[ad_1]

After Thursday's bell, NVIDIA chipset maker NVDA (NVDA) pulled together when it released its company's first quarter results. The title numbers will indicate beats both up and down, with indications that mostly correspond to expectations. However, given how much the situation has changed in recent months, it's not a report that has driven me to shout buy, buy, buy.

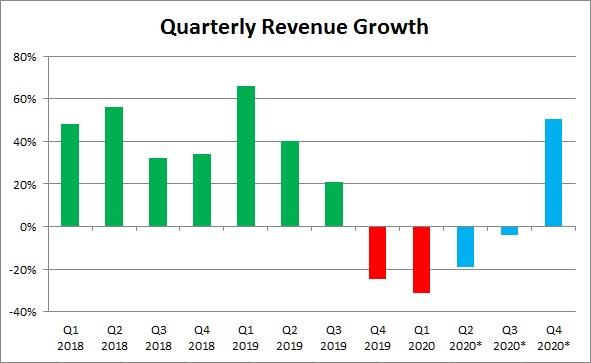

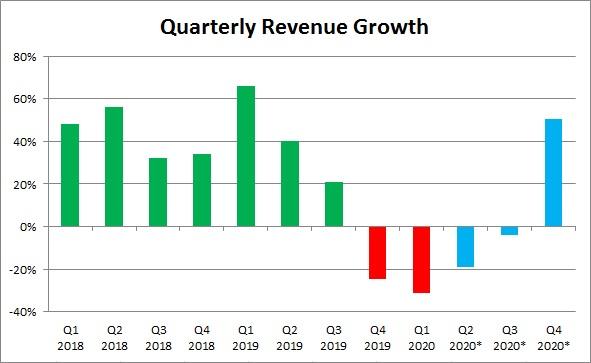

Revenues of $ 2.22 billion for the quarter were $ 20 million higher than forecast. However, this result is hardly impressive considering that three months ago the forecasts were disappointing: estimates were reduced by $ 210 million. In fact, there are only two reports, the street was looking for $ 2.89 billion during the quarter, which shows how much the expectations have gone down. The end result was a 31% year-on-year decline in revenue, as shown in the graph below. Blue (* periods) represents current estimates.

(Source: NVIDIA Win page, view here)

The same story was true for earnings per share. While the $ 0.88 non-GAAP EPS was 7 cents higher, it was estimated at $ 1.57 just six months ago. At that time, the title was worth only about $ 5, which has nothing to do with the market that has punished since. GAAP operating income decreased 72% from the same period last year, with net income of $ 394 million, which is only a fraction of earnings of nearly 1%. , $ 25 billion realized the year before.

As far as forecasts are concerned, an income forecast with a midpoint of $ 2.55 billion is right, but again, there is a small estimate. If these forecasts had been given just three months ago, they would have been terrible. Improvements are coming, but it takes time. In addition, I still do not like the fact that inventory levels are up 79% over the previous year, when the company is drastically reducing its revenues. This is not a very effective way of managing your capital allocation. I'm talking about inflated inventories for two or three quarters and the situation has not improved dramatically.

In the press release on profits, Jensen Huang, CEO of NVIDIA, said the company was on an upward trajectory. Well, it's hard not to be when revenues are down more than 30% during the quarter. Moreover, if the outlook is so optimistic, why has the company not bought back any stock during this period? A year ago, more than $ 650 million was spent. This concerns the ongoing acquisition of Mellanox (MLNX), which, with $ 6.9 billion, accounts for almost all of the company's current cash balance. With a stock price down more than 45% from its record level, some investors might think the time has come to buy back shares.

In the end, NVIDIA's first quarter report was ok, but I do not see it sending shares soaring so early. The title beats and online tips will be primarily history, but that's only because of the massive reduction in expectations. The company is starting to recover, but it will take a few quarters to see further growth, and the impact of the transaction on the deal with Mellanox has put an end to share buybacks for now. If the company does not buy its own shares, should you? There are certainly better days, but it was not really a report that would make me want to rush to buy the stock.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Investors are always reminded that before investing, you must do your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

[ad_2]

Source link