[ad_1]

Nvidia (NVDA) – Get the NVIDIA Corporation report isn’t just one of the best tech stocks to buy; it was one of the best stocks overall.

It shows strong long-term performance and has outperformed many of its peers this year, both large and small.

Nvidia’s 57% year-to-date surpass Advanced Micro Devices (AMD) – Get the Advanced Micro Devices, Inc., which is up 11.75% this year and 25% in the past 12 months.

He is at the head of the FAANG group, although Alphabet (GOOGL) – Get the Class A report from Alphabet Inc. (GOOG) – Get the Alphabet Inc. Class C report is close, up 56% so far this year. The second best performer in the group is up 22%.

In my opinion, Nvidia remains one of the best large-cap growth stocks available to investors. It also remains a top choice among analysts.

It was then that she faced regulatory issues with her acquisition of Arm. This is also because stocks are down around 15% from highs. Let’s look at the graph.

Nvidia and AMD are part of the Action Alerts PLUS member club. Want to be alerted before buying or selling NVDA or AMD? Find out more now.

Trade Nvidia shares

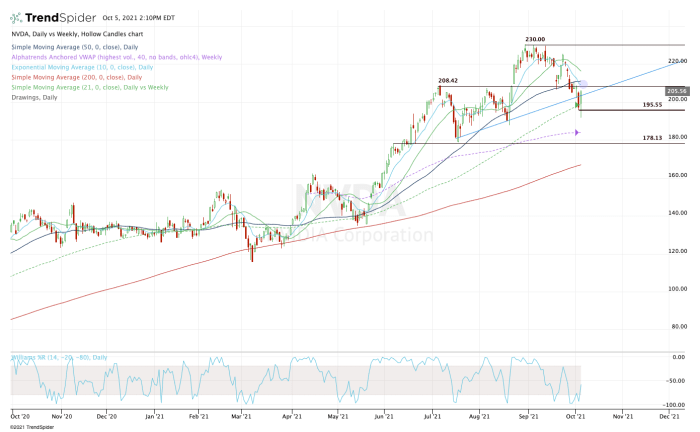

Notice, in the first half of this chart, how well the consolidation of Nvidia shares did the trick. Despite its excellent profits, impressive lectures, strong forecasts and stock split, Wall Street was simply not willing to reward the stock.

Granted, it had recovered sharply from the Covid troughs, but the lack of a lasting reward in the form of a well-deserved rally was chilling for the bulls.

That changed at the end of May, when Nvidia announced better than expected results – again.

This triggered a move under $ 140 to the $ 208 to $ 210 area. This area has become important as it was a major breakout level in August.

This breakout helped propel the move to $ 230, which became resistance, while the $ 208- $ 210 area was initially support during the recent decline. However, this level failed as a support last week.

On the upside, the bulls should see Nvidia shares recover the $ 208- $ 210 area, along with the 10-day and 50-day moving averages. This brings into play the 21-day moving average, followed by $ 220, then the resistance at $ 230.

On the downside, the bulls don’t want Nvidia stocks to lose the 21-week moving average. Underneath it puts this week’s low on the line at $ 195.55.

If Nvidia closes below that level, it opens the door for the VWAP weekly measure near $ 184, followed by the $ 178- $ 180 area.

I love this business, but it’s not an easy job here.

Failure to recover some of those key levels should prompt investors to look to buy the downside – which is a potentially larger drop if this week’s low doesn’t hold.

Otherwise, stocks may run if they close above the 50-day moving average.

[ad_2]

Source link