[ad_1]

Oyo is ready to explore the public markets. The eight-year-old Indian budget hotel giant has filed the documents (PDF) with the local market regulator for an initial public offering, in which it seeks to raise around $ 1.16 billion.

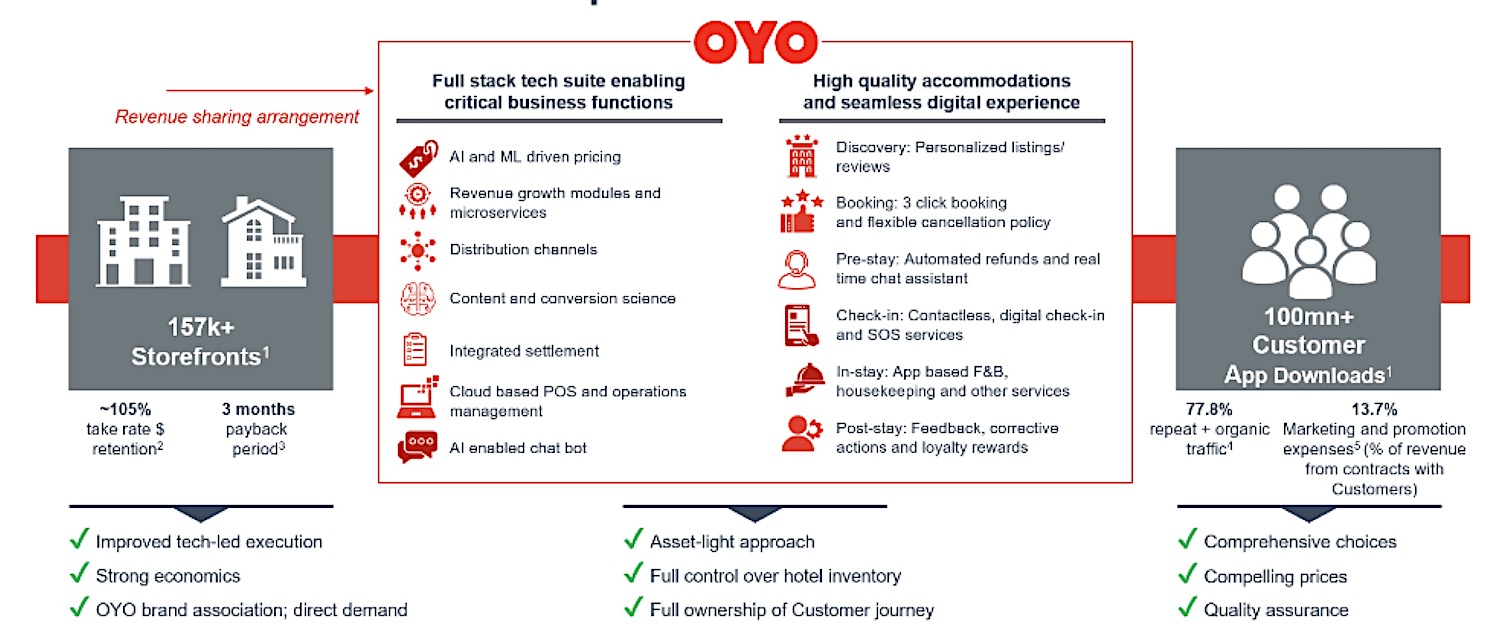

The Gurgaon-based startup – which offers some sort of operating system to help hoteliers accept digital reservations, payments, determine the best price for a room, and integrate with third-party reservation services – is looking to lift approximately $ 942 million through the sale of new shares, while the remainder is reserved for the sale of existing shares (secondary transaction).

SoftBank plans to sell a stake worth more than $ 175 million, Oyo said in the filing. The startup plans to deploy more than $ 330 million to pay off its debt. Oyo recently raised $ 660 million in debt.

The startup – which counts SoftBank, Airbnb, Lightspeed Venture Partners, Sequoia Capital India and Microsoft among its investors and was recently valued at $ 9.6 billion – didn’t provide a ton of other details on what it did. looking for retail investors, but here’s what we know: As we reported earlier this week, Oyo is looking for a valuation of over $ 12 billion on the IPO. And the young founder of the startup, Ritesh Agarwal, does not plan to sell his shares as part of the public offer.

Today’s filing marks a major turnaround for Oyo who has grown too ambitiously in international markets in recent years, but corrected the course by curbing some of those efforts.

Much like all other hospitality and travel companies, Oyo has also been severely disrupted by the pandemic. At one point, the startup reported that its activity had declined by up to 60%, with several countries imposing lockdowns as they rushed to contain the spread of the virus.

The startup recorded a loss of $ 528 million on total income of $ 600 million in the fiscal year that ended in March of this year.

But it has shown signs of a rapid recovery in recent months as some of its key markets have opened up in recent quarters. The startup said in today’s filing that four markets – India, Indonesia, Malaysia and Europe – account for around 90% of its overall revenue.

Oyo has also streamlined its relationship with hotels in recent quarters. Today, the startup owns no hotels and works with more than 157,000 partners and helps them operate hotels, resorts and homes. It does not promise any minimum guarantee to these partners.

The story of Oyo – in which SoftBank currently owns over 45% of the stake – begins with Agarwal, who left his rural town in search of a better education in Rajasthan. He often visited his friends in Delhi and stayed at their homes or rented cheap hotels. It was then that Agarwal, then in his late teens and recent college dropout, spotted a budget hotel that was struggling to fill its rooms every night.

Agarwal then, he said in previous conversations, convinced the hotelier to negotiate a deal allowing him to renovate the hotel and began marketing it to businesses in exchange for reduced future commissions.

This deal immediately proved to be a success, which then prompted Agarwal to explore expanding its offering – now using technology – to focus on neglected segments of the market.

Oyo’s offers

This was the start of Oyo, which immediately became successful and quickly gained the attention of a foundation run exchange of PayPal co-founder Peter Thiel.

Oyo first assumed the leading position of the market and then began to expand, starting with Southeast Asia, Europe, China and the United States, to name a few. -a. His aggressive expansion bet had a mixed success rate. It is doing well in Europe and Southeast Asia, but making inroads in China and North America has proven to be more difficult than the startup probably assumed.

At the height of this expansion, Agarwal, 27, invested $ 700 million in the startup. That year, he announced that he planned to spend $ 2 billion through an entity called RA Hospitality Holdings to increase his stake in Oyo to 30%, from 10% before the $ 700 million investment. of dollars. Filed documents show that now Ritesh and its other holding companies own around 32-33% of Oyo’s capital.

Oyo said in the file that its app has been downloaded over 100 million times and that 70% of its workforce live in India. As of December 2019, he said on the file, the startup viewed its total addressable market opportunity as serving 54 million short-lived storefronts.

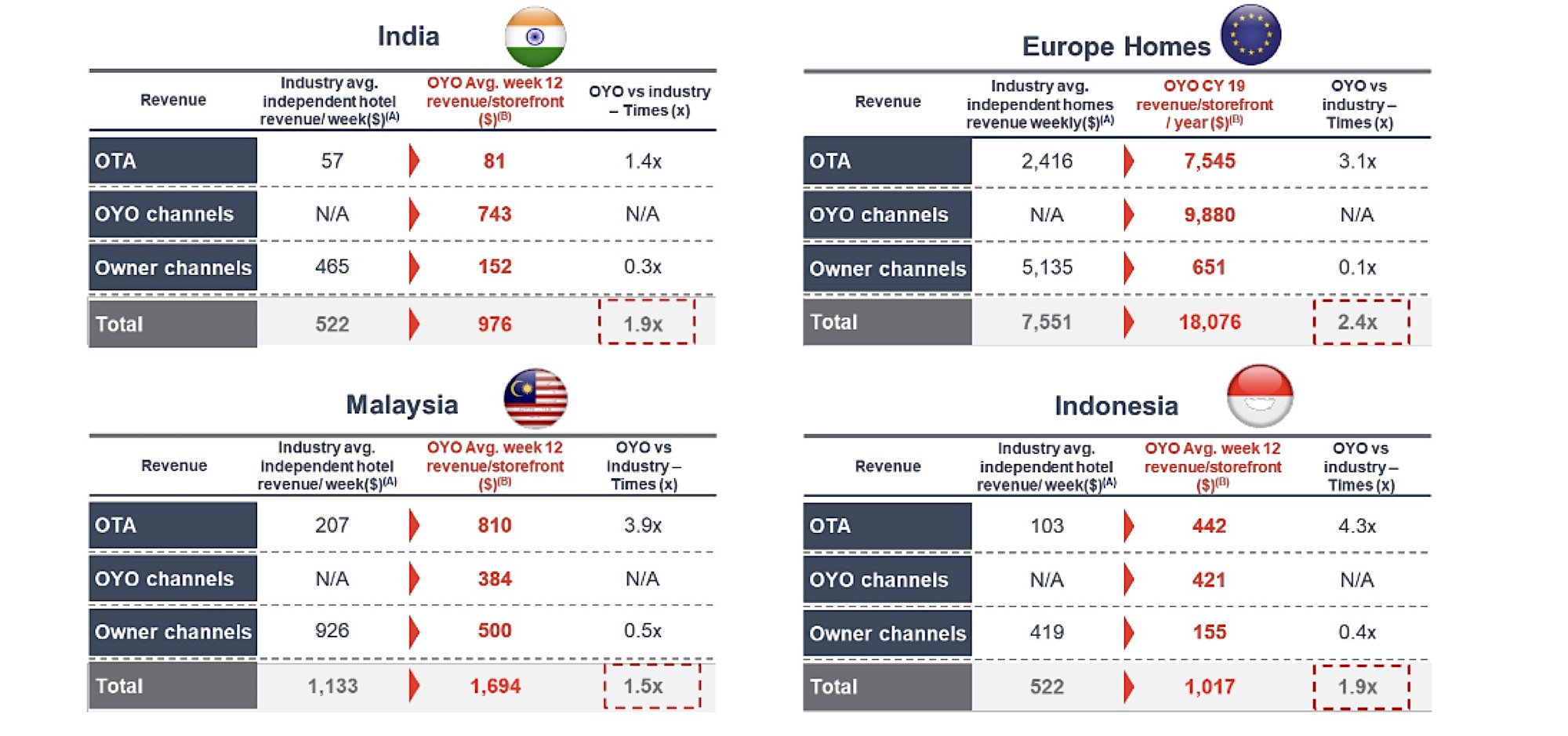

“In India, Indonesia and Malaysia, OYO-powered hotel storefronts that joined the platform in 2018 and 2019 outperformed independent hotels of similar sizes in India, Indonesia and Malaysia respectively in 2019 on average. After 12 weeks of membership in the OYO platform, hotel storefronts powered by OYO generated on average 1.5 to 1.9 times more revenue than the estimated average revenue in independent hotels of similar size in India, in Indonesia and Malaysia in 2019. In Europe, OYO- Electric house storefronts generated on average 2.4 times more revenue in 2019 compared to the estimated average revenue for an independently managed house in Europe in 2019 ”, a he said in the file.

Two interesting slides from the dossier that offer an overview of Oyo’s activities:

Average revenue of OYO-powered hotels and comparable independent hotels before COVID (US $ – 2019).

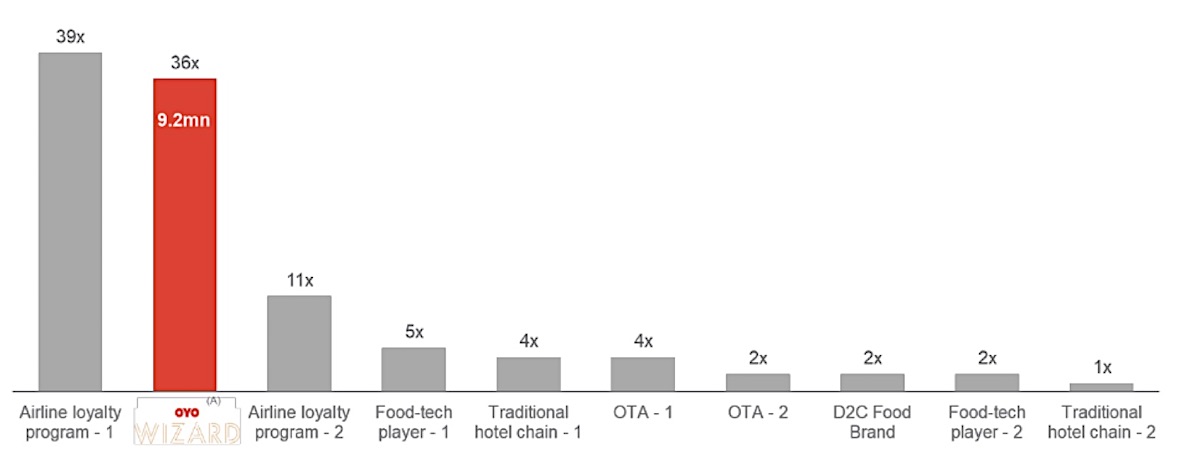

Oyo operates the second largest loyalty program in India among food, retail, hospitality and travel companies.

Oyo operates the second largest loyalty program in India among food, retail, hospitality and travel companies.

Catherine Shu contributed to this story.

[ad_2]

Source link