[ad_1]

Most industrial raw materials reached their lowest level in late 2015 and early 2016. Copper, the leader of the pack in its sensitivity to global economic conditions, found its nadir in January 2016. A this time, the weakness of the domestic Chinese stock market market caused a tsunami of sales on the stock markets around the world. The S & P 500 index fell more than 11.5% in the first six weeks of 2016, as slower growth in China led to the sale of stocks and commodity markets

reached a record low of $ 4.6495 per pound steadily declining and finally found a fund at $ 1.9355 in the first month of 2016. A ten-month price consolidation period followed that kept the metal red in the range of $ 2 to $ 2.30 per pound. In November 2016, copper jumped higher and reached higher and higher, peaking at $ 3,320 at the end of 2017. During the copper rally, the price did not increase. not exceeded the previous lows. perfect bull market. However, last week the price of copper fell and fell below some critical technical levels.

A stronger test followed by a dip

In early May, the threat of a strike on the world's largest copper mine. Escondida in Chile, took the copper price just 0.65 cents below its December 2017 high and the level of critical technical resistance. After reaching $ 3.3155 and learning that the union and mine operator, BHP, was sitting at the bargaining table, the price of the red metal went down.

Source: CQG

As highlighted in the weekly chart, nearby COMEX copper futures have abandoned all gains from May 30 to June 7 and much more. The price dropped to lows of $ 2.7855 a pound last week as the price momentum indicator crossed the decline. In late June and early July, the copper futures market did something that it had not done since January 2016.

The bullish model since early 2016 is no longer

From January 2016 until early June 2018, copper has never violated a technical support level, but this has changed in recent weeks.

Source: CQG

As the weekly chart illustrates, red metal has increased over the eighteen-month period, and each trough has been successively higher. In March 2018, copper posted a low of $ 2.9460 per pound, a record low of $ 2.9205 from the December low of $ 2.88750 per pound. During the week of June 25, copper removed the first level of support, and last week, it fell below the other two and the lowest price in a year. The next level of support for the red metal is $ 2.47 per pound at the May 2017 low. The uptrend in the market has evaporated in recent weeks

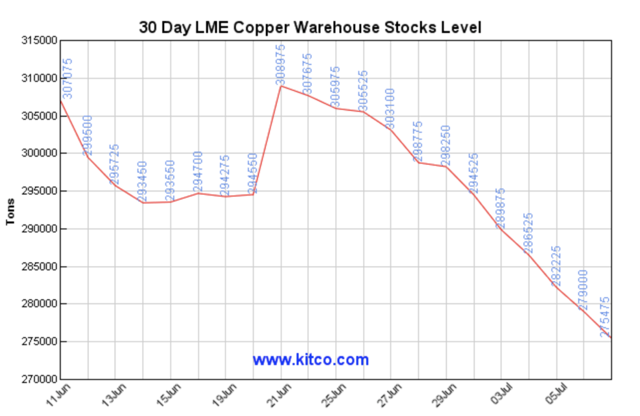

Meanwhile, the decline Prices have been accompanied by a drop in copper stocks at the London Metal Exchange over the last few weeks.

Source: Kitco / LME

As shown in the graph, LME stocks went from 308 975 tonnes on 21 June to 270 550 tonnes on 9 July. Stocks of the world's major copper exchange have done little to stem the price decline in recent weeks

Copper prevents tariffs

Dr. Copper has long been diagnosing the health and well-being of Global economy. Nowadays, economic news is dominated by the ongoing trade dispute where US tariffs on steel, aluminum and Chinese products have provoked a protracted protectionist wave of retaliation from trading partners Americans around the world. At the center of the matter is a dispute between the United States and China. President Trump seeks " reciprocity and equity " in international trade, while US trading partners, including the Chinese, want to maintain the status quo. Tit-for-tat's protectionist maneuvers have raised fears that the dispute could lead to a protracted trade war that would plunge the global economy into a recession. The decline in the price of copper, as well as the prices of many other industrial and agricultural products in recent weeks, are probably a reaction to growing fears of recession. The fact that the trade issue is a serious and potentially devastating factor for the global economy is a break from the critical areas of technical support.

Escondida could have an impact on the price over the next few weeks

sent the lower copper price and broke the back of the bull market since early 2016, the labor negotiations between BHP and the union on a new contract enter the home stretch. The current contract expires at the end of July and both parties have reached an agreement on more than 20% of the "points of interest" separating them. The union filed applications with BHP on July 1, while copper was preparing to reach its most recent peak. The proposal includes a one-time premium equal to four per cent of dividends paid to shareholders in 2017, ranging from $ 34,000 to $ 40,000 per worker. The union is also seeking a 5 per cent wage increase. The five points of contention include a new health care plan, contractual benefits, good practice bonuses and a bonus related to the production goal. Last year, a strike at the mine caused the loss of about 156,000 tonnes of products and a loss of $ 1 billion for BHP. The outcome of the negotiations could have an effect on other Chilean copper mines and other properties in South America where collective bargaining will take place later this year.

Negotiations between the union and BHP will continue until July 24th. its final offer. Between July 27 and 31, the union will vote to accept or reject the offer. In the case of a rejection, a strike will begin after a ten-day mediation period by the Chilean government. The threat of a strike pushed the price of copper to 0.65 cents per pound from the high of December 2017 at $ 3.3220 per pound. A real strike would probably turn the bear market into a bull despite the current commercial problems weighing on the price of red metal.

Technical Levels to Watch Downward

Next Level of Critical Support for Red Metals Price Copper on COMEX's near copper futures contract in September is $ 2.47 per pound, which is significantly lower than the closing price on July 10 at $ 2.8395. The month of July could be a volatile month for the red metal, a harbinger of the volatility of many other industrial metals and minerals, with copper being a leader in the asset class

in Chile , in South America and around the world. A drop in production could weigh on stocks and cause a significant rebound in the price of copper in the coming weeks. At the same time, the continuation of the protectionist wave sweeping the world is likely to weigh on the price of metal and other raw materials as the risks of a war build up. trade and recessionary pressures. However, a settlement of the US-China trade dispute with other trading partners in Canada, Mexico and the European Union could pave the way for an economic boom that would strongly support the price of the United States. copper and other raw materials. materials. The bottom line is that the copper market is preparing for a month of madness with great price variability because the information cycle is likely to provide a myriad of elements that can fluctuate every day. the price.

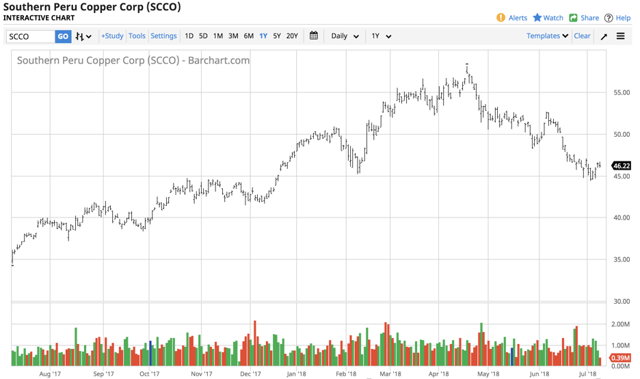

Copper is via LME or COMEX futures contracts and futures contracts. Meanwhile, the JJCB ETN product that replaced JJC earlier this year continues to build critical mass but remains an illiquid product with only $ 11.39 million in net assets and an average daily volume of 1,545 shares dated July 10th. work of monitoring the price of the metal.

Source: Barchart

As the graph shows, the SCCO reached $ 52.63 per share on June 6, with copper approaching its most recent peak and falling to less than $ 46 per share at the end of last week. While SCCO is tracking the price of copper, any labor problems that could affect this company would likely cause a divergence between the price of the red metal and that of the SCCO over the next few months.

I think we will see a lot of volatility throughout the month of July, which means that Dr. Copper could dominate the markets of all asset classes other than a quiet summer season. The recent price action broke the back of the upward trend in the copper market that lasted eighteen months. We are likely to see significant volatility and price fluctuations in the red metal in the coming weeks, as the factors facing the market have the potential to move up and down at any time.

Reports on the most comprehensive products available today from the author ranked # 2 in both raw materials and precious metals. My weekly report covers the market movements of 20 different products and provides bullish, bearish and neutral calls; directional negotiation recommendations, and action ideas for traders. More than 120 subscribers derive real value from Hecht's product report

Disclosure: I have / we have no post in the stocks mentioned, and we are not considering no position in the next 72 hours. write this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose title is mentioned in this article.

Additional Disclosure: The author still has positions in commodity markets, options, ETFs / ETNs and commodities. These long and short positions tend to change on an intraday basis

Publisher's Note: This article covers one or more securities trading at less than $ 1 per share and / or with a market capitalization of less than 100 millions of dollars. Be aware of the risks associated with these stocks.

[ad_2]

Source link