[ad_1]

Novavax (NVAX) has accumulated a considerable group of champions and critics over the last 30 years as a public company. Having pretty angry at his latest RSV test, there are very few champions willing to spend their hard-earned money to have an opportunity to see how the company will evolve. Indeed, the latest article by Seeking Alpha introducing Novavax at the time I write you is titled "Novavax: More Hope".

Since the publication of the article "hopeless", Novavax has announced its fourth quarter results 2018. This article aims to indicate whether, after the publication of its report, I hoped at least for the shareholders of Novavax. This article will support the thesis described in its title.

Let's be clear: I do not advocate hope as a viable investment strategy. However, as far as Novavax is concerned, the proverb "Any port in the event of a storm" applies to the current moment. For shareholders who do not want to sell their shares at the price of today, hope is such a port.

Novavax's RSV program, however, runs on fumes; it always has value

On February 27, 2019, I sent members of Seeking Alpha to the Novavax cause. At that time, we had been waiting for the release of Novavax's promised data for the first quarter of 2019 on its pivotal F vaccine for infants through a maternal vaccination trial.

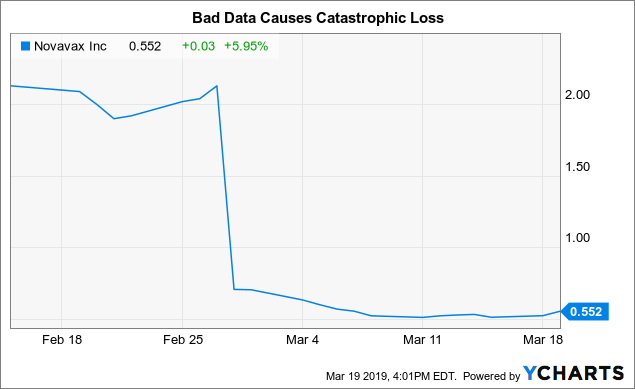

I expected the data to be favorable. I was wrong. Novavax announced its data the next day. Seeking Alpha's news feed hailed the report with the following: "Novavax's VRS vaccine fails in the final stage of its study, with stocks down 63%".

At least my estimate of the reaction of Novavax's actions to the negative data was accurate; they tanked. The title above indicates the numbers. The following graph provides a better visceral representation:

Data by YCharts

This was not the first phase 3 data reuse for Novavax investors. By September 2016, the company had reported disappointing data on the RSV vaccine for the elderly, its share price having plummeted from around 8.00 USD to around 2, $ 00.

In his most recent Q4 2018 results, Chief Executive Officer Stan Erck turned a blind eye to Novavax's VRS situation. He emphasized how serious the situation was in the United States and around the world. In the United States, RSV is the leading cause of hospitalization of infants in the first six months of life. Globally, it is the second leading cause of death in infants up to the age of one year.

He also highlighted the benign safety profile of the Novavax RSV vaccine. The purpose of his position was to make the vaccine a moderately effective, safe and useful treatment for a large number of users.

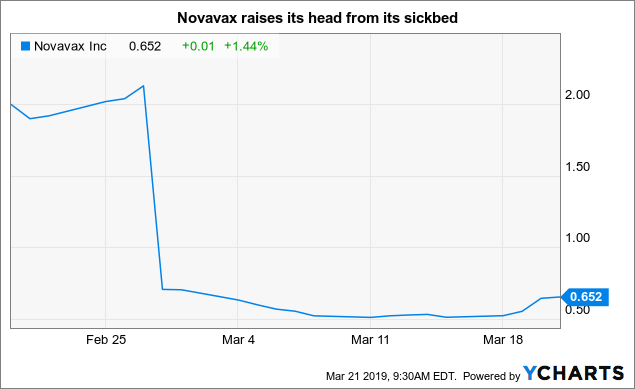

It seems to work. as I wrote in the morning of 21/03/19, Novavax's shares displayed a noticeable glimmer of life given their recent austere mood according to the table below:

Data by YCharts

Novavax flu program stays intact and unloved

After addressing his VRS program, President and CEO Erck decided to switch to the NanoFlu vaccine. First, he reminded investors how Novavax started in 2018 with "very encouraging" data from NanoFlu's Phase 1 clinical data, which were later published in the New England Journal of Medicine, which he described as an important distinction for the results of early clinical trials. .

This is probably the case. On the other hand, it was published as a peer-reviewed letter to the editor. This would seem to have less cachet than a peer-reviewed article. Whatever the case may be, the letter accompanied by a detailed appendix is available online. Readers can judge its importance for themselves.

This year, 2019, began with more results from NanoFlu clinical trials. This time, Novavax released the results of its Phase 2 trial comparing:

"… the safety and immune responses of various quadrivalent formulations of NanoFlu, with or without Novavax 'Matrix-M ™ adjuvant, [against] two influenza vaccines approved by the United States among 1375 healthy adults aged 65 and over. "

This test, referenced as NCT03658629 on clinical trials.gov, played an important role for Novavax. Dr. Glenn Novavax's President of R & D aptly described it in his presentation of JPMorgan at 1/10/19:

… the vaccine, the results of NanoFlu which we are very happy. The vaccine was well tolerated and similar to high dose foods. We have reached our main goal to show this adjuvant effect which is a crucial step to go forward. We have demonstrated co-formulation; we have a quadrivalent vaccine that is a big step forward and we have reproduced the data from the first phase 1/2 where we see the immune response using a measure that is generally perceived as likely to predict a protection called ATI. We show that the responses to H3N2 are significantly higher than those obtained with the high dose of Fluzone.

The net result remains the same or better for Novavax's NanoFlu vaccine. It continues to be an attractive asset, which helps to sustain the title with hope. Novavax expects that the FDA will grant it accelerated approval, which will allow it to move to a pivotal trial and submit an NDA. Dr. Glenn summarized the problem as follows:

At the same time next year (January 2020), I will be back here to talk to you about our essential flu-based data – which would inform and speed up the approval process of a patient. exercise permit.

Whether the FDA accepts or not must respect the event.

Offers are in the wind

With the results of his VRS Phase 3 trial and the healthy NanoFlu track record, President and CEO Erck has used the "P" as a partner word several times over Novavax's recent financial results. Nothing seems imminent, there was just an allusion to keep the shareholders interested.

The following excerpts provide examples:

… we continue to evaluate the best partner for our ResVax program, and perhaps several partners with capabilities in different geographic regions. The partnerships include a potential combination with large multinational vaccine companies, small regional vaccine companies and, hopefully, one or more global health sponsors. [or United nations] [ph].

We have new and ongoing discussions with all these types of partners and will keep you informed of the progress of these discussions. An important element for our potential partners is the way in which our various regulatory discussions take place. I think we will come to the conclusions about the partnership shortly after getting more clarity in the regulations.

The simple word "partner" sounds good to investors who have grown tired of Novavax 's insatiable appetite for money, as explained below.

Dilution remains the curse that keeps Novavax shares below the $ 1.00 mark.

Novavax is trying to play in the big leagues with its ambitious RSV programs in addition to its NanoFlu and other efforts. For 2018 10-K (p.45), Novavax used $ 184 million in 2018, an increase of more than 27% from the $ 144 million in 2017.

To date, in 30 years of existence, he has not had to worry about the income of his products. Its main sources of livelihood are grants, loans and equity offers. This last quarter, its cash stocks amounted to $ 41 million.

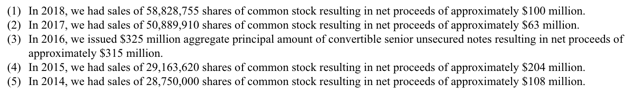

The following footnote to his 10-K, 2018 (p.36) provides an overview of his fund increases over the last five years:

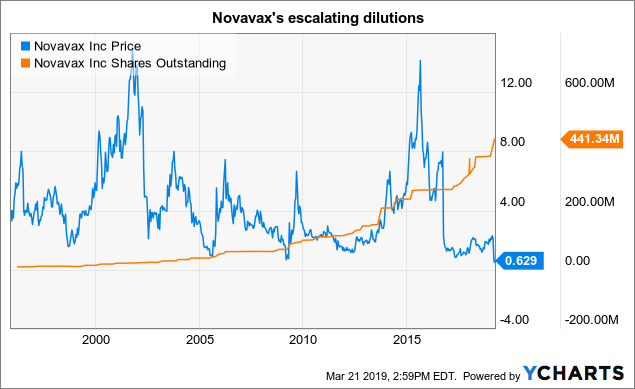

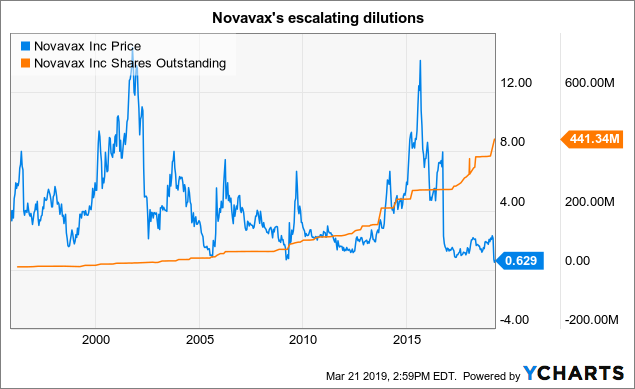

These share issues contributed to the overall balance of 441,344,182 shares outstanding on 3/12/19 by 10-K mentioned above.

The graph below shows how this process has intensified over the course of Novavax's long history.

Data by YCharts

Conclusion

So where does this leave current investors? As the title of this ad indicates, there is room for hope. The time will come when all the opponents will be wrong. As a shareholder, this is my position and I like it.

However, to be quite frank, I'd confess that I'm not sure about the value of my stock, but I'd like to think that it's more than the price currently offered. In any case, I made my bed as they say and I will continue to lie on it.

I would not recommend this stock to anyone. Regardless of how it behaves on the market, it is not worth it to be aggravated. During the lens season, this is a handy handbag.

After writing and initially submitting this publication, Novavax sent a letter to its shareholders proposing to vote on a 20-to-1 share consolidation. Although, theoretically, this should not affect the value of the share price. As it only divides the same cake into several larger slices, I expect it to have an extremely negative effect.

The thesis of this article remains the same. The shareholders, whose number of participations should soon be reduced by 20 to one, have reason to hope good things from this company. I would not recommend anyone to buy shares.

Disclosure: I am / we are long NVAX. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional information: I can buy or sell NVAX stock within the next 72 hours.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]

Source link