[ad_1]

A special investment opportunity just dropped on our desk …And we wanted to give you a first glimpse of this exciting new industry.

It's so big that even billionaires such as Jeff Bezos and Richard Branson are spending a significant portion of their fortunes on this emerging sector.

It will be bigger than anything we have ever seen. Forget the technological boom of the 2000s … The shale boom … Or even that of cannabis.

And it is not too late to enter the ground floor!

Get the full story here

(And see how investors turn small sums of money into wealth)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Oil fell on Friday after China announced new tariffs on US goods, including crude oil. The move has revived fears of economic recession. Meanwhile, global financial markets are closely watching the Jackson Hole Symposium, an elite financial summit that could provide clues to the thinking of the US Federal Reserve.

Alberta extends production cuts until 2020. Alberta has extended the authorization to reduce its production until the end of 2020 due to the uncertainty of the pipelines. The move comes after the delay in replacing line 3, which means that bottlenecks at mid-term may persist.

Oil producers fight oil pipelines over tariff surcharge All American Pipeline Pipeline (NYSE: PAA) imposed a surtax on oil producers using its new Cactus II pipeline to offset the higher costs of steel due to US tariffs. But ConocoPhillips (NYSE: COP) and Encana (NYSE: ECA) have asked the US regulators to shoot down the pipeline charges.

The expansion of Chinese petrochemicals threatens others. A rapid increase in China's petrochemical production capacity could force producers in Japan and South Korea to cut production in the second quarter of 2020, according to Reuters. China is expected to add 10 million tons of paraxylene capacity between March 2019 and March 2020.

The United States says Iran's exports are less than 100,000 b / d. Brian Hook, Special Representative of the US State Department for Iran, said Iranian oil exports have dropped below 100,000 bpd, although independent valuations of S & P Global Platts are getting closer 450,000 bpd. "We have effectively eliminated oil exports from Iran," Hook said at a news briefing in New York. "I can not exaggerate the importance of this achievement."

The United States adds 61% of all new hydrocarbons. Over the next decade, the United States will account for 61% of new oil and gas production worldwide. The new production should "plunge the world into oil," Global Witness said in a report.

Related: LNG increases the European gas market

Natural gas reaches its lowest level in 10 years in Europe. Natural gas prices in Europe have fallen to their lowest level in 10 years, with cheap LNG spreading across the continent. Gas storage in many European countries is well above the five-year average.

Layoffs in the Indian car industry. According to Reuters, the decline in auto sales is leading to layoffs and slow production in India. Auto sales fell for nine consecutive months in India, a sign of a deterioration in the economy.

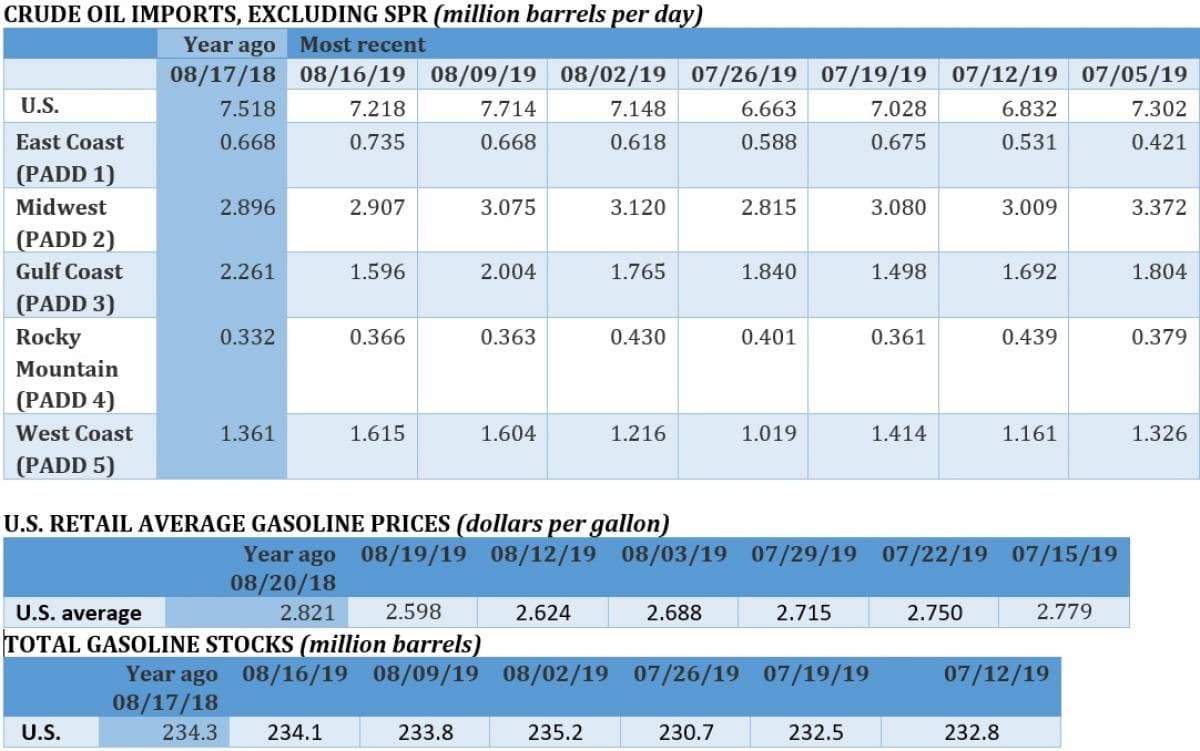

China unveils $ 75 billion tariff. China said it would react if the US went ahead with additional tariffs of 10% on goods worth $ 300 billion, and announced on Friday plans for new tariffs on US imports of $ 75 billion. The plans include a 5% surcharge on US soybeans and crude oil, which will come into effect in September, while the 25% tariff on cars will come into effect in December.

Rosneft becomes oil trader for PDVSA. Russia, Rosneft, has become the main trader of Venezuelan oil and has transferred it to buyers in India and China, according to Reuters. This decision comes as traders in traditional oil are turning away from Venezuela because of the sanctions imposed by the United States. Rosneft took 40% of PDVSA's oil in July and 66% in August.

Rosneft for trading in euros. Rosneft has informed its clients that future contracts will be issued in euros and not in dollars.

US puts China out of oil. The United States warned China Thursday against any interference in oil and gas exploration in Vietnam, highlighting the long-standing tension in the South China Sea territory.

Pembina to buy Kinder Morgan's Canadian assets for $ 3.3 billion. Pembina Pipeline Corp. (NYSE: PBA) agreed to buy the remaining Canadian assets owned by Kinder Morgan (NYSE: KMI) for $ 3.3 billion. The agreement gives Pembina a major source of oil storage in Edmonton and marks a major bet on the future of Canada's oil sands. Kinder Morgan's exit is one of many divestitures by international oil companies in Canada.

Trans Mountain Pipeline Resumes Construction. Now under the control of a government-owned entity, the construction of the Trans Mountain Expansion has resumed. The commissioning of the pipeline is scheduled for the middle of 2022, with further delays.

OPEC's market share drops to 30%. OPEC's market share is at its lowest point in years, even as the group faces an oversupply of supply in 2020, which could even lead to further cuts.

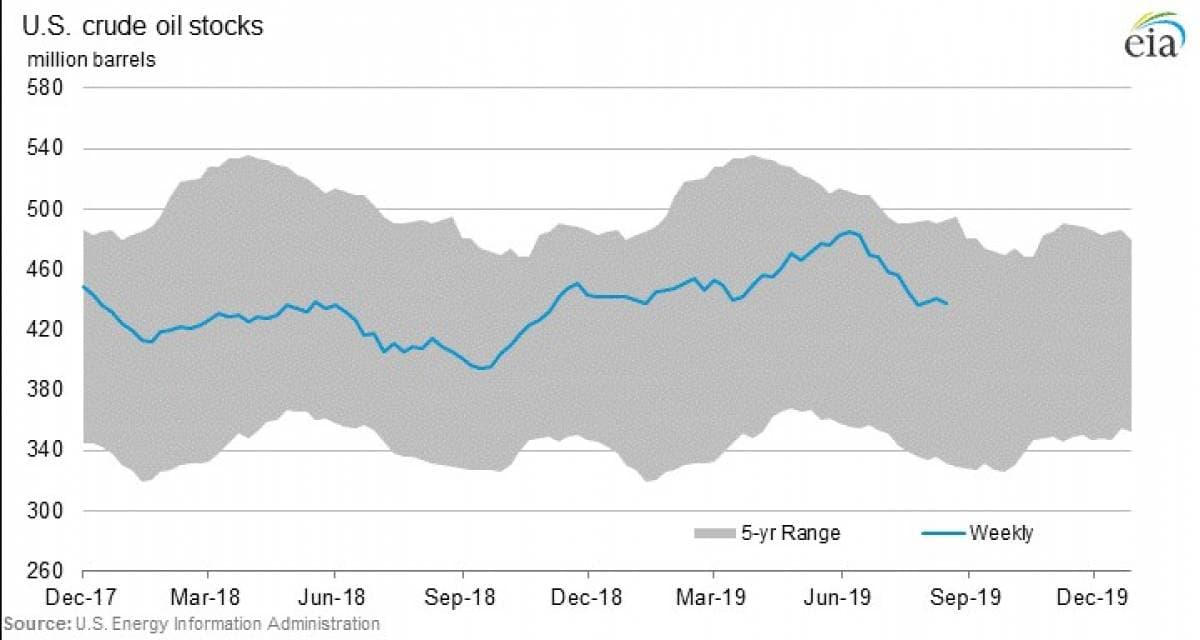

The United States will sell 10 million barrels to SPR. The US Department of Energy will sell 10 million barrels of oil from its RSP for delivery in October and November. The sale stems from legislation previously passed by the US Congress.

The development of cubes can increase shale drilling returns. A new study by Wood Mackenzie reveals that the development of cubes (drilling an entire section rather than individual wells) can increase the current value by 20% in Wolfcamp and Bone Spring. "The cubes will not work for every business. That said, they offer big benefits if they are executed as planned, "said Ryan Duman, Senior Analyst at WoodMac. But the approach also involves risks. "Investors should be aware that the cube approach concentrates geographic and underground risks. And that does not completely eliminate the risk of children's wells, "said Duman. "Producing wells at the same time can actually cost the unit more if the wells are not as productive as expected at too dense spacing."

Brazil wants to privatize Petrobras. The Brazilian government wants to completely privatize Petrobras by 2022. Meanwhile, Petrobras CEO Roberto Castello Branco has suggested that the company should end the use of production-sharing contracts and instead adopt a concession model.

By Tom Kool for Oilprice.com

More from Reading Oilprice.com:

[ad_2]

Source link