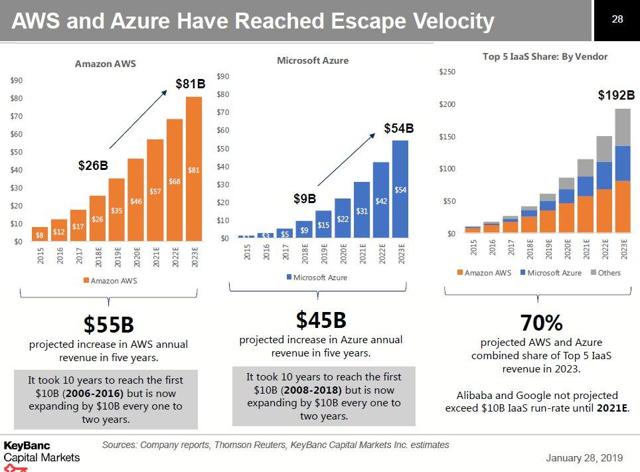

MSFT to record 70 times revenue growth from Azure platform compared to AMZN 11x growth from AWS Platform. AWS has an advantage over Azure because they were first on the market in 2006. It took 10 years, from 2006 to 2016, to generate the first $ 10 billion in product revenue, but only two years to add the 10 billion. . Now, they should earn $ 10 billion in 2019 only.

Source: Biased value

Microsoft is working on the same trajectory, but Amazon has a two-year lead. After 2020, MSFT should see the fast gains that their main competitor has known. They will still lag behind, but their momentum will be on their side, with forecasts to add $ 10 billion in revenue in 2021E.

Source: Biased value

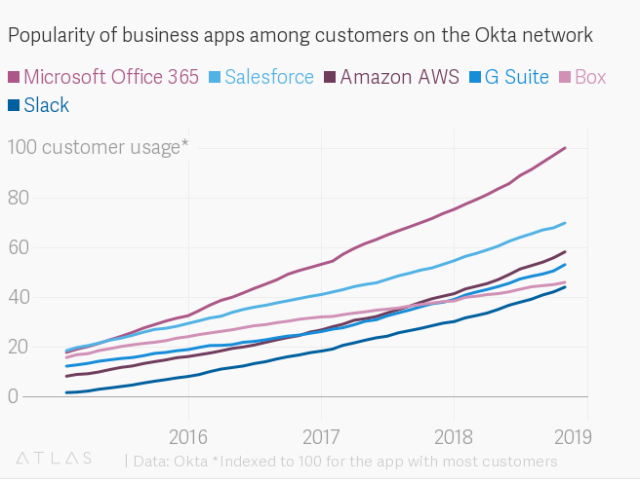

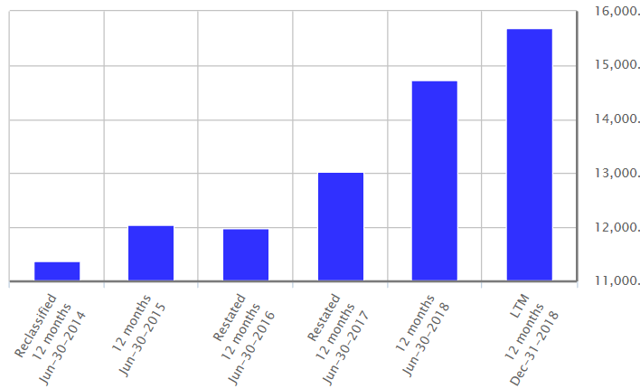

Both companies are not very transparent with the exact amount that they earn with their products. AWS recorded 46.94% growth in its year – over – year revenue from Fiscal 2017 to Fiscal 2008. a contraction compared to previous growth figures. By doing the same analysis on MSFT, we get 17.6% growth year-on-year, which is well below Amazon's growth parameter. AWS is also leading quarter-over-quarter growth, recording 45.3% growth in Q3 revenue in Q18, compared to 20.3% growth in similar period.

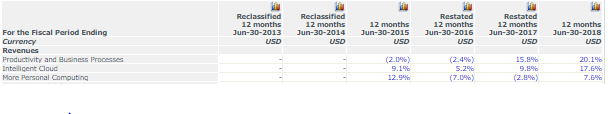

Microsoft Income:

Amazon Revenue:

Source: Capital IQ

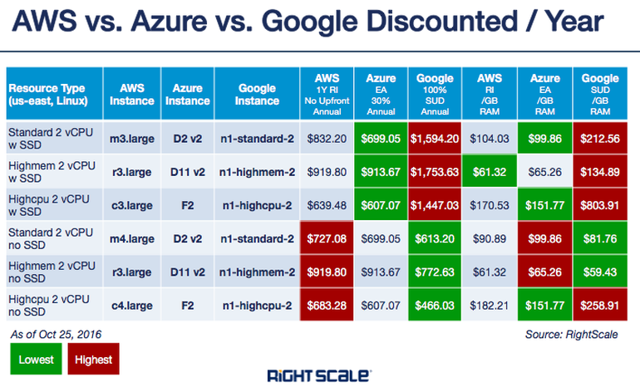

Cost leadership: Azure at the head of the pack

Microsoft Azure has some advantages over its competitors, especially in terms of price. They offer on-demand pricing options. AWS is not usually the least expensive option, but they offer more services than their counterparts. Google's cloud product line tends to be the most expensive.

Microsoft also has a larger reach than its cloud competitors in 54 regions of the world. They also have over 120 new subscribers to their product each month. It offers the industry's largest compliance offering, which is important for the longevity of the business world.

Strong growth in all areas

MSFT is experiencing growth in most of their key areas and in most key growth opportunities for the industry. Azure will be a huge opportunity for them, as well as gaming and gear offerings. During the last quarter, they ran out of revenue for the Personal Computing, the company having invoked a problem of supply chain to explain this situation. However, their smart cloud segment exceeded expectations by 10.7 percent.

Source: CNBC

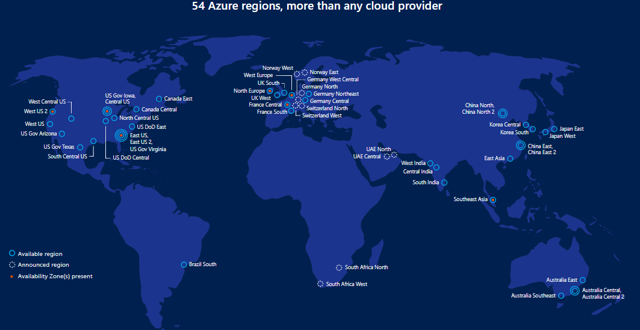

Office 365 Commercial was also a strong growth sector for the company, with subscribers increasing 2.5% over the first quarter. They had problems with Office consumer products and will have to think about how to manage the competition in this space. Okta, which is an integration network for different cloud platforms, has experienced an extreme increase in the popularity of Microsoft Office 365.

Source: Okta

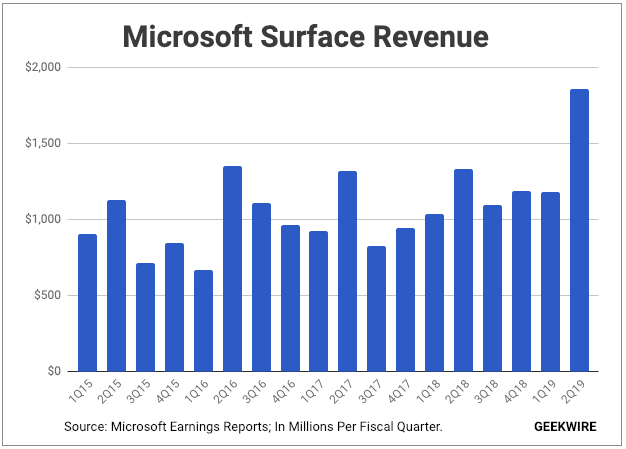

The Surface device also came off its "greatest quarter ever," with revenue of $ 1.86 billion for Q219, an increase of 39% over the previous quarter. ;last year. The CFO expects revenue growth of 20% in the next quarter. There have been several new devices in the product line, with rumors of a product called "Andromeda", a "dual-screen foldable device" that could be Microsoft's next attempt to penetrate the smartphone market.

Source: Geek Wire

Hiking in the AMZN: peer-to-peer comparison

One of the advantages of Microsoft over its competitors is the differentiation of their products and their geographic scope. The company derives roughly the same revenue from its Productivity and Business Process segments, Smart Cloud and More Personal Computing. The latter segment had the weakest year-over-year growth at 7.6%, but the other two segments are aligned at 20.1% and 17.6%, respectively.

Source: Capital IQ

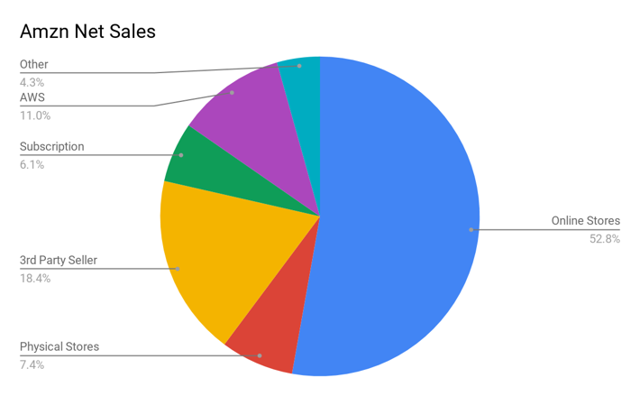

In comparison, Amazon derives approximately 50% of its sales from its online stores, but they have grown monumental in each of their respective categories. As noted in this article, AWS growth figures will be a permanent benchmark that the rest of the industry will try to meet.

Amazon is much more dependent on sales in the United States, 68% of its revenue from domestic sources. MSFT derives approximately 50.7% of their income from the United States and the other half from other countries. Amazon derives 20.6% of its revenues from Germany, the United Kingdom and Japan, the rest of the world accounting for 10.5% of a source of revenue.

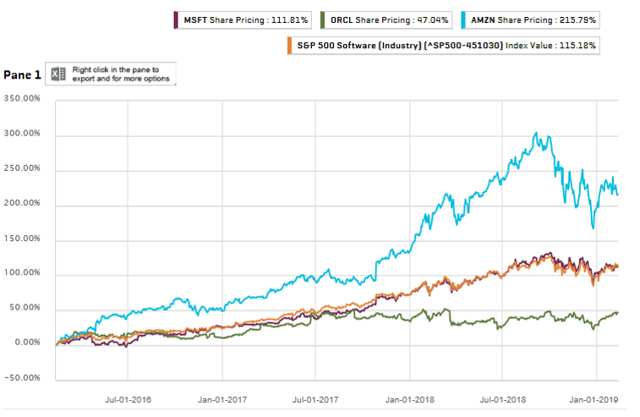

Amazon has outperformed Microsoft and the industry over the past three years. Microsoft is quite aligned with the S & P 500 software index, posting a return of 111.8%, up from 115.18%. This means that Microsoft has the opportunity to reduce the gap and potentially catch up on Amazon's 215.79% return.

Source: Capital IQ

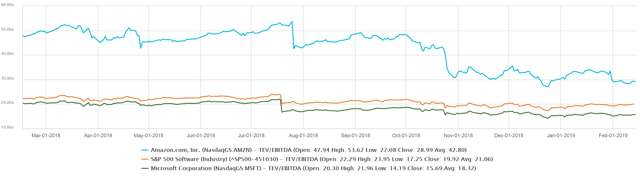

In terms of evaluation, it is common knowledge that Amazon is trading at a high cost. The technology sector as a whole has been the subject of massive evaluation in recent years. Microsoft has a TEV / EBITDA of 15.44 compared to 28.43 from Amazon. The industry, represented by the orange line, has a value of 19.92; using this measure, MSFT is trading at a cheaper valuation than that of the industry as a whole.

Immerse yourself in the data: Microsoft's financial data

Microsoft is strong in terms of operational performance and liquidity, but they are lagging behind their peers in terms of solvency. Their interest coverage ratios are lower than those of their competitors, including EBITDA / interest expense and cash flow from operations relative to total debt. The total debt on capital is almost double that of their peers, as is the total debt on revenues.

Source: Capital IQ

The company has invested heavily in R & D, which is good for its continued growth. It is also important that they do it against the competitive power of Amazon in the cloud.

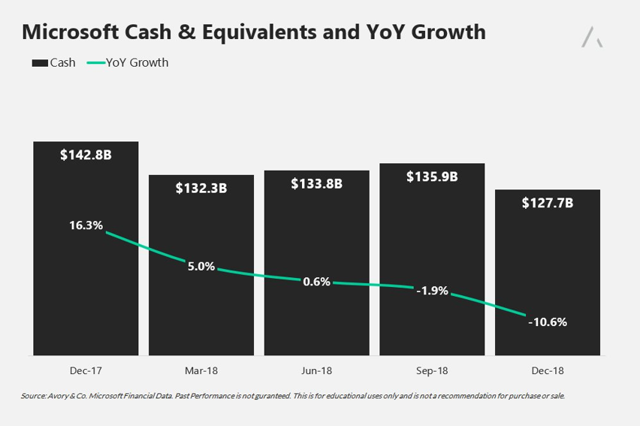

Their cash flow has not been as high as it used to be, with year-over-year growth down nearly 9% in the last quarter. Their free cash flow was also reduced, but only 1.8% for the same year on 18 December. This is a much stronger indicator than the negative growth of 17.2% recorded in early 2018.

Conclusion: MSFT has room to grow

Microsoft has a strong brand and a diversified product portfolio. They are open to collaboration and partnerships. They are vulnerable to certain weaknesses, such as not taking advantage of potential economies of scale and potential overexposure in some aspects of the industry in which they perform poorly, such as consumer products.

If we enter a global slowdown, the demand for Microsoft products will most likely decline and the regulatory framework may be detrimental to business. But overall, the cloud space gives them continued growth, they are quite popular and they have a number of growth opportunities out of the cloud space through gaming and expanding their product line. Area.

They will need to focus on improving their cash flow, but they have seen strong revenue growth that is expected to remain stable in the future, gross profit margins and net profit margins high. All of their profitability margins improved in 2018 and it seems that the company is solving some of the problems it has encountered in the past. MSFT is a constant in a constantly evolving industry and would provide excellent added value for portfolios that need a less risky way to become familiar with the technology sector.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link