[ad_1]

President Donald Trump once again took to Twitter to proclaim OPEC for driving up oil prices. The group is a good scapegoat for blaming the rise in gas prices at home, but getting it to pump more crude will not make them go down long. The way to really lower prices is for him to change his policy on Iran.

Unfortunately, this should not happen, so oil prices may well continue to rise. Oil prices climbed more than 50 percent in a year and nearly hit $ 80 a barrel last week, with traders anticipating that the global production margin available to offset supply disruptions should be seriously decrease.

They know something that the president does not understand or understand: when the sanctions against Iran come into effect in November, producers do not have the opportunity to offset the loss of production. If Trump manages to stop all Iranian oil exports, he will have to replace 2.7 million barrels per day of Iranian supply. It's a big hole to fill.

And if they can not do it, the cost will be high. According to Bank of America Merrill Lynch, a complete shutdown of Iranian sales could drive up oil prices above $ 120 a barrel if Saudi Arabia can not keep up.

In the world of Trump, the prices of gasoline on which it focuses should already be lowered. On Wednesday, Saudi Arabia said it pumped about 10.5 million barrels of crude oil a day last month in anticipation of the agreement reached in 1965 between the group of countries in the United States. OPEC + in Vienna. This represents an increase of about 500,000 barrels per day from May, making it the biggest monthly leap in the kingdom's production since June 2004.

Gas Pressure

Prices are near highest since 2014 – just in front of Mid-term elections in the United States in November

Source: Bloomberg

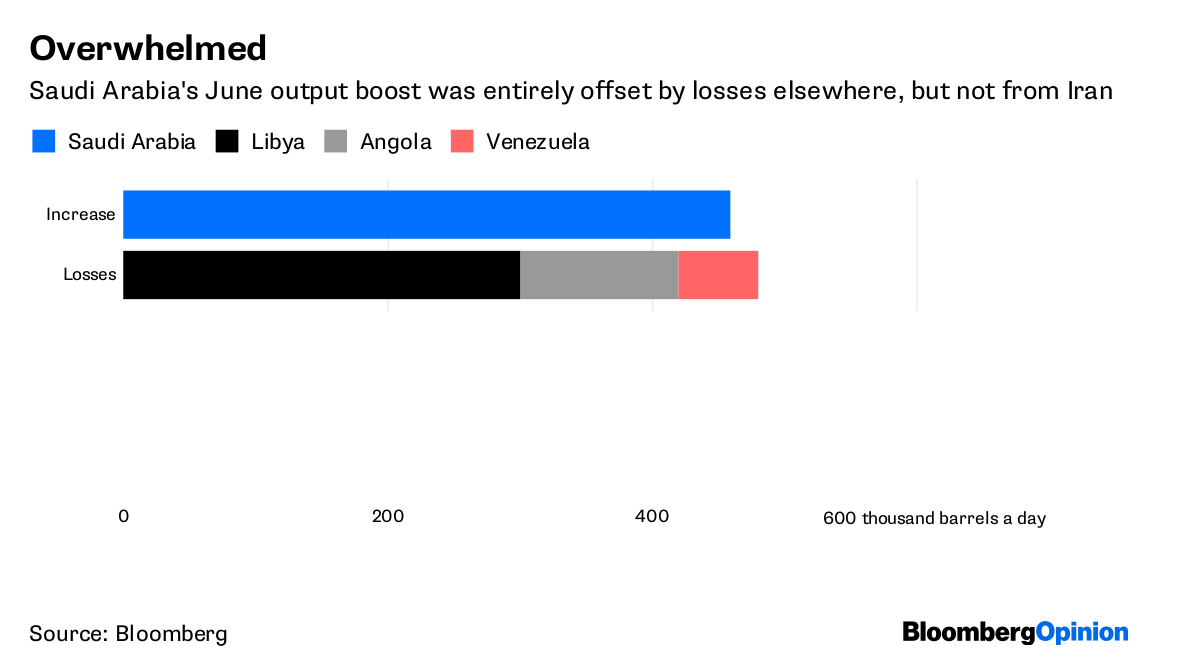

But there is a problem. The leap in production should have appeared as a similar increase in total OPEC production. This is not the case. The increase was entirely overwhelmed by declines elsewhere in the group. Add to that the loss of 350,000 barrels a day of Canadian supplies from an explosion at an oil sands upgrader in Fort McMurray, and Saudi Arabia's boost has completely lost

by losses elsewhere, but not in Iran

Source: Bloomberg

The simple truth is that there is not enough production capacity available in the world to replace the total loss of Iranian exports. Saudi Arabia can immediately increase production to 11.5 million barrels per day and increase to 12.5 million in six to nine months, said Crown Prince Mohammed bin Salman at Bloomberg in 2016. He has not said anything since this interview to suggest that the numbers have changed. Others are less optimistic – the International Energy Agency said that at the time [1965-1919] beyond 11 million euros, it would take increase costly offshore production.

Saudi Arabia has never been so abundant on an average monthly basis of 10.72 million barrels per day in November 2016, according to official figures provided to OPEC. All that is beyond is unexplored territory. That's not to say that it's impossible, just uncertain. All we can say for sure at this point is that it has about 200,000 barrels per day of available capacity immediately available.

Nearing the Top

Oil production in Saudi Arabia is approaching its highest level, even before Iran bites

Source: Bloomberg

There may be a few hundred thousand barrels a day in the United Arab Emirates and Kuwait, and up to 500,000 in the neutral zone shared by Saudi Arabia and Kuwait. The fields have remained inactive since 2015 after Saudi Arabia closed them for environmental reasons. There are now suggestions that they could be reopened in the coming months.

The rest of OPEC may still hold a hundred thousand barrels of unused capacity and, outside the group, Russia has already begun to boost its production. Russia has never shared an official estimate of how much inactive production capacity it could restore. Forecasts range from 215,000 barrels per day from Renaissance Capital to some 500,000 barrels seen by Gazprom Neft PJSC, the third largest domestic producer

but about 1.5 million barrels per day of oil immediately available to replace what Iran is not going to pump. This is not enough.

The release of oil from the US oil strategic reserve could provide a short-term theoretical answer, but it will not work. It's in the wrong place. US refineries are already almost exhausted, so any additional supplies from the RPD should be exported and it would take a few months to ship to Asian refineries that need them.

So, when Trump tweets this:

It is clear that as energy consultant, FGE said a report last week "either President Trump's advisors do not understand the oil market or he just does not listen to them."

There is a way for the President to quickly get lower prices and to look in the mirror. It could reimpose the sanctions against Iran much more gradually, instead of all at once on November 4. Of course, this would prolong the process, but it would also ease pressure on oil markets and gas prices. Unfortunately, patience does not seem to be considered one of the virtues of the president.

Pushing more crude into the market may seem to have to calm fears of a supply shortage as Trump's Iranian sanctions begin to bite. will be short-lived.

This column does not necessarily reflect the opinion of the Reading Committee or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Jennifer Ryan to [email protected]

[ad_2]

Source link