[ad_1]

According to data from the World Bank Federation in May 2018

Andrés Venegas Loaiza – [email protected]

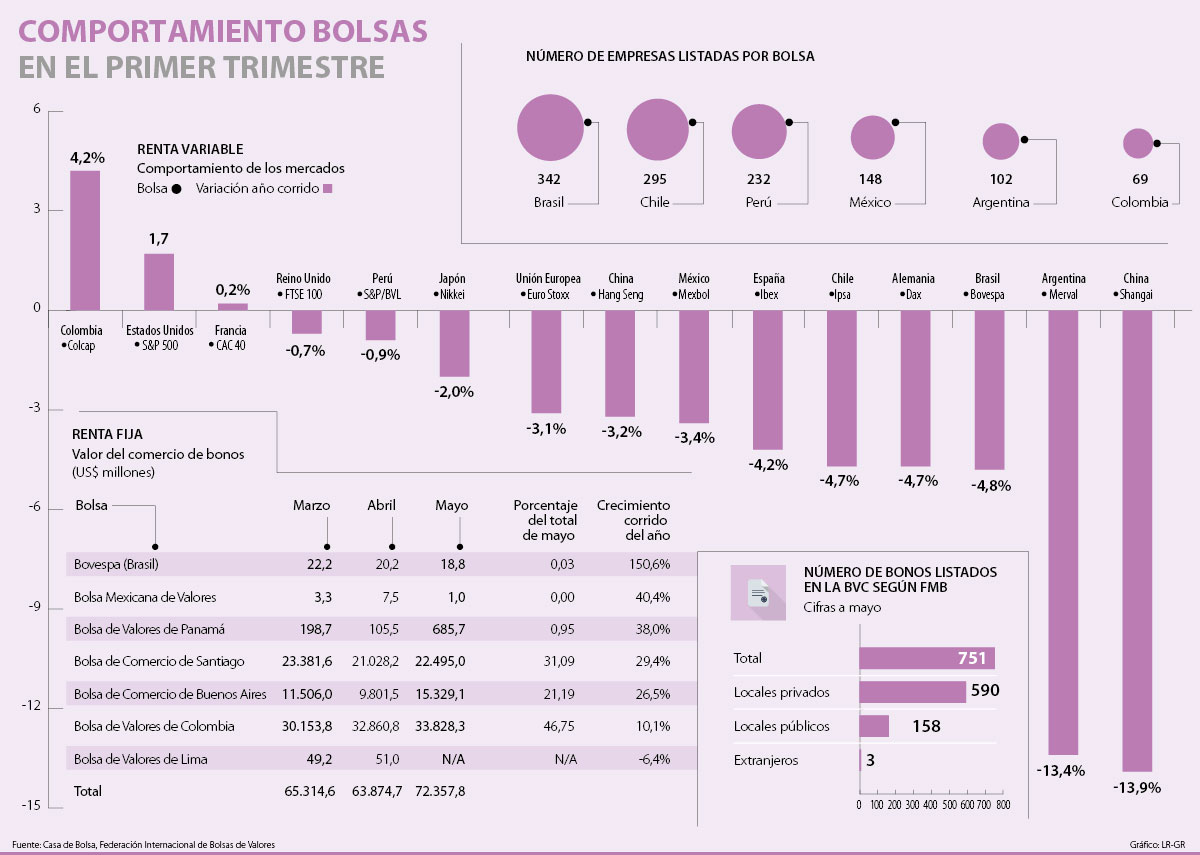

According to data provided by the monthly report of the World Federation of Bags (WFE, for its acronym in English), the Colombian Stock Exchange is, with updated figures in May, which has a higher percentage of the total value of the bond trade of the main stock exchanges in the region; Among these are Argentina, Brazil, Chile, Mexico, Peru and Panama.

While the local stock market gets 46.75% of the sum of the value of those appointed, the next is the Santiago Stock Exchange with 31.09% and the Buenos Aires Stock Exchange with 21.19%. At the beginning of the year, according to a report from the same entity, it was established that the country participation in fixed income transactions in 2017 was 47.22% for Chile, 36.56% for Colombia and 16.11% for Argentina, taking into account the number of transactions carried out.

The same report indicates that out of a total of 751 CVB bonds issued in May 2018, 590 are individuals, 158 are nationals and three are foreign nationals. These represent a growth of 10.1% so far this year, which is the second smallest after that achieved by the Lima Stock Exchange, of which there is no record since April, and lower than the one reached by the Buenos Aires Stock Exchange. Aires (see chart)

Regarding performance in variable income, according to a report from Casa de Bolsa, Colcap was the index with the highest growth among those in the region, very affected by the tensions emerging markets and geopolitics around the world. In addition, the local index is among the first in the world to show better performance since the beginning of the year.

This is evidenced by the fact that Colcap shows a positive change of 4.2% since the beginning of the year with the closing date last week, while those in the region have a negative variation of up to 39 to 4.8% in the case of Brazil to -13.4% in the case of Argentina.

In front of the rest of the world, the report notes that the Colombian index has had better growth than the S & P 500 in the United States which has 1.7% and the CAC 40 in France with 0.2 %, while other indices such as Japan, China and Germany have negative variations, driven by trade tensions between the United States and China, Donald Trump's policies and financial crises and policies of Europe.

Ómar Suárez, equity manager of Casa de Bolsa, points out that the Colcap's best behavior than the anter The above "should be compared to the stock markets of the region and emerging markets".

Andrés Moreno, stock market analyst, comments that "we must keep in mind that over 90% of trading volumes in Colombia are"

Moreno adds that good results are given, among other things, because that "the country has issued longer-term bonds, which helps to cushion future maturities, better long-term.In addition, it has not tended recently leftist governments, has a stable economic policy and never broke its debt, now its rating and its currency stable, making it a very attractive country. "

Regarding the number of listed companies, the BVC is among the region (with data from the World Bank Federation), it is surpassed only by the trade of Panama, Costa Rica, Bermuda and Barbados between , the right moment of Ecopetrol with a high price of oil up to 39%. this year, and the good results of financial institutions such as Bancolombia and Davivienda, drag the index, which is also beginning to see a recovery of businesses in the infrastructure and construction sector, the Brazilian stock market counts 342 and the Chilean stock market has 295 companies.

The Right Moment of the BVC in Variable Rental

Colombia is one of the countries with the lowest number of issuers in the stock market, according to information from the FMB, which means that its results are loaded into some species. Ecopetrol and Bancolombia weigh about 35% of Colcap, so as long as they see good results, the bag will remain in place. Although the index is one of the strongest globally, analysts point out that most species are losing value, and a dozen of them are driving them.

Source link