[ad_1]

Fundamental US Dollar Forecast: Neutral

- The main event of the week will be Fed Chairman Jerome Powell title to Capitol Hill for two days of testimony to deliver the semi-annual Monetary Policy Report.

- But traders shouldn’t sleep on the US economic calendar. January’s upcoming durable goods orders and PCE / Core PCE price indices could further fuel inflation fears, pushing further gains by US yields.

- The IG client sentiment indexsuggests the US dollar has a mixed bias as we approach the last week of February.

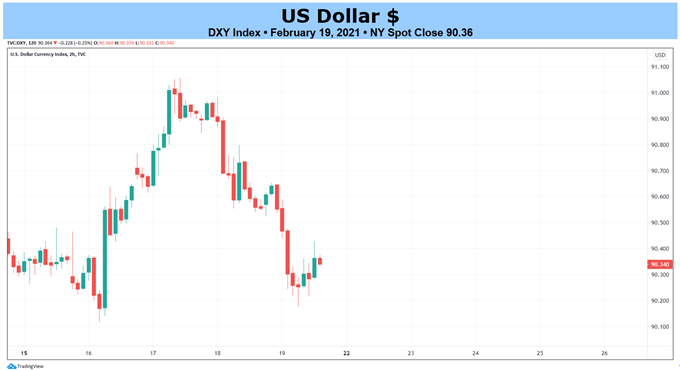

US dollar falls as inflation expectations and yields rise

The US dollar (via the DXY index) fell over the weekend, catching up with the emerging rally through the pandemic’s downtrend (March and November 2020 highs). US economic data outperformed, leading to a rise in both nominal yields (treasury bills) and inflation expectations (breakevens), but the latter rising faster than the former, real US yields rose. come down. Notably, EUR / USD again ended the week above 1.2100, while GBP / USD closed just at 1.4000 for the first time since mid-April 2018.

Recommended by Christopher Vecchio, CFA

Trading Forex News: The Strategy

Risky US Economic Calendar

The last week of February brings a veritable cornucopia of event risk for the US dollar. The main event of the week will be Fed Chairman Jerome Powell, who will travel to Capitol Hill for two days of testimony to present the Semi-Annual Monetary Policy Report. (which we will discuss in more detail below).

But the economic calendar itself is oversaturated with event risk, which likely gives traders plenty of opportunities to catch bouts of volatility from USD pairs over the next few days:

- Sure On Monday, February 22, Federal Reserve Governor Michelle Bowman will deliver a speech.

- On Tuesday, February 23, the December US House Price Index will be released, as will the February US Consumer Confidence report. In addition, the first day of the Humphrey-Hawkins testimony will begin.

- On Wednesday, February 24, data on new home sales in the United States will be released. Brainard and Clarida from the Fed will both give speeches. In addition, the second day of the Humphrey-Hawkins testimony will come to an end.

- On Thursday, February 25, durable goods orders in the United States will be released, which might surprise on the upside in the same way as the January retail sales report in the United States. The second release of the 4Q’20 US GDP report is due, as is the weekly US Unemployment Claims Report. Later today, January pending home sales in the United States will be released. The Fed’s Quarles and Williams will both give speeches.

- On Friday, February 26, January US PCE and Core PCE data will be released, as will January data on personal income and spending for the United States. The good US trade balance in January is expected, as is Michigan’s final US consumer confidence report in February. Finally, the US fiscal plan for fiscal 2022 will be released to close the week.

Atlanta Fed GDP growth estimateNow 1Q’21 (February 18, 2021) (Chart 1)

Based on the data received so far, approximately 1Q’21, the Atlanta Fed GDPNow forecast sees growth at +9.5% annualized. The estimate has risen sharply in recent weeks, from + 4.5% in early February, supported by a much better-than-expected January US retail sales report (thanks to those $ 600 stimulus checks, as well as than greater consumer confidence in the face of accelerating vaccination rates). The Atlanta Fed’s next GDPNow forecast for 1Q21 will be released on Thursday, February 25.

The Fed still on point

Federal Reserve policymakers have been nonchalant about the accelerating US economy, with FOMC member and St. Louis Fed Chairman James Bullard saying we are not necessarily in a ‘bubble’ , but rather to “invest normally” in recent days. For a week now, Fed Chairman Jerome Powell himself ended discussions of the tantrum, but all views on the U.S. economy will be finalized this week when he travels to Washington, DC for the semi-annual Humphrey-Hawkins testimony.

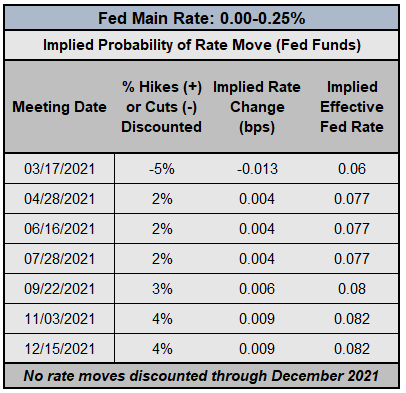

Federal Reserve interest rate expectations (February 19, 2021) (Table 1)

By delivering the biannual monetary policy report to Congress, the Fed chairman will most likely use his time on Capitol Hill to allay fears that rising US Treasury yields herald excruciating levels of inflation. Fed Chairman Powell may well admit that inflation could rise, but the Fed seems ready to “ look through ” any near-term hikes.

As long as Fed Chairman Powell is at the helm, the FOMC will stay the course, with the intention of keeping interest rates low until 2023. Federal funds futures project a 96% probability no change in Fed rates in 2021. For context, a month ago, when the 10-year yield on the US Treasury was around 20bp lower, the federal funds estimated a 93% probability of do not change the rates. Even though the US Treasury yield curve steepened over the past month, market participants do not expect any acceleration in the Fed’s efforts to normalize its policy.

For full American economy forecast data, display DailyFX Economic Calendar.

Recommended by Christopher Vecchio, CFA

Get your free USD forecasts

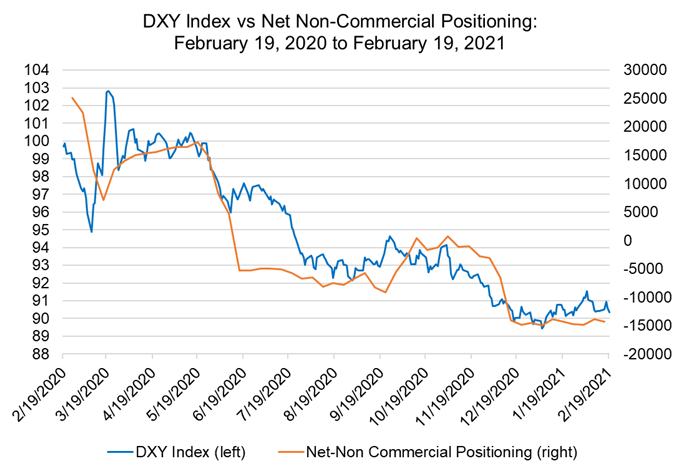

The US dollar’s net-shorts persist (graph 2)

Finally, looking at the positioning, according to the CFTC’s TOC for the week ended February 16 speculators slightly increased their net short US dollar positions at 14,287 contracts, against 13,875 contracts held the previous week. The net-short positioning of the US dollar is close to its highest level since March 2011, when speculators held 15,494 net-short contracts. Overall, positioning has been relatively stable since the third week of December, when speculators held 14,056 net short contracts.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

[ad_2]

Source link