[ad_1]

The four main findings of the survey

1. Increased popularity of Chinese smartphone brands

We conducted a Handset market survey in 2017 and 2018 with 1056 and 1788 respondents respectively. About 96% of respondents in 2018 are in mainland China, up from 100% in 2017.

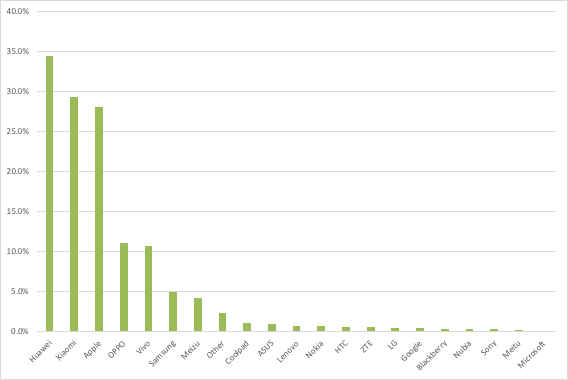

Figure 1: Which smartphone brand do you use most frequently?

Source: Invbots.com

In 2018, the 5 most used handset brands in 2018 are Huawei (27.80% chose), Xiaomi (XI ) (23.25%), Apple (NASDAQ: AAPL) (22.55%), OPPO (8.41%) and Vivo (7.83%). Huawei won first place in 2018 as Apple's popularity dropped. Xiaomi, along with other brands of Chinese smartphones, also gained market share.

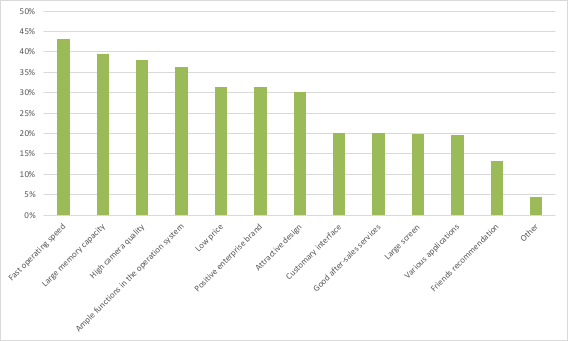

Figure 2: Comparison of the popularity of the smartphone brand between 2017 and 2018:

Source: Invbots.com

In tier 1 cities, Huawei, Xiaomi and Apple have the highest popularity, while in other cities, Huawei, OPPO and Vivo's popularity have increased significantly. decreased significantly. However, the popularity of the Chinese brand is much lower outside of China.

Figure 3: Popularity of Smartphone Brand by Cities:

|

Huawei |

Xiaomi |

Apple |

OPPO |

Vivo |

|

|

Chinese Cities (1 Level] * |

28% |

24% |

24% |

9% |

8% |

|

Chinese cities (other levels) |

30% |

21% |

15% |

12 % |

11% |

|

Other (Hong Kong and foreign countries) |

1% |

3% |

70% |

0% |

2% |

* 1 st level cities include Beijing, Shanghai, Shenzhen, Guangzhou, Chengdu, Hangzhou, Tianjin, Wuhan, Chongqing, Nanjing, Suzhou, Xi'an, Zhengzhou, Changsha, Shenyang, Qingdao, Ningbo, Dongguan and Wuxi

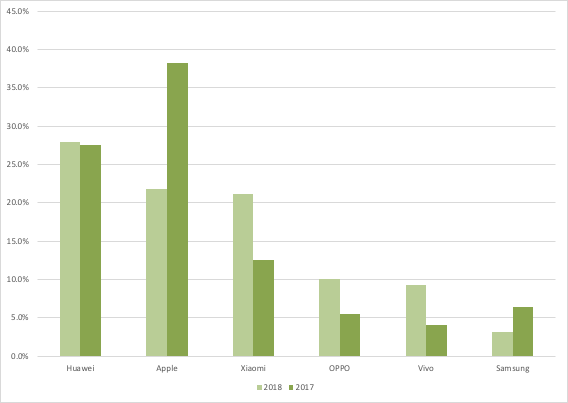

2. Which brand to buy next? Xiaomi in front of Apple

Regarding the question of which brand to buy for the new handsets, Huawei, Xiaomi, Apple, OPPO and Vivo are the First 5 scored In this question, Xiaomi is ahead of Apple as a # 2 brand.

Figure 4: Brand new smartphone (Bar Graphs: Top 5 Brand to Buy vs. Top 5 Existing Brands): [19659011]

Source: Invbots.com

In this multiple-choice question, we assumed that respondents would have the same probability of buying the chosen marks. After calculating the probability that each respondent will buy each brand, we take the average of 1788 respondents and obtain the following probability:

3. Apple and Xiaomi users have high fidelity

We selected respondents who only selected one brand name for the current phone to investigate loyalty. For each respondent, we calculated their likelihood to buy each brand for the new phone and take an average to get the likelihood of buying their current brand again.

Apple users are the most loyal to their smartphone brand since 71% of Apple users are ready to buy an iPhone again. Among Chinese suppliers, 64% of Xiaomi users will buy the same brand for replacement, while Huawei loyalty is 61%.

Excluding existing users choosing the same brand for replacement, Huawei has the largest popular vote, 83% Figure 5: Popularity of the new smartphone brand, based on the existing smartphone brand *:

|

Brand of existing telephone |

|||||

|

New telephone |

Apple |

Xiaomi |

Huawei |

OPPO |

Vivo |

|

Apple |

71% |

8% [19659017] 12% |

12% |

7% |

|

|

Xiaomi |

5% |

64% |

14% |

10% |

10% |

|

Huawei |

14% |

15% |

61% [19659019] 26% |

28% |

|

|

OPPO |

3% |

3% |

4% [19659017] 35% |

13% |

|

|

Vivo |

2% |

3% [19659019] 4% |

10% |

34% |

|

Source: Invbots.com

* Users can choose from multiple choices

4. Xiaomi IoT Peripherals to high penetration

More than 92% of respondents use at least one Xiaomi IoT device.

98% of Xiaomi users use Xiaomi IoT devices, followed by 96% for Huawei users, 92% for OPPO, 91% for Vivo and 88% for Apple.

Xiaomi users have an average of 2.55 different types of IoT Xiaomi devices, while non-Xiaomi users have an average of 1.56. This shows that Xiaomi users have a great loyalty to the brand and an affiliation to the Xiaomi brand. Probability of Xiaomi users using Xiaomi IoT device is higher than non Xiaomi users among all devices except Mi TV, probably because Mi TV's price level is higher than others.

Figure 6: Proportion of Xiaomi users and non-Xiaomi users using the following devices):

|

Xiaomi users |

Non-Xiaomi users |

|||

|

Mi TV |

10% |

29 % |

||

|

Mi Box |

33% |

16% [19659022] Notebooks and Related Accessories |

39% |

21% |

|

Appliances |

15% |

10% |

||

|

] Housewares |

18% |

11% |

||

|

Travel gadgets for children |

37% |

19% |

||

|

Routers & accessories for smartphones |

4% |

4% |

||

|

] Emergency batteries and chargers accessories |

27% |

14% [19659022] Audio |

40% |

19% |

|

Lifestyle products |

27% |

10% |

||

|

Other |

6% |

3% |

Source: Invbots.com

Figure 7: Number of IoT devices by br and:

|

Huawei |

Xiaomi |

Apple [19659013] OPPO |

Vivo |

|

|

Number of types of devices Xiaomi IoT |

1.93 |

2.55 |

1.87 |

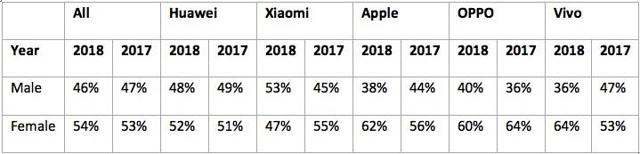

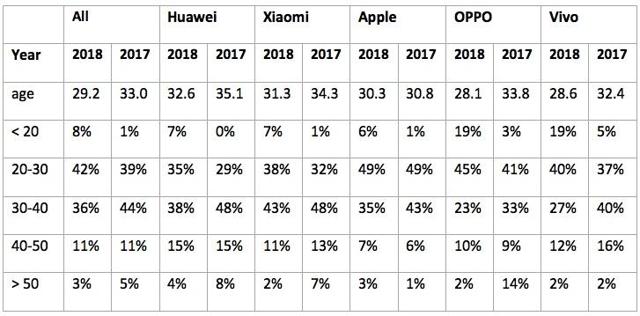

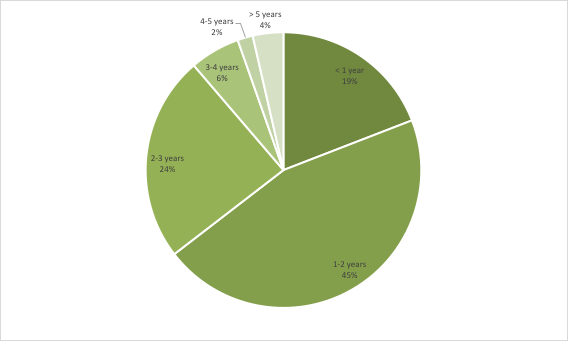

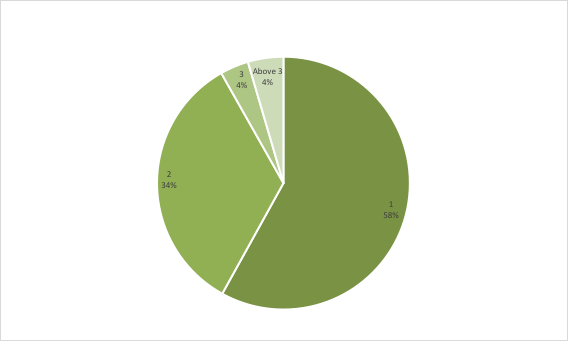

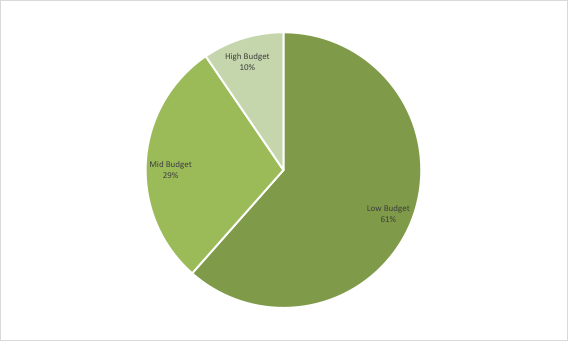

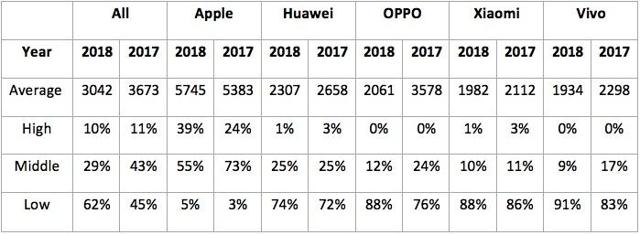

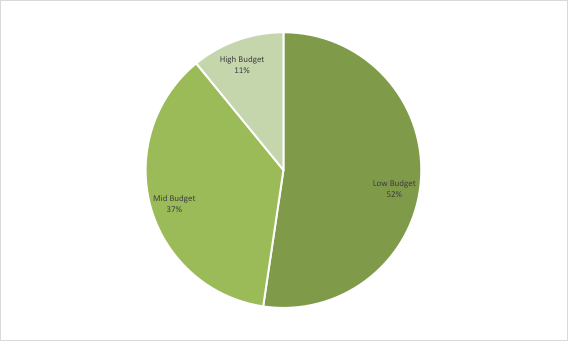

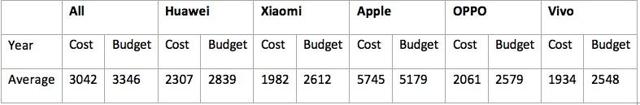

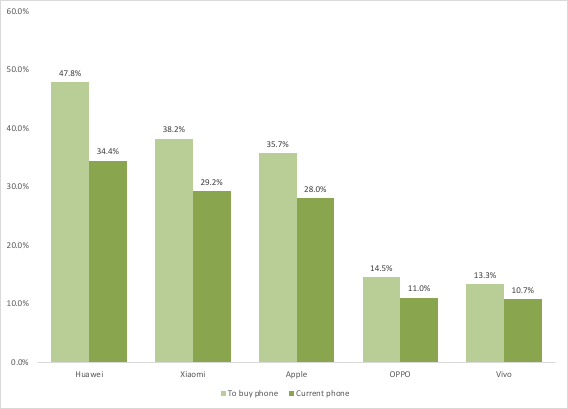

1.6 [19659017] 1.64 [19659134] Source: Invbots.com Other interesting results from the surveyXiaomi – male users dominate, the average age of users Women account for a higher proportion Apple smartphone users, OPPO and Vivo, while male users are dominant in Xiaomi. Figure 8: Popularity of the smartphone brand by sex: Source: Invbots.com The average age of OPPO and Vivo users was younger than that of the whole users. The age of Xiaomi and Huawei users is the highest. Figure 9: Popularity of the smartphone brand by sex: Source: Invbots.com The average lifetime of smartphones surveyed surveyed in 2018 is 1.87, or 51% more than that. in 2017. Thus, many users have lengthened Product Replacement Cycle Figure 10: Age Distribution of the Smartphone: Source: Invbots.com The average age of the Apple handset at 2.28 is the highest in 2018, and has increased significantly by 1, 25 in 2017. This would imply many users have not updated his phone during the 2017 product cycle. The average age of Xiaomi smartphones was 1.72, up 31% year-over-year. , and the average age of Huawei was 1.64, up 41% over the previous year . Source: Invbots.com The possession of smartphones increases in 2018 In a poll of 2018, 58% of respondents answered using 1 smartphone, while 34 % used 2 phones and rest by using 3 or more phones. On average, each respondent uses an average of 1.54 smartphones, more than respondents in 2017 (1.38), an increase of 11.59%. Figure 12: Number of smartphones used: Source: Invbots.com For respondents who report using 2 handsets, 56% use both Android phones. Smartphone costs 17% drop in 2018: Xiaomi – among the lowest costs Figure 13: What is the cost of your smartphone? Source: Invbots.com Regarding the cost of existing smartphones, Apple phone users pay the highest of all. The average cost of Apple smartphones was 5,745 RMB, with 7% year-on-year growth, while the average cost of the industry declined. The average cost of Vivo and Xiaomi handsets is less than RMB 2,000 Figure 14: Cost of smart phones per budget (high budget, average budget, limited budget): * High budget: over RMB 6,000; Average budget: RMB 3,000 to 6,000; Small budget: less than RMB3,000 Source: Invbots.com Budget for new smartphones declined: Xiaomi among the lowest Regarding the budget for the purchase of new smartphones , the average smartphone budget in 2018 is RMB3,042, with a decrease of 22%. Figure 15: Budget for new smartphones: Source: Invbots.com Comparing the answers to the two questions: "cost of the existing phone" and "new phone budget", the budget of the smartphone user has increased by 10% compared to the average cost. The budget to buy Chinese smartphones has increased from 19% to 24% of the cost while Apple's phone budget is 11% lower than the existing cost. Figure 16: Comparison of Costs and Budget of the Smartphone: Speed, memory and the camera are the top three reasons to buy a new phone Figure 17: Reasons for use the preferred brand: Source: Invbots.com Figure 18: Reasons to use the preferred smartphone brand (by make): ] Source: Invbots.com

Disclosure: I / we have no positions in the stocks mentioned, and we do not expect to take position in the next 72 years hours I wrote this article myself, and it expresses my own opinions. I do not get compensation for that. I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Tags China Chinese loyalty market popularity Private profits smartphone Survey users Xi Xiaomi |