[ad_1]

This is definitely a season of interesting results for the airlines. Notably, the group traded after United Airlines (UAL) announced positive results on July 18 with strong unit revenue growth, higher forecasts and capacity limits. A week later, the group traded after a negative report from Jet Blue (NASDAQ: JBLU), after posting lower-than-expected results (citing higher fuel costs) and lowered growth expectations for the second half .

Southwest Airlines (LUV) once again reversed the trend and the company's stock jumped on Thursday and Friday after posting a solid earnings report with better-than-expected prospects for the rest of the year. ;year.

Although good quarterly results rebounded the stock from its previous lows, the stock remains cheap and the profitability normalized and the ability to generate cash flow available, motivated by the history of the operational efficiency of the company, the user-friendly management of shareholders, and a new underestimated revenue management system are still underestimated by the market.This is probably due investors' concerns about rising fuel prices (and an extrapolation of current trends), stock price volatility and concerns over short-term performance and the competitive threat

Second Quarter Overview and 2018 Outlook

Despite some non-recurring headwinds, Southwest had a good second quarter. This statement from CEO Gary C. Kelly sums up the results:

"Despite higher fuel prices and the expected effects of the 1380 accident, we achieved solid financial results, including a profit per quarter. record action for the second quarter of 2018 I am particularly proud of the heroic efforts of our people to meet and overcome the challenges resulting from the accident. "

Revenue declined slightly, mainly due to the impact 1380 flight accident (which reduced revenues by $ 100 million), but profits were solid and the management team expects strong demand and a reduction in headwinds in the second half of 2006 The company posted strong operating margins and a return on invested capital (after tax) of 16.9 Cash flow and shareholder returns were also strong raised $ 1.1 billion to FCF and returned $ 593 million to shareholders through stock repurchases ($ 500 million) and dividends. ds ($ 93 million). The company has a stock repurchase authorization of $ 2 billion for $ 350 million and has returned nearly 100% of FCF to its shareholders over the past 5 years. On the operational side, the company is excited about its new booking system and is maintaining its forecast of approximately $ 200 million in pre-tax results as it will be able to better manage its rates. The medium- and long-term accretion of this new revenue management system still seems underestimated by the market (potentially EBIT / year of $ 500M, since we see about $ 200M in initial deployment) , probably because of a lack of clear direction beyond the year. What the new revenue management systems allow Southwest to do is better adjust and manage the price of its tickets. For example, if Southwest wanted to match the rates of a very low cost carrier like Spirit Airlines (SAVE), they would have to pay the lowest fare for the whole day (which would lead other competitors to do the same), now they can choose and choose specific slots from which to lower the tariffs, and are much more agile in their price capacity.

Other Statistics and Prospects for Exploitation:

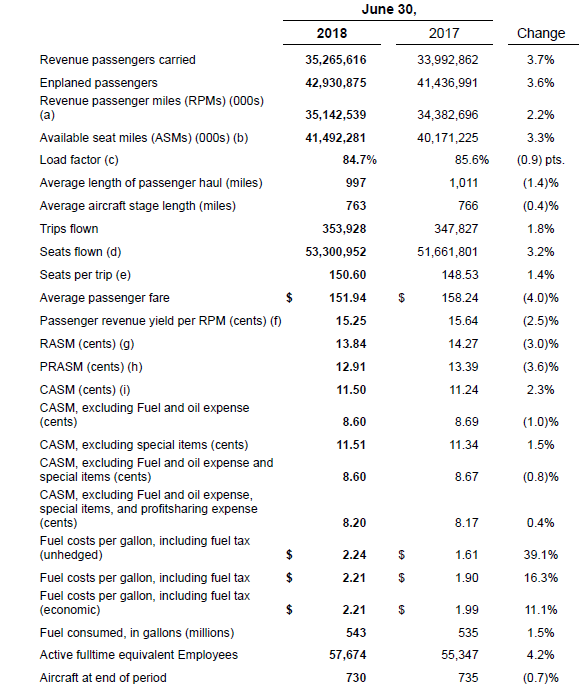

(Source: 7/26 8-K

- ASM (Capacity): Guided to increase in the low range of 4% Y / Y for 2018 [19659012] MSAR (Unit Income): Guided around Y / Y flat for Q3, and should check in Q4

- CASM eg fuel / oil and profit sharing (unit costs): Stable 1% compared to 2017 8, 47 cents

- Economic cost of fuel estimated at about $ 2.25 / gallon for the third quarter Overall, although the Southwest still has headwinds in the third quarter (mainly due to some short-term events having a negative impact on performance), the company should be able to pull out of the game. the performance of half of the year, aided by new deliveries of aircraft and l & # 's; 39, energy efficiency improvement, the integration of its new system of r Saving and reducing temporary headwinds

Update of the valuation

About Southwest, the stock price has fluctuated considerably, dropping to nearly $ 50 per share before to recover around $ 58 per share after the second quarter.

Multiple:

Earnings Yield

The airlines are currently trading on a P / E TTM of 9.65 and a P / E forward of 13.26, offering a profit return of 10, 4% or 7.5%, respectively. The application of an average of 3, 5 and 7 years average and median historical P / E ratios of Southwest to the revised estimate of $ 4.37 for EPS of 2018 (the consensus analysts is $ 4.24, down slightly from the previous quarter) translates into a discounted value of about

Return of dividend and share repurchase

Dividend yield Southwest is still fairly low at around 0.92% (NYSE: TTM) but management has regularly repurchased shares with an average redemption yield of 4.50% over three years. It is likely that other share buybacks will be permitted and continued in the future given Southwest's strong FCF production.

FCF yield

Southwest is currently trading at a net price / earnings ratio of 16.23 TTM, offering free cash

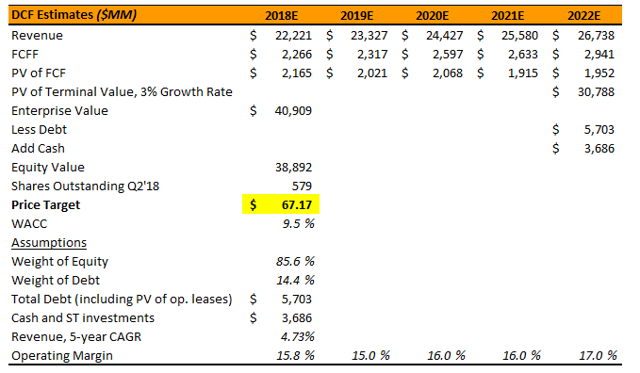

I have projected Southwest's financial statements to calculate free cash flow projected for five years, then applied a perpetual growth rate of 3% to arrive at a terminal value. Based on relatively conservative projections, I calculated a value of about $ 67 / share with a WACC of 9.5%, indicating that Southwest Airlines is slightly understated relative to the value of its shares. future free cash flow. It is important to know that the second largest cost of Southwest (fuel and oil) is extremely volatile, which could make the future financial performance of Southwest very different from my predictions (or anybody else's). elsewhere). That said, I am confident that my projections represent a near-normal level of operational performance for Southwest Airlines

(Source: My Own Chart, SEC Filings Data and My Own Projections)

Key Assumptions: [19659031] 4.73% CAGR revenue over 5 years, and a final growth rate of 3% (which is down from most analysts' estimates.)

- Debt includes my estimate of the current value of off-balance sheet

- Wages and salaries remain high around 34% of turnover, before dropping slightly to 33% for the year-end (the 5-year average is about 31%) . This high cost is the result of a combination of factors, including the unionized nature of the Southwest workforce and the friendly culture of Southwest employees.

- The costs of fuel and oil increase slightly over the next few years. This appears to be a relatively conservative estimate of a normalized level as it is consistent with historical averages and does not account for the increased fuel consumption of the Southwest fleet (Q2 available miles per gallon were up 1.7% y / y). (Source: My own chart, data from SEC filings)

- 2018 Capex of $ 2.05 billion (average of guidance), held about $ 2 billion for the projection period then Southwest expands its fleet. While all of this may seem like a growth investment, the continued modernization of the fleet is becoming an essential part of the airline industry and Southwest will likely continue to invest in fleet upgrades in order to maximize unit savings. CEO Gary C. Kelly also mentioned on the T1 earnings call that the new tax reform will help their growth and modernization efforts.

- Southwest is able to maintain its loyal customer base and high level of operational efficiency. Statistics on this front are again positive for the quarter, despite some recent challenges

Risks:

- Slowdown in US GDP: A general slowdown in the economy would definitely damage consumer confidence and therefore the request for air travel. It is a cyclical risk that the company would be able to overcome, but the course of action should most likely be affected.

- Costs continue to increase above my estimates of normalized levels: If Southwest's key costs continue to rise in the long run (throughout market cycles), the value of the cost will be higher. company would fall below my estimates. Although the company has a strong history of cost and operational efficiency, some elements are beyond the control of the company.

- Competition intensifies: Southwest is now competing with very low cost carriers and can hardly maintain its current demand. levels. The new revenue management system is a step in the right direction for the company, but it will still be a difficult battle. In addition, although the industry has stabilized and become more profitable recently, it is not entirely excluded that the positive trends of the industry can reverse.

Conclusion

Although the stock is now trading higher Southwest's normalized earnings and the ability to generate free cash flow still appear underestimated by the market, especially if we take into account the operational and cost performance, the shareholder-friendly management team and the new revenue management system. An investment at current prices remains attractive relative to other opportunities in the market, and Southwest Airlines remains a solid buy.

To add a quick portfolio thinking; If you are worried that the price of oil will increase, it's not a bad idea to have some upward exposure, as this would lessen the volatility and also offer the opportunity to buy / sell oil. two placements at attractive points throughout the year. market cycles.

Disclosure: I am / we are long LUV

I have written this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link