[ad_1]

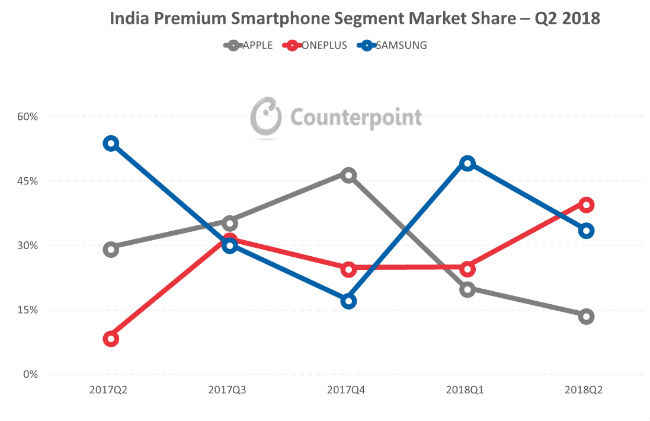

For the first time, OnePlus beat Samsung and Apple to become the leading Indian smartphone in the second quarter of 2018, market research firm Counterpoint Research said. The Chinese smartphone brand has captured 40% of the market thanks to record deliveries of its OnePlus 6 compared to its previous flagship products. OnePlus was also the fastest growing brand in the premium segment with 446% growth, while shipments for Apple and Samsung declined from one year to the next (YoY).

Samsung captured 34% of the high-end segment and its shipments decreased by 25% year-over-year due to a downward spiral of Galaxy S9 shipments compared to the Galaxy S8. Apple's share in the premium segment reached its lowest level ever at 14 percent due to lower shipments for its iPhone 8 and iPhone X devices.

Counterpoint predicts that since OnePlus launched its offline and exclusive stores in the country's major cities, the brand will be able to reach a larger base of users. For Samsung, S9-series promotions helped drive both offline and online sales by the end of the quarter. For Apple, the research firm said the increase in import duties and the lack of local manufacturing have had an impact on the pricing strategy of the company led by Tim Cook in India.

In terms of top-selling models, OnePlus 6 was the top-selling model in the premium segment in India, followed by the Samsung Galaxy S9 Plus and the OnePlus 5T. Sales of the S9 series remain skewed in favor of S9 plus because users were not afraid to spend more on the big screen.

The Indian premium smartphone segment as a whole

According to Counterpoint Research, the premium smartphone segment grew by 19% per year and 10% sequentially second trimester. consumers upgraded for flagship launches. The rise in consumer demand in the high-end segment has been spurred by the increase in offers around new launches compared to the previous year. These offers include cash back, electromagnetic interference, data aggregation and exchanges. In addition, although the Indian premium smartphone market has grown, demand has shifted towards devices of less than Rs 40,000 due to aggressive offerings such as OnePlus and the online segment.

The three major brands Samsung, OnePlus and Apple contributed 88% of the overall premium market, compared to 95% a quarter ago. The reason is the entry of new players in the segment led by Huawei (P20), Vivo (X21), Nokia HMD (Nokia 8 Sirocco) and LG (V30 Plus). "This is a new trend where" ultra-affordable premium "is courting young consumers and young consumers, far from the more expensive offers of Samsung and Apple. OPPO, Huawei, vivo and Google looking to be aggressive in Rs 40,000 Rs 60,000 segment in the coming quarters, the pressure on the likes of Apple and Samsung will be even higher, "said Tarun Pathak, associate director of Counterpoint Research.

Global Smartphone Market

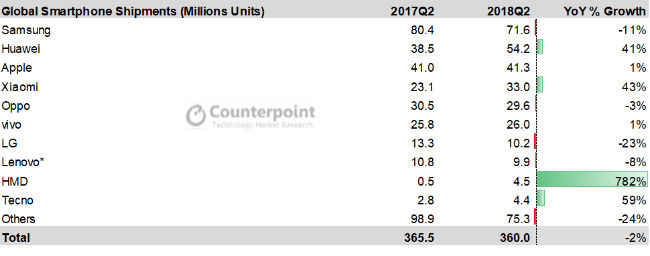

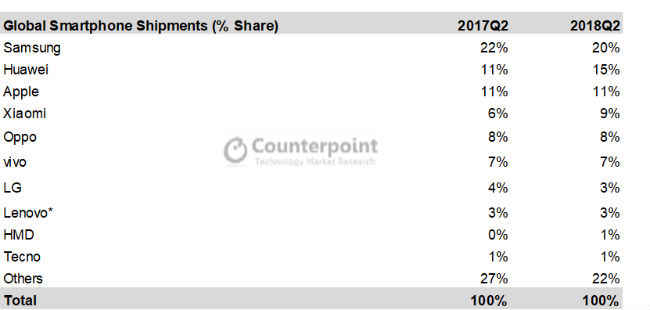

At first glance, global smartphone shipments declined by 2% per year in the second quarter of 2018. The top 10 players now capture 79% of the market, leaving more of 600 brands to compete for the remaining 21 percent of the market. According to Counterpoint's Market Monitor service, the weak demand for smartphones is due to a slowdown in developed markets such as China, the United States and Western Europe, where smartphone replacement cycles s & # 39; longer. Huawei became the first brand in a declining market in China and took second place in the world ranking of smartphone shipments for the first time in a single quarter.

"Huawei had a good second quarter in 2018 by shipping more smartphones than Apple to grab second place in the global smartphone rankings after seven years of Apple-Samsung domination Huawei achieved this by launching smartphones in the premium segment and capturing the mid-market segment with its growing sub-brand Honor.The Huawei with its Honor brand offers a broad and refreshed portfolio at a price affordable, boosting growth in the overseas market Honor, already strong in the e-commerce segment, is now adopting a multi-channel strategy through branded brands in the Southeast Asian market. predict that the number of stores will increase in the future, "Pathak said.

Nokia HMD, OnePlus, Tecno, Xiaomi, Infinix and Huawei were the fastest growing brands for the quarter. Lenovo, Gionee, Micromax and Sony recorded the largest declines in shipment volume during the quarter. Tecno entered the top 10 smartphone market for the first time. Together, Transsion's three smartphone brands (Tecno, iTel and Infinix) accounted for more than 9.4 million smartphones delivered during the quarter.

"The major Chinese brands like OPPO, vivo, Huawei are now focusing on increasing their ASPs by gradually improving their portfolio at higher prices by bringing in features such as Artificial Intelligence, screens without bezel, two cameras and innovative industrial design colors, materials and finishes in the affordable premium segment Mid-range brands now launch several variants of the same smartphone with different storage capacities, which encourages customers to spend more money For a more sophisticated device, it also boosts sales by increasing the portfolio's reach and increasing margins by selling higher-priced devices, "added research analyst Shobhit Srivastava.

Samsung dominated the global smartphone market with a 20% market share. Huawei has surpassed Apple to become the second largest brand worldwide with an annual growth of 41% of shipments. The company managed to be the fastest growing smartphone brand (21 percent) in China and grew 71 percent overseas. The Chinese brand has grown 75% in Europe, 67% in the Middle East and Africa and India, it has recorded a phenomenal growth of 188%. Third place went to Apple, which shipped 41.3 million iPhones, up only one percent from the same quarter last year. The iPhone X remains the first seller for Apple during the quarter. Xiaomi shipped 33 million smartphones, capturing only nine percent of the global market share.

<! – commented on @ July 6, 2016

-> <! –

->

[ad_2]

Source link