[ad_1]

- Oil prices have fallen to their lowest level since January, after government data showed an increase in crude oil and fuel stocks.

- US commercial crude stocks jumped 6.8 million barrels in the week to May 31, the US Energy Information Administration announced.

- Oil prices were already under pressure from fears of a slowdown in global growth due to trade disputes in the United States.

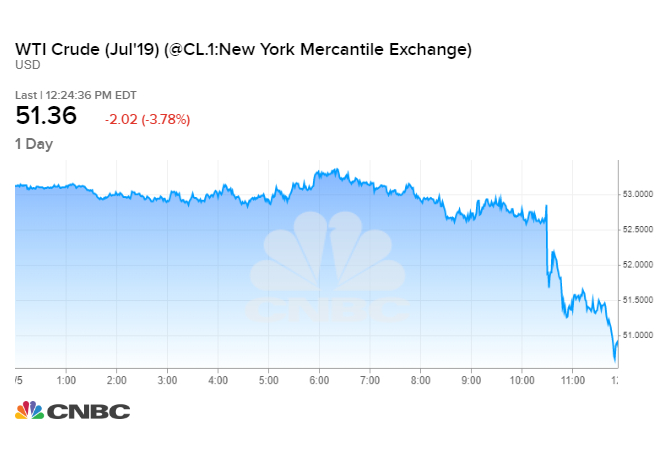

Oil prices fell on Wednesday as futures prices fell to their lowest level since January, after the US government announced an unexpected increase in crude inventories.

US commercial crude stocks jumped 6.8 million barrels in the week to May 31, the US Energy Information Administration announced. Inventories rose despite increased refinery activity and US crude imports of more than one million barrels per day.

This went beyond an earlier reading of the American Petroleum Institute that inventories were expected to increase by 3.5 million barrels during the week. Analysts expected inventories to drop by 849,000 barrels, according to a Reuters poll.

US West Texas Intermediate crude fell to $ 50.66 after the report, its lowest level since January 15th. WTI fell from $ 1.80 to $ 51.68 a barrel, dropping 3.4% to its lowest closing price in the last five months.

Brent futures dropped to $ 59.45, their lowest level since mid-January. Brent was down $ 1.31, or 2.1%, at $ 60.66 a barrel, around 2:25 pm. HE (18:25 GMT).

Brent futures dropped to $ 59.45, their lowest level since mid-January. Brent was down $ 1.31, or 2.1%, at $ 60.66 a barrel, around 2:25 pm. HE (18:25 GMT).

Gasoline inventories in the United States also increased 3.2 million barrels during the week. Inventories of distillates, including diesel and fuel oil, jumped 4.6 million barrels.

At the same time, weekly US oil production hit a record 12.4 million bpd, according to a preliminary reading of the EIA.

"We once again had record production in the US and this surge in imports surpassed the all-time surpassing ratio," said John Kilduff, Founding Partner of the Again Capital Energy Hedge Fund.

"This is obviously more than enough to meet the demand and create a truly bearish relationship in all areas."

Stocks report compound pressure on oil prices, which collapsed sharply over the past week as the market geared up for a prolonged trade battle between the US and China. Last week, President Donald Trump threatened to freeze tariffs on Mexican products, exacerbating fears of a slowdown in global economic growth and a reduction in fuel demand.

Crude futures posted gains on Tuesday as the stock market rebounded on the hope that the Federal Reserve will reduce its interest rates. Shares continued to rise on Wednesday, setting a floor below crude prices earlier in the day.

"Really $ 50 is a legitimate support area [for WTI] because we had a hard time getting by at the December rally, "Kilduff said. "So, this will be the next level to watch."

The increase in US inventories and lower prices for crude oil prices come as OPEC and its oil market allies prepare to meet to decide on production policy in the coming weeks.

The OPEC + alliance has been holding the offer since the beginning of the year in order to drain excess supply and raise prices.

Saudi Arabia's powerful energy minister said his group was inclined to expand production ceilings in the second half of the year.

However, Russian oil companies have begun to shelter under quotas. Igor Sechin, CEO and chairman of the Russian energy giant Rosneft, said this week that Russia should be free to increase production and had launched the idea of seeking compensation if Moscow agreed to renew the production agreement.

Russia suffers the heaviest cuts among producers in non-OPEC countries.

the United States Oil Fund LP (USO) dropped $ 0.07 (-0.65%) after trading hours on Wednesday. Since the beginning of the year, the USO has declined -10.32%, against a 6.46% rise in the S & P 500 benchmark over the same period .

USO currently has a SMART ETN Daily News rating of A (strong purchase)and ranks # 1 out of 109 ETFs in the Commodity ETF category.

This article is courtesy of CNBC.

[ad_2]

Source link