[ad_1]

Pretium Resources (PVG) announces its production figures for the second quarter. The operating results are very good and ultimately comply with the feasibility study. In the second quarter, Pretium produced 111,340 gold and the gold content rose to 14.9 g / t. Gold recoveries remain very high, close to 98%. This is a very positive news and the market reaction has been very positive as well. The Pretium stock price jumped 14% and closed the day at $ 9.3, the highest level since January, when the stock price collapsed in response surprisingly negative fourth quarter production results. If the price of gold exceeds the level of $ 1,250 / toz, Pretium shares could reach double-digit prices in the coming days.

PVG Data by YCharts

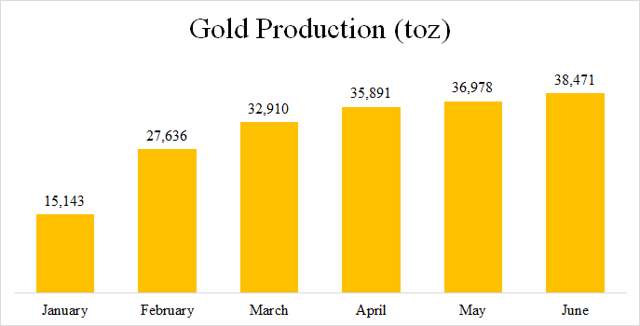

In April, I estimated that Pretium should produce at least 98,730 gold gold in Q2, assuming that it is able to support volumes of March production. But as the press release shows, production has steadily increased throughout Q2. Although there was gold at 32,910 toz in March in Brucejack, 35,891 gold gold was produced in April, 36,978 in May and 38,471 in June (graph below) . In fact, the 111,340 toz produced in Q2 correspond to an annualized volume of more than 445,000 toz of gold. And the June output of 38,471 toz equates to an annualized volume of more than 460,000 toz of gold.

Source: Own Treatment Using Pretium Resources Data

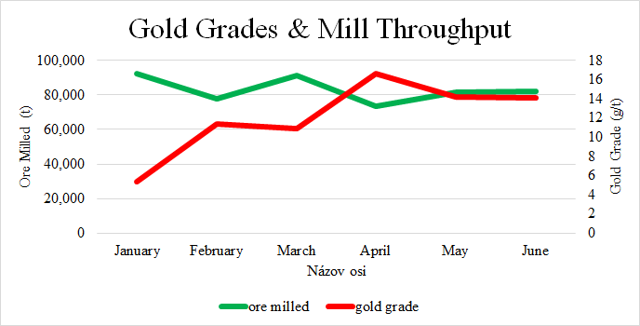

Gold shades have seen a significant improvement in recent months, mainly measures taken by management earlier this year. The measures include a new grade control program, new drilling, and an increased inventory of shipyards available to supply the plant. As a result, gold grades increased from 5.4 g / t in January to 16.6 g / t in April (graph below). The average gold content reached the level of 14.9 g / t in the second quarter. It is approximately consistent with the proven content of 14.5 g / t gold reserves

Source: Own Treatment Using Pretium Resources Data

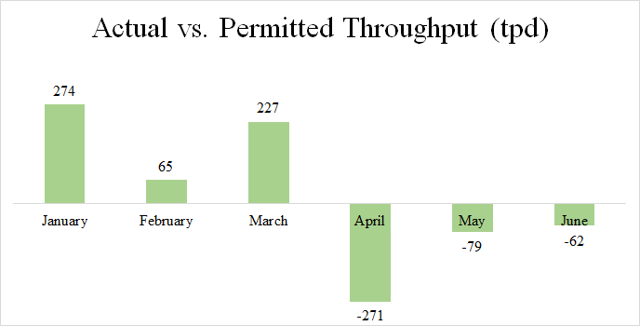

It is also important that because of the grades in higher gold, Pretium was able to achieve very good production volumes even at lower flow rates. The authorized throughput of the plant is 990,000 tonnes per year (tpa), which equates to 2,712 tonnes per day (tpd). Although the plant can process more ore, the company must maintain its annual volume of ore processed below the 990,000 t level. The flow rate was well above the level of 2712 tpd in Q1 (graph below). However, much of this surplus was eliminated in the second quarter, especially in April, when the plant was operating at only 2,441 tonnes per day.

Source: own processing using data from Pretium Resources

Pretium also announced H2 2018 production guidance. The company plans to produce 200,000-220,000 toz of gold. The AISC Q2 is projected in the $ 710-770 range. If Q2 production volumes are retained, the upper limit of the interval will be interrupted. A little less positive is the cost guidance. Although $ 710-770 is a good figure, it is far below the levels below $ 500 expected by the feasibility study. It can be expected that some cost optimization can bring down costs gradually, but they will probably not be less than $ 650 / tz, without increasing production volumes. However, this goal can be achieved after the expansion of the factory. Last December, Pretium submitted a request to increase throughput from 2,700 tpd to 3,800 tpd, or more than 40%. The authorization is expected to be finalized in the second half of 2018 and, if successful, we can expect the flow to be increased as of early 2019. As stated by Joseph Ovsenek, CEO of Pretium:

Si everything goes well, maybe we will have our 3800 tons a day allow a little earlier, we can accelerate faster, but we do not rely on that. The plan calls for 3,800 tonnes per day by January 1st.

The flow of 3800 tpd would result in an annual gold production of about 650 000 toz, a gold grade of 14.9 g / t and gold recoveries of 97.7 %. It is reasonable to expect a much lower AISC at such a huge production volume.

What is most important now, improving the performance of the Brucejack mine greatly improves the chances of Pretium to repay or refinance the debt. stream of gold. The senior secured debt of $ 350 million expires on December 31, 2018, but may be extended for one year. The price of gold can be redeemed from Osisko Royalties (OR) at the end of 2018 for $ 237 million or at the end of 2019 for $ 272 million. The best solution would be to refinance the debt and buy back the gold, ideally by the end of 2018.

Conclusion

Although the gold grades of the second quarter , recoveries and production volumes were significant the share price has seen a nice rise, it will probably take several quarters of similar operating performance to convince the market that the Brucejack mine is a real deal and that the poor Q4 2017 and T1 2018 were only an accident. Significant catalysts that could help drive up the stock price will be permits for expanding the flow of the plant and any news regarding repayment / refinancing or debt buyback efforts. I expect that Pretium 's stock price will reach the $ 10 level in the coming days and weeks and that it will reach $ 12 by the end of 2018.

I am / we are longtime PVG.

I myself wrote this article and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link