[ad_1]

Amazon Does It Again

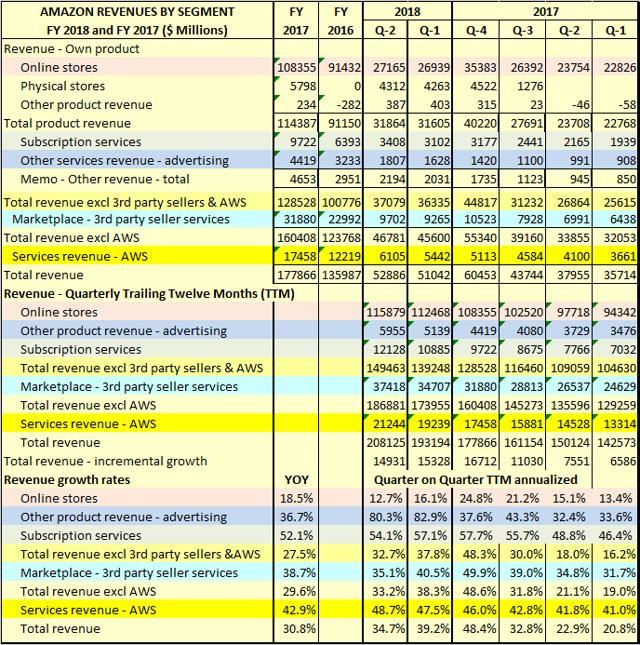

It is important to continue to grow at high growth rates over a long period of time. Maintaining high growth rates becomes exponentially more difficult in subsequent periods of time. A few quarters ago, the growth rate of Amazon Web Services [AWS] dropped, but it turned out to be only temporary. I continue to monitor the growth rates of all segments of the Amazon (AMZN) and I continue to be impressed by the persistence of high growth rates until the second quarter of 2018. Below, I review the growth rates of the second quarter business and operating income and discuss developing trends. Before that, I analyze the second quarter operating results to understand where the surprise comes from.

Amazon's Second Quarter 2018 Operating Profit Improvement Drivers

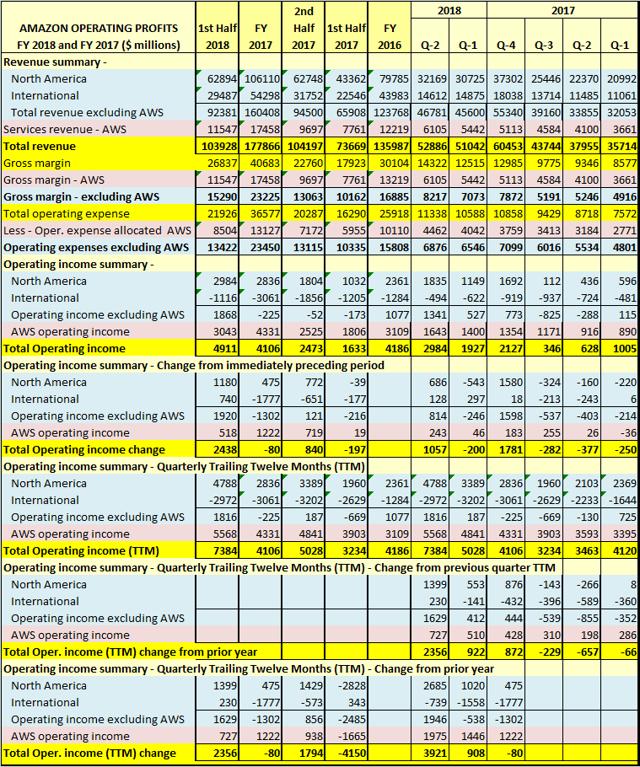

Table 1 below summarizes the operating profit for the second quarter and the first half of the year. 2018. as well as comparative figures for previous periods. Separate operating revenues are shown for North America, International and AWS

TABLE 1

Contribution of Amazon Web Services (AWS) in Q2 Results 2018

The result of Amazon's total operation for Q2 2018 was $ 4.911 billion, of which 3.043 billion (62%) was contributed by AWS. Amazon's total operating profit for the second quarter of 2018 increased by $ 1.057 billion compared to the first quarter of 2018, of which an increase of $ 0.243 billion (23%) was brought by AWS. Amazon's total operating profit for the second quarter of 2018 and the last twelve months (TTM) increased by $ 2,356 billion compared to the corresponding figures of the second quarter of 2017, of which $ 0.727 billion (31% ) were provided by AWS. Although AWS is clearly the largest contributor to operating profit for the quarter, it is not the largest contributor to the sharp increase in operating income compared to previous periods. The major contribution to the increase in operating income for the second quarter of 2018 comes from North American and international operations. Amazon does not provide additional analysis of the operating result beyond what is included in TABLE 1 above. But Amazon provides additional analysis of sales revenue. By using this additional income information and applying what I believe to be reasonable assumptions, I am able to develop further operating profit analyzes as shown in TABLE 2.

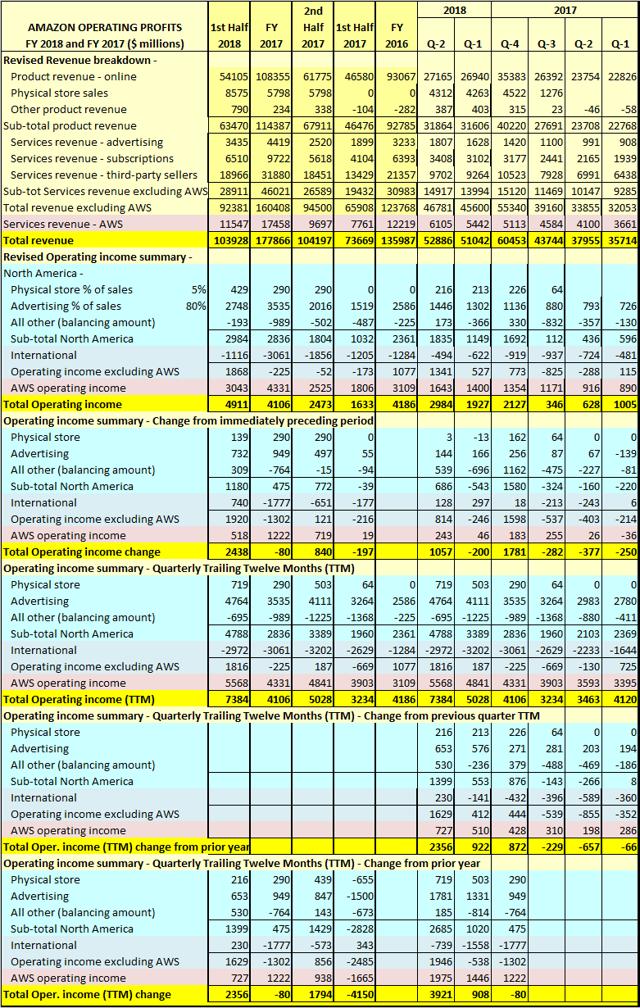

. Improvement in Amazon's operating profit was attributed in part to the increase in high-margin advertising revenue. In Table 2 below, I have assumed that the percentage of revenue from operating advertising revenue is about 80%. In addition, I have assumed that operating profit from Whole Foods' operations represents approximately 5% of physical store sales. After applying these assumptions, I find that the balance of North American operations has been in deficit, in line with the international operations sector. The good news is that it revolves around, with a small profit in the second quarter – increased premium subscription fees should still help in the coming quarters.

TABLE 2

TABLE 3

On a TTM basis from one quarter to the next, growth rates remained at high levels. However, all segments except AWS showed a decline in the growth rate. The growth rate of AWS has further improved from 47.5% annualized to 48.7%. Disappointingly, the services of third-party sellers declined from 40.5% to 35.1% after challenging AWS growth rates in previous quarters. Advertising is down slightly, from 82.9% to 80.7%, too early to make a judgment, but to be closely watched, given its high percentage of assumed contribution to operating profit. The growth rate of online stores posted a steady decline in sales growth from 16.1% to 12.7%. Perhaps, this slowdown in growth levels will accompany a significant reduction in expansion costs, which will lead to a much-anticipated improvement in operating margins. The results shown in TABLE 2 above suggest that this may already occur. The growth rate of subscriptions has held up well, indicating continued good growth in the number of Amazon Prime subscribers. The following quarters should be helped by the recently announced price increase of subscriptions

Amazon The Amazon Business Match The Price of Action

Any justification for the stock price of Amazon requires the maintaining high rates of sales growth and profit realization to begin to emerge with respect to online retail, both in North America and internationally. The second quarter results gave hope that profits could begin to emerge for the online retail business. The jury is always on how long high sales growth rates can be maintained. Close monitoring on a quarterly basis is required

Author's Note: As mentioned in previous articles, I was invited by Seeking Alpha to set up a Marketplace service. After some initial hesitation, I realized that this could be an opportunity to bring together the analysts among us (professionals and amateurs) to cooperate and facilitate the availability and accessibility of easily usable data in a wide range of settings. companies that interest us. I plan to proceed in the near future. If you would like to know more and stay informed about my progress, please click on the "Follow" button next to my name at the beginning of this article.

Disclaimer: The opinions expressed in this document are for information and education purposes only. and should not be construed as a recommendation to buy or sell the shares mentioned or solicit transactions or customers. Past performance of the companies discussed may not continue and companies may not achieve the expected earnings growth. The information in this document is believed to be accurate, but under no circumstances should anyone act on the information in this document. I do not recommend that anyone act on investment information without first consulting an investment advisor and / or tax advisor as to the suitability of these investments for their specific situation.

Disclosure: I / we have no positions in all the stocks mentioned, and no plans to initiate positions in the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link