[ad_1]

OPEC policy. OPEC policy. To quote, Prince Abdulaziz told reporters "There is nothing radical in Saudi Arabia. We all work for the government … Fundamentally Saudi Arabia's energy policy is resting on a few pillars. The pillars do not change. "

The comments to the salvation of the trainees who are nervous to the recent past. (En anglais) The boost in energy prices is more important to push global stocks in the S & P 500- an unusual occurrence as the sector has suffered losses of 7% since mid-July while the overall S & P has been flat.

This is an unusual start to the trading week following which traders tend to focus on bearish news. Meanwhile, there was, in fact, some negative news for the market to digest in the form of the IEA in the future. growth of 1.4m bpd for the year back in the Fall of 2018 and 1.35m bpd until this Spring giving us a sharp reminder of a darkening global macro picture. These forecasts are also serving as compliments to the US and Europe while US refining is flat and growing more than + 2% GDP growth.

From a technician's standpoint crude oil appears to be steady-running after rallying from a low print of $ 55 on August 7th, then holding its recent low on last week's selloff and currently trading over $ 62. Brent crude is currently trading above its 50-day moving average for the first time in a month with the short-term momentum is with the bulls.

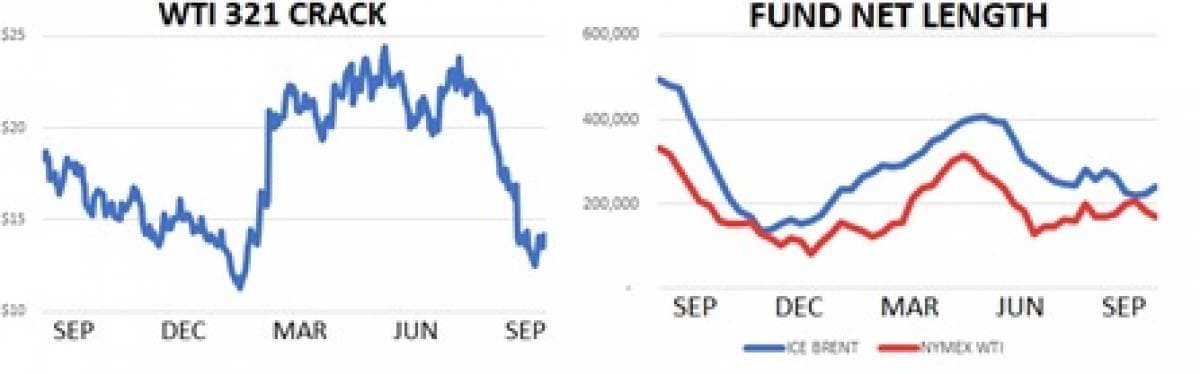

In reading signs from recent market action, however, we think that we are most likely to be in the market. In options markets, contracts dated for January of 2020 have 25 delta put options trading at a 3% premium to 25 delta call options as measured by the implied volatility that traders are paying for those options. Contracts dated for December of 2020, however, have the same put options trading at a 6% premium. Meanwhile, in spread markets the 6-month strip of Brent contracts beginning December '19 is yielding 30-cents contango per month. Unfortunately, the same 6-month strip spread beginning in June '20 is only yielding 15-cents of contango per month. This is the result of the recent selling of crude oil by hedge funds, which has a net-length of 44% smaller than it was back in April.

While none of these numbers 'prove' that oil traders are feeling negative, they do not need to know who they are. we are not feeling positive overly.

Quick Hits

– Brent crude traded back above $ 62 this week boosted by comments from the Saudi Energy Minister that they would continue to drive market-rebalancing efforts within OPEC. As Aramco speeds towards IPO we could look at the Saudis to work behind the scenes.

– President Trump fired national security advisor John Bolton from his staff on Tuesday which- if anything-helped cool oil prices. Mr. Bolton was the most influential advisor on Trump 's team and has repeatedly tried to raise tensions with Iran. Oil sold off about $ 1 when the news broke.

– Spread markets are trending bullishly and may signal that they are tighter than crude. This week the Brent 6-month spread offered more than 30-cents of backwardation per month.

LendingTree performed an analysis and concluded that Michigan has higher odds of a recession than any other state in the US. This is notable as Michigan was a key component of Trump's 2016 victory and suggests the Rust Belt could be underperforming the rest of the US. The US Manufacturing PMI printed 49.1 in August which was its lowest mark under the Trump administration.

– Global refining the margins of the market, which does not require a boost. The WTI 321 crack currently US country refiners about $ 13.50 / bbl while on global markets the gas oil / brent crack is trading near $ 17.50 / bbl.

– Leadership from OPEC's Equivalent Guinea member said $ 40- $ 45 / bbl in the cartel to ramp up their efforts to tighten supplies.

– Bloomberg reported that Aramco heard from the IPO back in August. Amin Nasser CEO told reporters that banks will be chosen soon

– Hedge funds were net buyers of ICE Brent last week and net buyer of NYMEX WTI. Overall net size between the two contracts currently stands at 410k which is lower from its recent April peak by 44%.

DOE Wrap Up

– US crude stocks fell 4.8m bbls last week and are 6% higher in the last two-week period.

– Crude stocks in the Cushing, OK delivery hub fell for the sixth straight time by about 230k bbls to 40.1m. Cushing stocks are lower than 12m in the USGC for export.

– Traders shipped 6.9m bpd into the US last year from abroad and moved 3.1m bpd of US sourced sourced sourced net imports of 3.8m bpd.

– US crude production fell by 100k bpd w / w to 12.4m bpd. Production has 12.1m bpd so far in 2019.

– The US currently has 24.2 days of crude oil supply, which is higher by 7%.

– As for demand, US refiners processed 17.4m last week bpd. Demand has averaged 17.45m bpd over the last four days which is lower by 290k bpd.

– US gasoline stocks continued to move lower last week falling 2.4m bbls to 230m. US gasoline stocks are lower by 0.5%.

– The US currently has 23.6 days of gasoline stocks which is lower by 3%.

– Gasoline traded near $ 1.60 / gl this week for a 10-cent improvement over the last week.

– US gasoline demand + exports are estimated at 10.29k last week for a 310k bpd w / w decline. Implied mogas asked averaged 10.4m bpd in August which was higher y / y by 165k bpd.

– US distillate stocks also fell sharply moving lower by 2.5m bbls to 134m. Distillate stocks have averaged 136m over the last four weeks which is higher by 4%.

[ad_2]

Source link