[ad_1]

Renting in the Bay Area means huge rent increases, fighting against others for attractive listings and constant uncertainty.

And this is true even if you are a big company.

With rising rents, businesses and public agencies with well-stocked pockets are buying more and more offices. For the same reasons, homebuyers collapse to have a living space: more long-term certainty on what they'll pay for having a roof. .

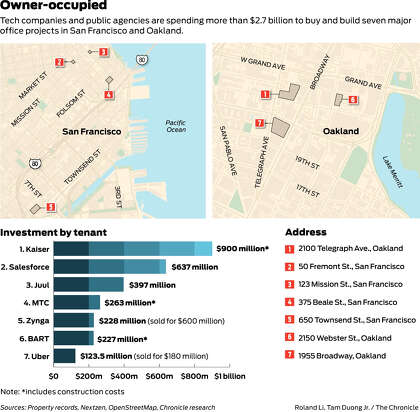

The last speaker is BART, which has a large network of rail lines but not its head office in Oakland, located at 300 Lakeside Drive. In response to a rent increase of more than 60%, BART's Board of Directors approved Thursday the purchase of a nearby building, located at 2150 Webster Street, for a new headquarters.

It will not be cheap. BART expects to spend $ 140 million and an additional $ 87 million on construction and other costs. The purchases will save millions of dollars a year from renewing the lease or hire-purchase elsewhere, said Sean Brooks, BART's property manager.

BART is not alone. Seven major tenants from San Francisco and Oakland have spent or committed to spending more than $ 2.7 billion in real estate since 2012, according to property records. Technology giants Google, Facebook and Apple have each spent billions of dollars to buy in Silicon Valley.

"In the entire San Francisco Bay Area, companies are looking to acquire strategic assets, head offices," said Tom Maloney of JLL, BART Real Estate Broker.

In addition to escaping the unpredictable office market, the property allows businesses to control the brand, design and safety of a building, Maloney said. Excess space can also be rented to other tenants for profit. Government agencies like BART do not pay property taxes on the buildings they own.

The biggest hurdle: Buyers must have money or the opportunity to borrow it cheaply.

BART will issue low interest rate bonds backed by sales tax revenue, which has made buying attractive, Brooks said. The bonds will not result in any tax increase and will not require the approval of electors.

Tobacco giant Altria invested $ 12.8 billion in Juul last year and the controversial vaping company bought 123 Mission Street for $ 397 million in June, continuing to hire. Northwood Investors has made a significant profit after paying $ 290 million for the tower in 2018.

As for the residential market, timing is important. The companies that spent money in offices at the beginning of this decade are in the process of pulling out. Zynga's head office in the south of the market has more than doubled in value from 2012 to 2019 and the gaming company has agreed to sell it this summer for $ 600 million. In 2017, Uber sold Uptown Station in Oakland for a profit of several tens of millions of dollars.

For the Metropolitan Transportation Commission, the region's transit planning agency, the purchase of a new head office at 375 Beale Street in 2011 was a wise choice, said Randy Rentschler, Director of Legislation and Public Safety. MTC Public Affairs.

One-third of the nearly 500,000-square-foot building is rented to private tenants, Conduent, Twilio and Degenkolb. The agency expects a net operating profit of more than $ 200 million over 30 years, enough to cover its costs.

The commission building, a former post office, houses the Bay Area Governments Association, a regional planning agency, and the San Francisco Bay Area Conservation and Development Commission, which oversees the bay and shore. This protects three agencies from rent increases and makes policy meetings more convenient.

"The problems we face are closely linked," said Rentschler. "It's just more effective."

Funding for this $ 263-million building comes from a $ 1 billion capital reserve that can not be invested in traditional funds, but can be used to purchase offices, did it? -he declares.

Unlike the commission, BART will not have a surplus of real estate that it can rent in its new headquarters. But the building will always be a better deal for taxpayers than to continue to rent, officials said.

Roland Li is a Chronicle writer. Email: [email protected] Twitter: @rolandlisf

[ad_2]

Source link