[ad_1]

Palo Alto Networks announced today its intention to acquire the Demisto security start-up for $ 560 million.

The company sees a tool that can help improve Palo Alto's security portfolio by adding a higher level of automation. "The addition of Demisto's automation and automation technologies will accelerate the development of Palo Alto Networks. Framework of the application strategy and are a major step forward in the company's goal of providing immediate threat prevention and response to security teams, "explained the company in a statement.

Palo Alto also hopes that Demisto's automated solutions will accelerate its artificial intelligence and machine learning capabilities to enable intelligent automation across the platform. Society brings more than just technology. It also carries its 150 customers to Palo Alto, a quarter of which is in the Fortune 500.

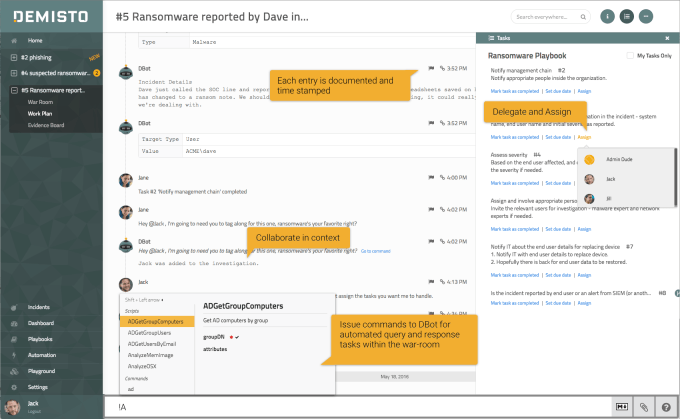

Prior to being acquired, Demisto had raised $ 69 million from Accel, Greylock, Stewart McClure and others. We hedged the company's Series A, worth $ 6 million. Investors have discovered a platform that allows security professionals with diverse backgrounds and skill levels to communicate with each other, while automating security tasks through a variety of security tools.

Here's how Slavik Markovich, CEO of Demisto, describes his company in this article:

"If you look at the security space, each company has its own API and interface to perform its tasks. [product]. What customers do not have is a multi-product workflow, "Slavik Markovich, CEO and co-founder of Demisto, told TechCrunch. This is what Demisto is trying to solve with this product.

With a purchase price of $ 560 million after collecting $ 69 million, it seems that Demisto has offered a satisfactory return to its investors, although the rumors that were before the sale raise prices. Customers will have to wait to see what impact Demisto's products and services will have on a larger company. The larger company offers much larger resources, but also brings a level of uncertainty, as in any acquisition scenario.

The acquisition is expected to be finalized during the company's third quarter, which is expected to occur in the coming months. As always, the acquisition is subject to regulatory approval.

[ad_2]

Source link