[ad_1]

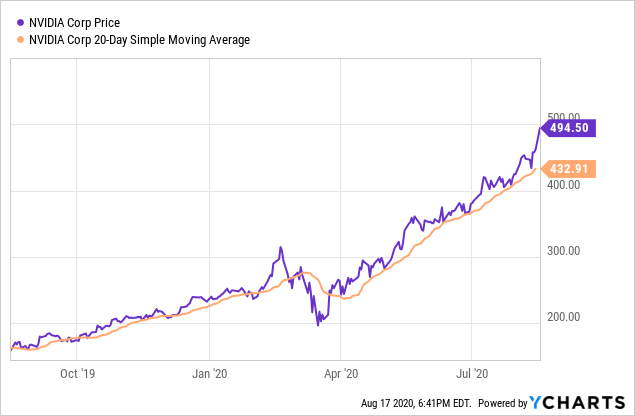

Nvidia (NVDA) has been one of the brightest to date in the semiconductor industry, as well as one of the fastest growing stocks. Stocks have nearly doubled since the start of the year and are up nearly $ 300 since March. Quarterly results are imminent, released Wednesday after business hours, and the report could make or break Nvidia’s high flight.

Data by YCharts

Data by YCharts

The company has come a long way from the woes of 2018 and 2019 and is on track to continue to post earnings growth – EPS for the quarter is expected to hit close to $ 2 per share, around the figure levels in the Q1 2019. Nvidia saw promising year-over-year growth in both GPU / Data Center and Games, but data center revenue growth was much higher.

From the first quarter results, Nvidia saw 80% year-on-year growth in data center revenue to $ 1.14 billion and the introduction of the A100 GPU along with other product launches. Gaming revenue grew 27% year-on-year (but fell 12% on a QoQ basis) to $ 1.34 billion, while the company also announced more than 100 new laptop models with built-in features. GeForce and RTX GPUs.

Much of that strength is expected to continue through the second quarter and through the end of the year, with new console releases later in the year and a new chip release slated for a few weeks, adding still growing.

The growth of Nvidia’s data centers is expected to remain relatively unchallenged in terms of AI, regardless of the steps Intel (INTC) takes with Tiger Lake and Xe LP. Nvidia has “a whole ecosystem filled with libraries and templates specially designed for [the] The CUDA architecture ”, and by combining this with the advancements the company has made in the field of deep learning (such as DLSS 2.0), it should contain growth rates, while fending off competition from Intel.

A100 also has the “biggest generational performance leap ever … with strong adoption among major hyperscalers,” which is expected to continue into the quarter. The launch of the A100 and related products has a high value in the quarterly results – future results could see data center revenue surpass gaming for the first time, with Mellanox revenue also contributing from this. quarter, after the closing of the acquisition.

The game still must not be eclipsed. Nvidia’s strength in gaming comes just before the launch of new consoles and after the expansion of GeForce Now, laptops using RTX processors, and the launch of Minecraft with RTX and DLSS 2.0. Still, gaming is unlikely to experience the same strengths as the first quarter with the relative slack in home orders fueling the surge in video games and screen time.

The first quarter showed strong demand for gaming products, and the second quarter is expected to show similar strengths in demand with releases since the first quarter. But like “staying at home” [was] leading to> 50% increase in game hours on the GeForce platform, “the gradual reopening of the economy has most likely led to a decrease in game hours. Minecraft with RTX could provide some strength, but action Higher performance of RTX and DLSS 2.0 could generate revenue for backup games up to around 10% QoQ.

ProViz, automotive and OEM / IP revenue contributions, while decent, could still be hampered for the quarter.

ProViz derives most of its revenues from “media and entertainment, architecture, engineering and construction, [and] public sector. “While the transition to working from home has been offset by the need for jobs in ‘healthcare, media and entertainment and higher education’, construction and engineering will likely still have little impact. effect on demand. ProViz may still be able to find its long-term strength through “expanding creative and design workflows. [and] mobile workstations. “

The automobile will likely be the laggard of revenue engines for Nvidia. Quarterly revenues have been largely unchanged from the third quarter of 2019, and since “spending on computer entertainment and self-driving cars is expected to decline over the next few quarters,” the company might not see the same 22% CAGR in the ‘automobile.

China and Taiwan are Nvidia’s two main geographic segments in terms of revenue, and although China was hit hard in the first quarter with their lockdowns, a relatively quick reopening of the country should have eased tensions across the channel. supply and stimulate demand for games again. The two combined account for about half of Nvidia’s revenue, so vigor has picked up when it reopens, and demand for games is expected to increase total revenue by 5% or 6% (~ $ 150 million).

Nvidia’s momentum has not gone unnoticed – it received high street price targets of $ 500 to $ 540 ahead of what could be solid profits driven by the game’s favorable winds and the forces of data centers. As is likely the case, stocks may have already cooked most of the good news, trading just below $ 500 and 7.5% below a market cap of $ 300 billion.

A strong earnings report is needed to keep the momentum going, as Nvidia has closed above its 20-day moving average since March 24, almost 5 consecutive months. If earnings are as strong as expected, given new releases of the game, relative geographic strength in China and Taiwan, data center growth above the A100, and previous chip releases to come , nothing prevents Nvidia from going to $ 530-550 by the end of September, or even $ 600 and more by the end of the year. However, if the performance or growth of the data center falls short of expectations or the headwinds in gaming prevent significant year-over-year growth due to the return to “normalcy” outside the home, Nvidia’s path would be back to its support created by the moving average.

Disclosure: I / we have no positions in the mentioned stocks, and I do not intend to initiate any positions within the next 72 hours. I wrote this article myself and it expresses my own opinions. I am not receiving any compensation for this (other than from Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link