[ad_1]

Pinterest, The nearly ten-year-old visual search engine has unveiled its S-1 as it prepares for a first public offering scheduled for April.

With a value of $ 12.3 billion in 2017, Pinterest has taken the first official step of its IPO in 2019 two months ago. hiring Goldman Sachs and JPMorgan Chase as principal underwriters for its offering to the NYSE. We are now looking more closely at its financial data.

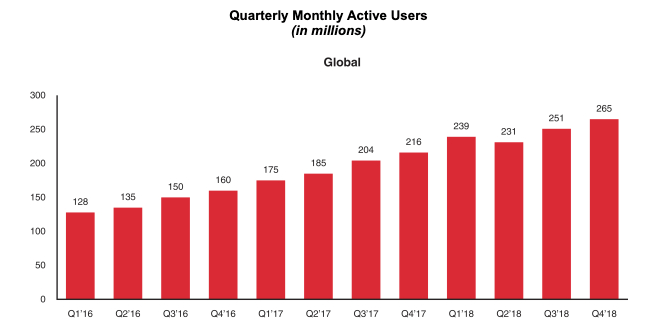

The San Francisco-based company, which trades under the symbol "PINS", posted sales of $ 755.9 million in the year ended December 31, 2018, up from 472 $ 8 million in 2017. 2016, reaching 265 million euros at the end of last year. Meanwhile, the company's net loss declined to $ 62.9 million from $ 130 million in 2017.

In total, Pinterest has achieved a turnover of $ 1.525 billion since 2016.

Similarly, Pinterest has raised approximately $ 1.5 billion from venture capital companies, listing early and advanced investors on its table. The main players in the company are Bessemer Venture Partners, FirstMark Capital, Andreessen Horowitz, Fidelity and Valiant Capital Partners, although the deposit does not indicate the ownership percentage of each of these entities.

Pinterest has more than 250 million monthly active users, generating advertising revenue of about $ 700 million in 2018, compared report, an increase of 50% over the previous year. The company employs 1,600 people in 13 cities, including Chicago, London, Paris, São Paulo, Berlin and Tokyo. According to the ranking, Pinterest has signed a lease agreement for the brand new San Francisco headquarters, which will be built near its current headquarters.

The Company's average total revenue per user (ARPU) for the year ended December 31, 2018 was $ 3.14, up 25% year-over-year. Meanwhile, its average revenue per US subscriber was $ 9.04, an increase of 47% over the previous year.

Pinterest was launched in 2010 as an animated social media start-up and mobile app for sharing images and inspiring quotes. Under the leadership of Ben Silbermann, co-founder and CEO, the group has been growing over the years trying to monetize the platform, which relies on advertising revenue to stay afloat. Last fall, in an effort to turn more of its users into buyers (and compete with Instagram), the company rebuilt the infrastructure behind its product pins. The update provided updated price and inventory information for all product pins, direct links to retailers, a new "Products like this" category under each decoration pin for all product pins. fashion and home decor, as well as other user-friendly adjustments.

Pinterest's IPO documents came just hours after another technology unicorn, Zoom, which went on sale. Several billionaire technology companies have opted for their IPO in 2019, even after a government shutdown that lasted several weeks and resulted in a significant delay in bids. Pinterest is following Lyft, which unveiled his S-1 and nearly $ 1 billion in 2018 losses just three weeks ago. Both Uber and Slack are expected to make their IPO documents available to the public soon.

Pinterest may be looking to take advantage of the hype of the 2019 IPO led by Uber and Lyft, although The Information has already reported on Pinterest's offer. could suffer because it's a social media company, that is, it's often compared to Facebook and Twitter, two companies that have repeatedly expressed concerns about privacy. users.

We'll have to wait a few more weeks to better understand Wall Street's demand for Pinterest. If this sounds like Lyft's IPO, which is already oversubscribed, the company will be fine.

This story is updated.

[ad_2]

Source link