[ad_1]

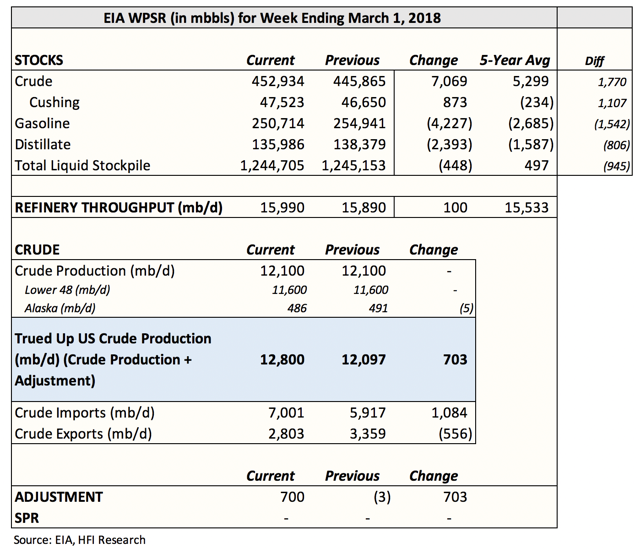

The EIA has released a bullish report on oil storage this week, despite crude storage of 7,069 Mbbl. This accumulation was due to the fact that imports were underestimated last week due to fog. The catch-up thus affected half of the land imports (from Canada) and the backlog of ships. The entire construction is explained by the difference between our imports and imports declared by the EIA.

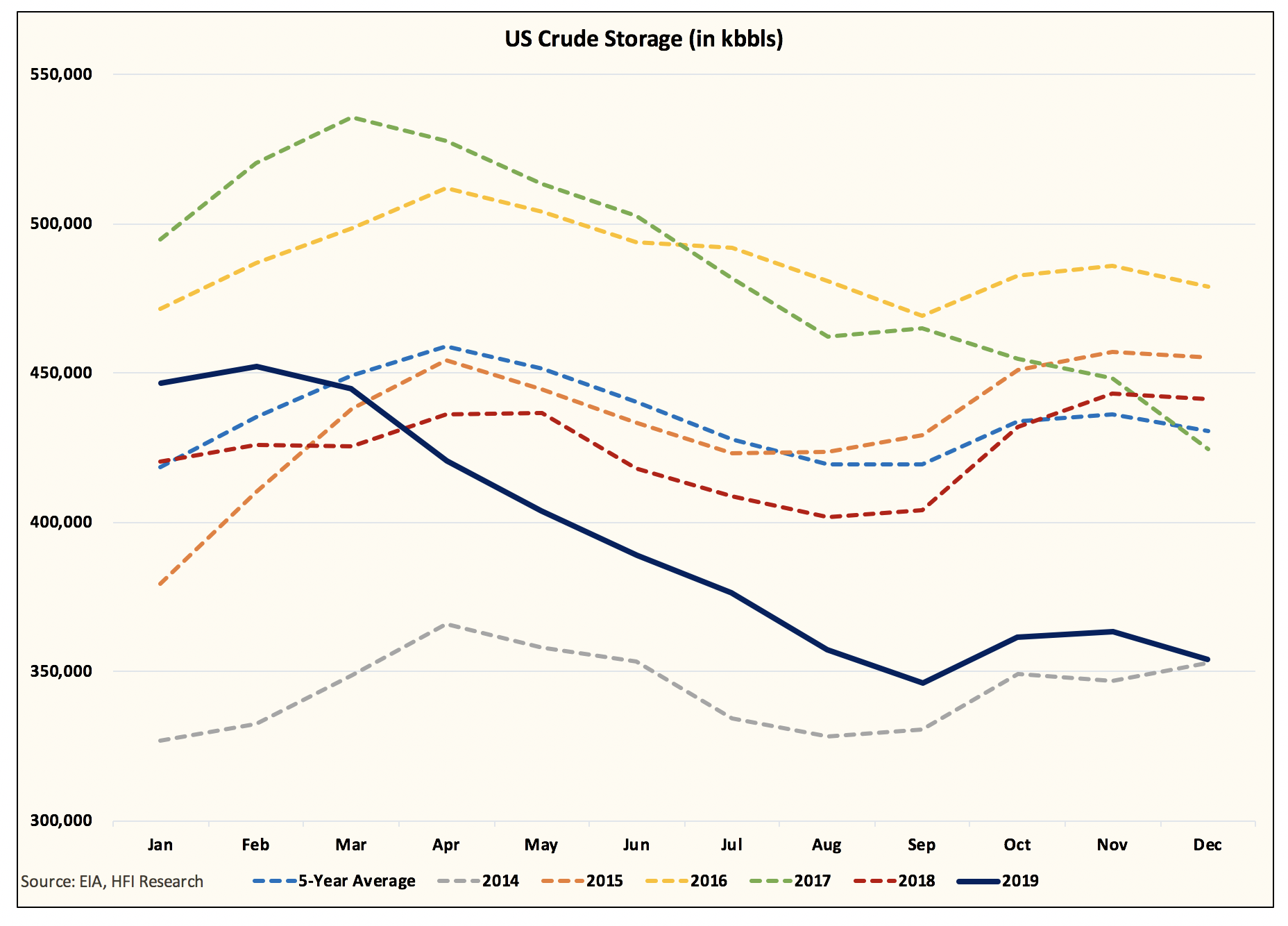

For next week, we will have a draw of 3.83 MB. The decrease in imports and the rise in exports. For the month of March, we have a preliminary draw of 7 Mbps, which would be very bullish compared to the 11-year average construction of 11.6 Mbbl.

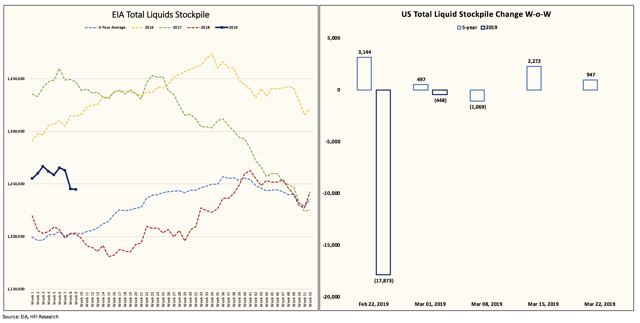

One of the key elements of February was that total liquids did not accumulate at all. In fact, it was one of the biggest draws.

Total liquids in the The United States is closely following the trajectory of 2018, which is very optimistic. In our estimation, next week's report on EIA storage should also be very optimistic as the weather outlook is significantly colder than normal. This should stimulate demand for weather conditions such as fuel oil, which should lead to a further decline in total liquids.

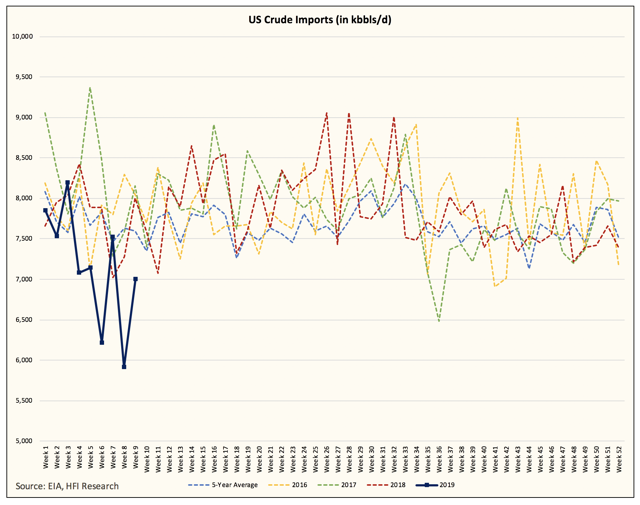

Moreover, since we are now following imports in great detail, we are seeing a downward trend in imports.

Despite the chaotic onset of the graph above, our assumption that US crude imports are expected to average 6.5 mb / d, which would result in higher crude oil consumption.

In our model, we also assume a very conservative ~ 2.3 mb / d for US crude exports in March. It is our margin of safety variable, with recent exports averaging about 3 Mb / d. This delta of about 700 kb / d helps us skew our estimate on the conservative side. And even in such a scenario, we have an estimate of the draw for March.

It's very bullish.

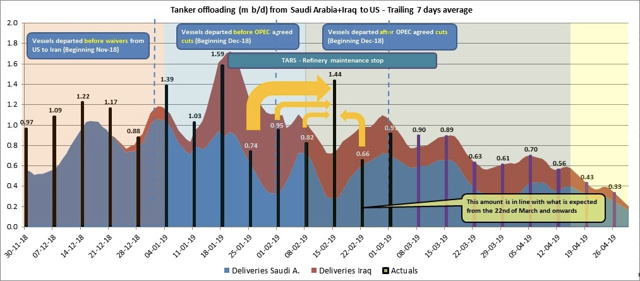

Source: Jorge Arjona-Perez

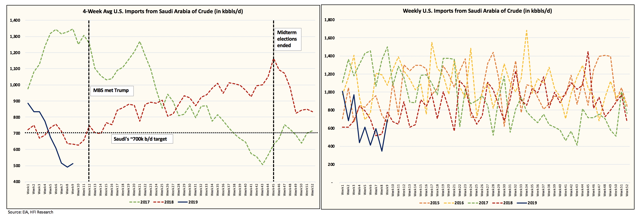

With the help of Jorge (Jorge Mojito on the cat), we can see that imports are suffering a huge blow in the following weeks from Iraq and Saudi Arabia. This tells us that the trend of average imports to about 6.5 mb / d will continue, which would further guarantee the relative relative stock ratios we see coming.

Data from the last half of April are still in the preliminary phase, so we will see that they will be updated throughout the month of March as they depend on Saudi exports this month.

Our preliminary hypothesis is that the Saudis export about 350,000 b / d to the United States in March.

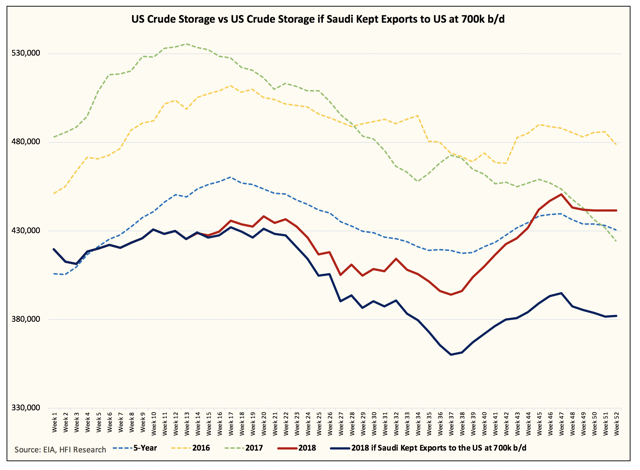

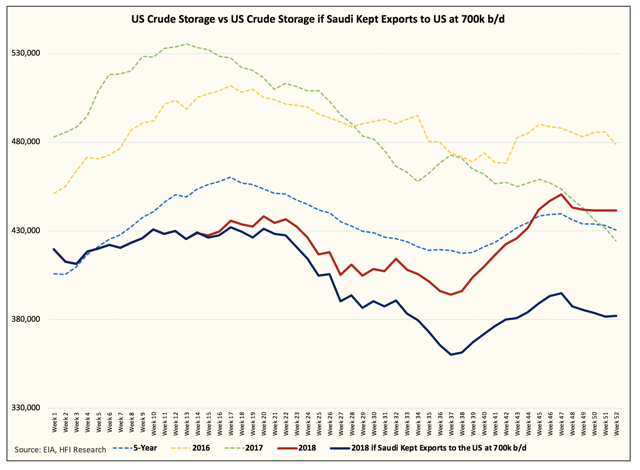

If all this happens according to what we see right now, there is a reasonable chance that In the United States, gross storage is around 30 billion barrels over the next 8 weeks. This will come as a sticker shock for many because American shale production has increased beyond 12 mb / d, but US crude storage continues to decline. One of the main reasons for this misunderstanding is the differentiated view that the Saudis were, in fact, the only reason US crude storage built excessively from April to December 2018.

In the chart that we have extensively documented last year, we see that the only reason US crude stockpile started to rise is the result of a Saudi policy shift aimed at increasing exports to the United States. United States: about 700,000 b / d.

So, if you adhere to our thesis, you know that the opposite will also be true. By keeping exports to the United States "below" 700,000 b / d, the Saudis will effectively drain the excessive storage of WE.

And we have already seen that in the data. As the trend continues, we believe that to allow Saudi Arabia to get the high oil price scenario it needs (about $ 80 per barrel), US crude storage is expected to stabilize at about 350 to 380 barrels.

We can reach this goal by September if the Saudis remain disciplined with exports WE.

Global – The data we follow continues to point us in the right direction. Because of our differentiated view of what caused the The accumulation of crude storage in the United States in the second half of 2018, we also know that the reversal of this trend will also be true (much lower). US raw storage).

We believe that the market is not even properly evaluating such an eventuality. The bullish surprise will be exactly that – a surprise.

Thank you for reading this article. HFI Research subscribers receive weekly reports on oil storage, as well as estimates of EIA crude storage for the following week. If you are interested, please see here for more information. We also offer a free 2 week trial for those who are interested. We hope to see you join the HFI research community.

Disclosure: I am / we have been UWT for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link