[ad_1]

A bond market liquidation calls for melody in financial markets, including for currencies. The balance is unlikely to return until the yield on the benchmark 10-year US Treasury note hits 2%, a well-known analyst argued Friday.

“There will be no peace until the 10 Americans reach 2%,” Kit Juckes, macro-global strategist at Société Générale, said in a note.

Should know: Here’s how far the Nasdaq could fall if bond yields hit 2%

A pair of US government bond auctions, which had been a source of nervousness, went off without major problems over the past week, with yields settling into a new, higher range, said Juckes. But with the S&P 500 index closing at a record high on Thursday, the yield on the 10-year note TMUBMUSD10Y,

pushed back above 1.6%, weighing on equities.

The surge in yields triggered a rotation from growth-oriented stocks, including large-cap tech-related stocks, to more cycle-sensitive and often value-oriented stocks and sectors. The highly technological Nasdaq Composite COMP,

slipped into correction territory, defined as a 10% pullback from a recent high, as yields continued to climb, while the S&P 500 SPX,

and Dow Jones Industrial Average DJIA,

have traded records. All three benchmarks are positive for the week, with the Nasdaq rebounding on days when the rise in yields has slowed.

The surge in yields led to a resurgence of strength for the dollar, which Juckes said he was not eager to fight just yet. The ICE US Dollar DXY index,

a measure of the currency against a basket of six big rivals, rose 0.3% on Friday and has gained 0.9% so far in March.

“The pattern seems pretty clear: the stock market is experiencing a sector rotation but not a correction; the bond market seeks a new equilibrium in light of vastly improved economic prospects in the United States and elsewhere; some policymakers oppose bond movements, with little success, ”Juckes wrote.

Read: Fed to stay easygoing as Powell channels his inner calm from Gary Cooper

“As yields rise, the dollar rebounds, but when yields stabilize at a new level, the dollar falls. The pattern will likely continue until bonds strike a balance, unlikely until 10-year note yields have a handle of 2, judging by temper tantrums and cycles past, ”he said. -he declares.

Societe Generale

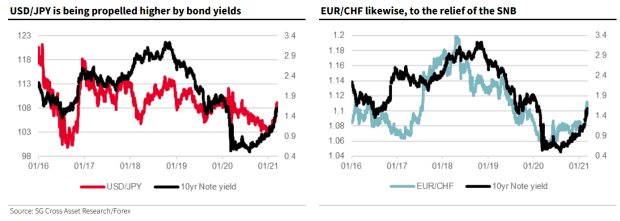

Meanwhile, the dollar / Japanese yen USDJPY,

and euro / Swiss franc EURCHF,

Currency pairs are most sensitive to higher yields on Treasuries (see chart above), Juckes said, noting that the dollar / yen is generally more closely correlated with the real or adjusted United States. inflation. yields than nominal rates, while the Euro / Swiss franc tends to follow nominal yields more closely.

Instead, this year has seen all four – real and nominal, dollar / yen and euro / Swissfranc – rise largely at the same time, he said.

“As US yields rise, EUR / CHF and USD / JPY will likely continue to rise, at least as long as the momentum is this strong. If we get to 2% of 10-year note yields in the coming weeks, a stupid extrapolation could take USD / JPY to 111 and EUR / CHF to 0.96, ”he said. “Perhaps too simplistic, but these movements are too strong to be fought in the short term.”

[ad_2]

Source link